Retirement changes spending patterns

5 min

The budget deficit is expanding, and that is a concern. The government is once again grappling with how to stop the growing deficit and ideally reverse it. In the longer term, it has already made notable progress: the additional cost of population ageing is expected to be halved by 2070. But what about pensions in our country? Together with Prometis Lab, we examined how our spending patterns change once we retire.

Tenants cut back the most on certain types of spending

For this analysis, we used anonymised transaction data from households who are clients of the bank. Between 2020 and 2023, they were classified as either ‘retired’ or ‘(not yet) retired’. We also drew on the methodology used by Johannes Weytjens, Head of Operations at Prometis Lab, in his previous research into how Belgian households respond to different types of income shocks (see this earlier article).

A shift after retirement

Overall, we see that retirement tends to go hand in hand with lower spending on durable goods such as white goods and cars. At the same time, a larger share of the household budget is directed towards non-durable goods such as food, and so-called semi-durables (recurring but not frequent purchases) like shoes and clothing.

An interesting finding: when we zoom in on those who had been saving for retirement in advance, we see the same trends as in the general population, but far less pronounced. This aligns with economic theory, which suggests that saving helps stabilise consumption patterns.

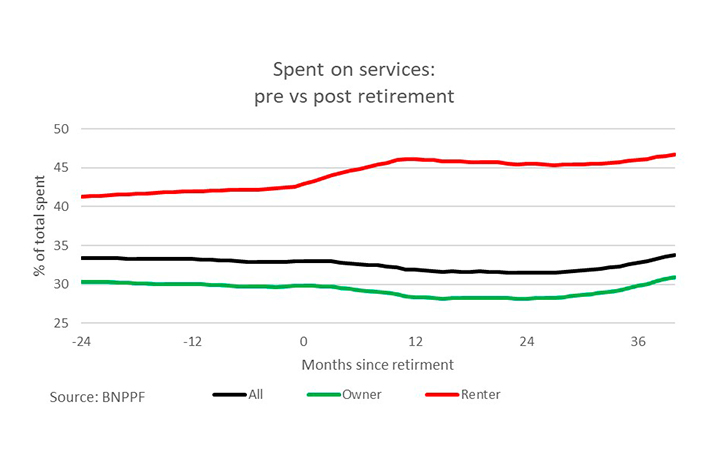

Renters shift their spending more drastically

Even more striking is the difference in spending patterns between homeowners and renters. The latter see their spending on services (including rent) increase considerably. Once they retire, their monthly income – the denominator in the calculation – decreases. Consequently, the overall proportion spent on services (including rent) increases, even if the total amount spent remains the same. In later years, the proportion of spending allocated to services also increases across the general population.

It is also worth noting that renters partially offset the larger proportion of services in their budget by spending less on non-durable and semi-durable goods. This suggests that renters may be less able or willing to spend on what one study called 'fun but less essential expenses' after retirement.