Survey: how do parents handle pocket money?

5 min

Pocket money is a topic that concerns many parents. After all, in addition to being a nice extra, it is also a first step in a child’s financial education. Together with Maison Slash, we conducted a survey: how much pocket money do parents give, and from what age? Do children spend the money right away, or do they also save it? And are they allowed to choose what they want to do with it? Almost 500 parents took part in the big pocket money survey. Together with Liesje Vanneste, financial expert at the Artevelde University of Applied Sciences and author of the book 'Sparen? Kinderspel' ['Saving? Child's Play'], we dive into the results and share practical pocket money tips.

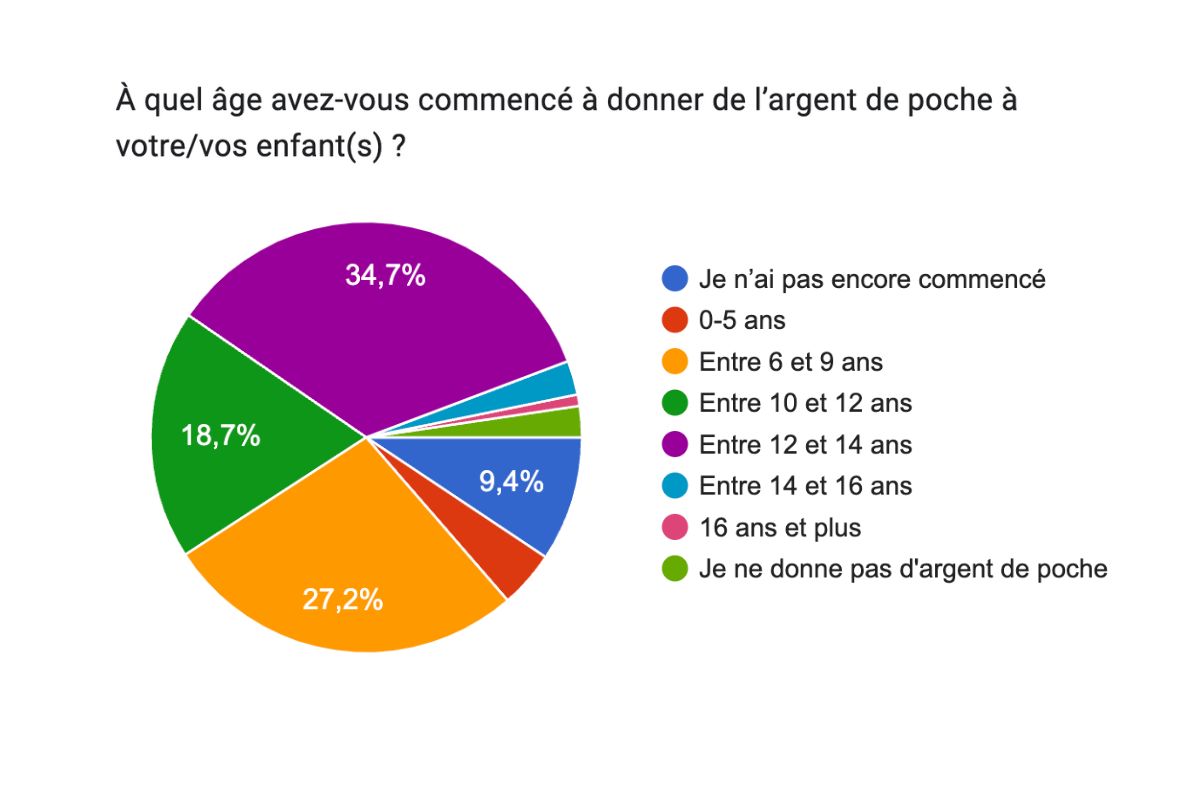

When should you start giving pocket money?

The survey shows that a large group of parents start giving pocket money from the age of 12 (34.7%). An understandable age, as teenagers often already have a bit more freedom and expenses. Another group of parents (27.2%) already get started with pocket money between the ages of 6 and 9.

Liesje Vanneste thinks it’s a good idea to give a little pocket money in primary school: “At that age, children already have sufficient counting skills. They are also less susceptible to all kinds of external temptations and peer pressure. Younger children will make more choices from their own perspective. Quite simply, the earlier you learn to handle money, the better you become at it.”

According to the survey, there is only a small group of parents (2.3%) who don't give pocket money. Liesje: “Of course, you are not obliged to give your child pocket money. It also depends on your financial situation. Giving pocket money is a good lesson, but there are different ways to educate your child about money. You can also involve your children in financial decisions without giving them pocket money. For example, by talking to them about how you, as a parent, save and manage the family budget.”

Infographic only available in French

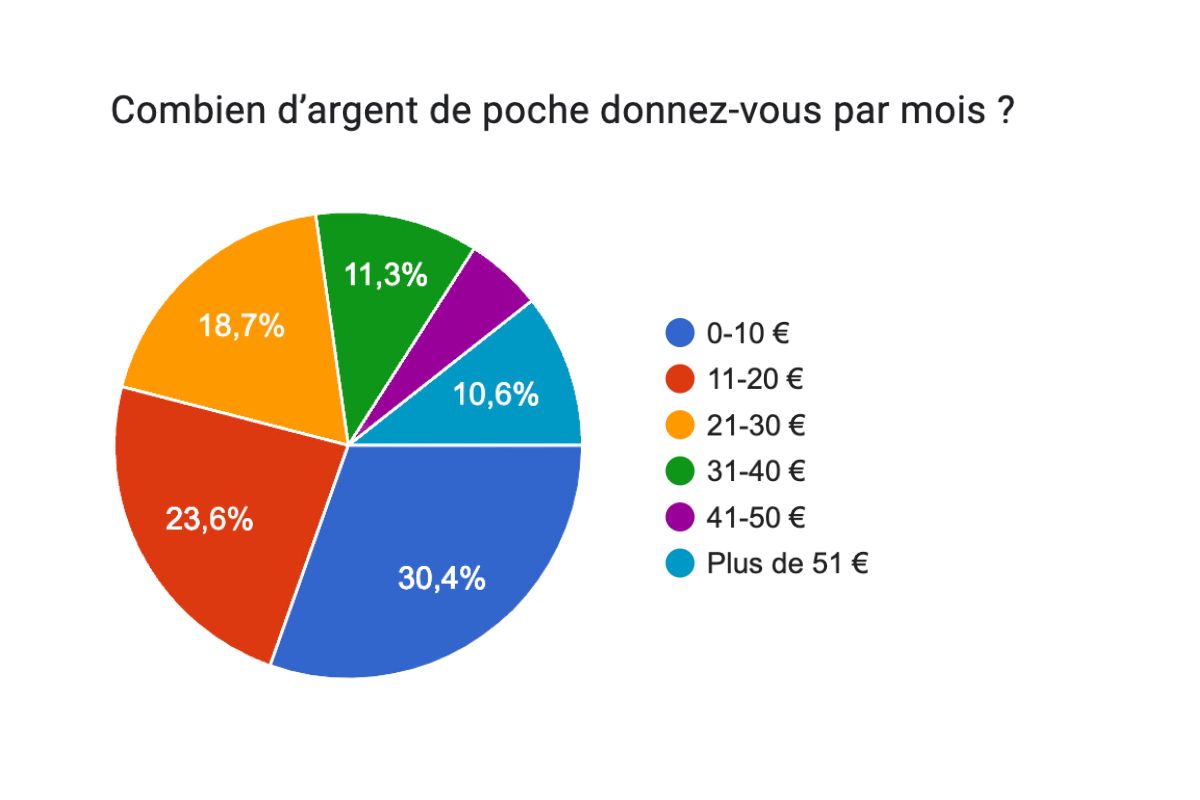

How much pocket money do you give?

Liesje: “When it comes to the amount of pocket money, a useful guideline is between half and one euro of pocket money per week for each year of the child's age. For a child aged 12, for example, that works out to 24 to 48 euros per month. The survey shows that many parents give less than this. Perhaps that’s because they take into account that children also receive money for birthdays and end-of-year celebrations. In that case, I understand why you might give them a bit less pocket money.”

Infographic only available in French

Cash or card

Most parents (66.6%) give pocket money electronically. Learning how to use a debit card and a banking app, and how to make secure online purchases are important skills. Via online and mobile banking, children can check their balance and carry out simple transactions. They learn how to handle money safely, while you can keep an eye on them.

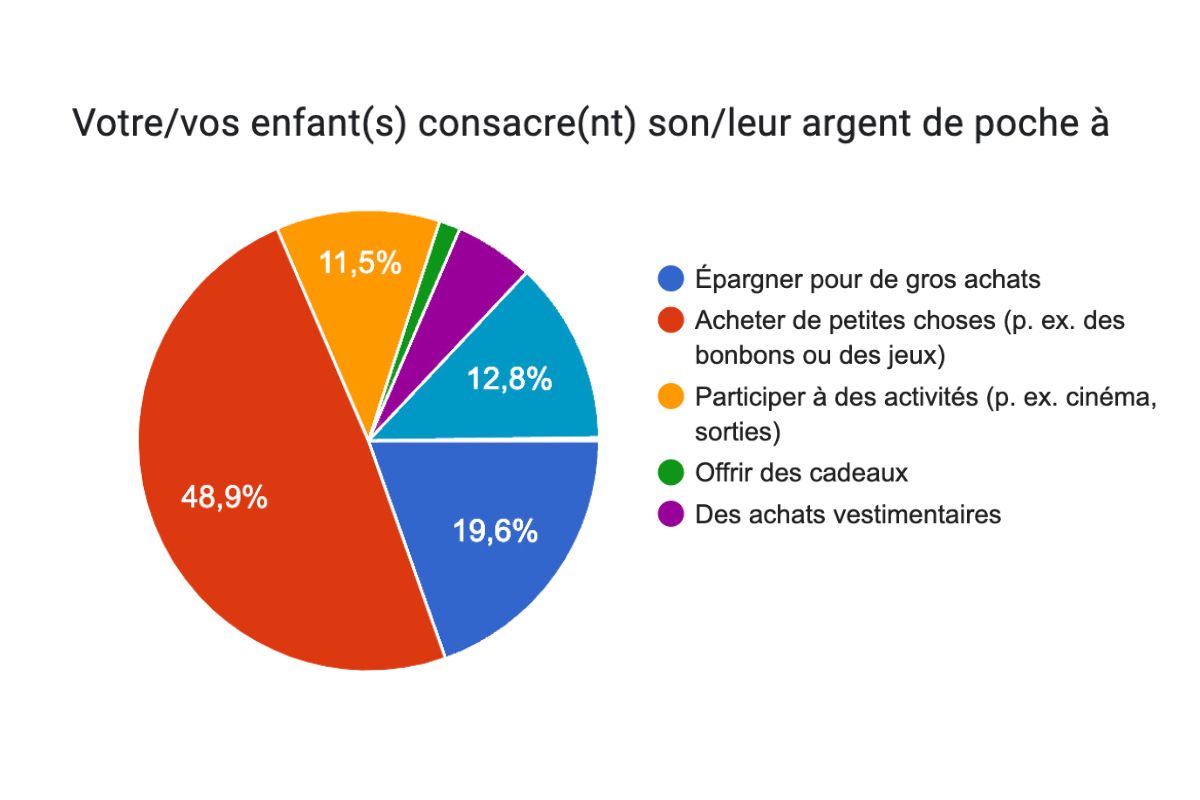

The art of saving and spending

The survey shows that children mainly use pocket money to buy small things (48.9%) such as sweets or ice cream. Pocket money is also used for savings (19.6%), but in a relatively limited way. Parents say they want their children to save (52.2%) for bigger goals, but life is expensive. Ten euros are quickly spent.

“Giving pocket money without a conversation has little value”

Liesje: “If the budget for pocket money is limited, you can focus on helping your child think about how they want to spend it. It’s important for parents to talk about this. What standards and values do you want to instil? Perhaps you don't want them to spend it on things that promote violence, on sugary snacks or on slime. Learning to spend also means learning how much things cost, and that you can only spend your money once. That might sound obvious to parents, but it's not to a ten-year-old. If you get ten euros of pocket money at the beginning of the month and it’s gone two days later, you’ll soon learn how to budget.”

Infographic only available in French

Weekly or monthly

The majority of parents (50.4%) give pocket money monthly, and 37.4% do so weekly. Liesje: “I would rather give young children pocket money every week, because a month is very long time for a 7-year-old. If you see that not everything is spent right away, you can build up to two weeks. A 12-year-old can usually manage a month, but there are always exceptions. In that case, make the period a little shorter. On the other hand, a child who spends everything at the beginning of the month also learns a lesson.”

Chores for extra pocket money

“Of course, you don't have to give them money for emptying the dishwasher”

Just over half of parents say that their teenagers under the age of 15 are allowed to do odd jobs for neighbours or earn a little extra money by selling second-hand items. Liesje: “I suspect it’s things like mowing the lawn or selling old toys or clothes. There must be a kind of grey area, because you're not actually allowed to have a student job until you're 15. Still I'm a fan of this kind of effort. It’s a great way to learn about the value of money. Young teenagers learn that they have to invest time to earn money.”

Only 17.4% of parents give extra pocket money for big household chores, such as helping with spring cleaning. Liesje: “I don't think it’s bad to do something like that anyway. Of course, you don't have to give them money for emptying the dishwasher. You are part of a family and certain tasks just have to be done. You don't get paid for that.”

How financially literate are our children?

Liesje: “When I look at this generation, I am still optimistic about their financial skills. From the results of this survey, you might infer that they are fairly spoiled and love expensive things, but I think that's also true of our generation. We also spend more time at restaurants and travelling than our parents did. It makes sense for our children to follow that pattern. In my opinion, this generation has even better financial literacy than we had. Like everyone else, they are shocked when they have to pay bills or discover how much real estate costs. That’s why it’s important to give pocket money and talk to your child about money.”

Need more information?

We’re happy to help.