Nowcast Q1 : 0,2% | BNP Paribas Fortis

In our latest Nowcast update of the recently ended quarter, we note a slowdown to 0.2% quarter-on-quarter. Both national accounts, high-frequency indicators and our own bank indices point in that direction. In the short term, the uncertain international context is weighing more heavily on our growth than announced government spending at home or abroad.

The National Bank of Belgium (NBB) recently confirmed that the slowdown in growth was already underway at the end of last year. In the last three months of the year, quarterly growth fell to 0.2%, well below trend growth. The high frequency indicators and transaction figures that form the basis of our monthly Nowcast update offer little hope for improvement.

High frequency indicators

As recently as February, the consumer barometer showed a notable uptick. The NBB commented that this was due to optimism among respondents following the recently concluded coalition agreement. That optimism largely disappeared from the March figures: fears of unemployment in particular rose sharply once again, against a background of an only gradually cooling labour market.

Business confidence also fell again last month. This was true for all sectors except trade. The situation is particularly uncertain in the manufacturing sector. There, more and more business leaders are seeing an increase in inventories and a thinning of order books.

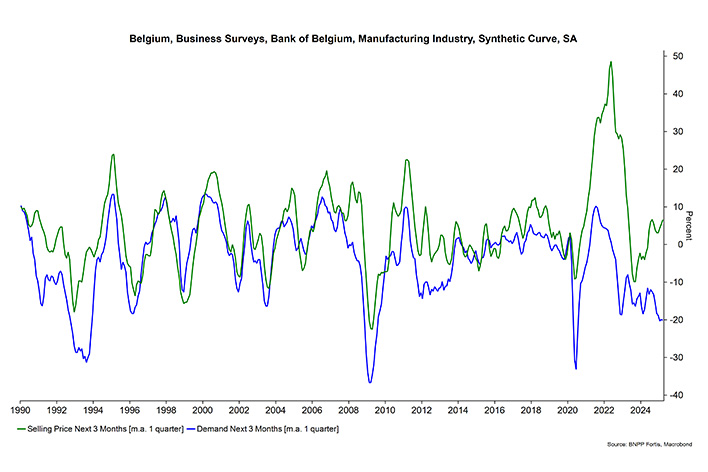

The divergence in expected demand and sale price is also striking. The graph below shows how a higher expected product demand typically for the manufacturing industry goes hand in hand with a similar evolution in the sale price. Looking "through" the Covid period, it is striking that since late last year, the captains of industry have been assuming both a fall in demand and a rise in selling prices The surging trade war seems, of course, to be the main explanatory factor for this.

Transaction figures

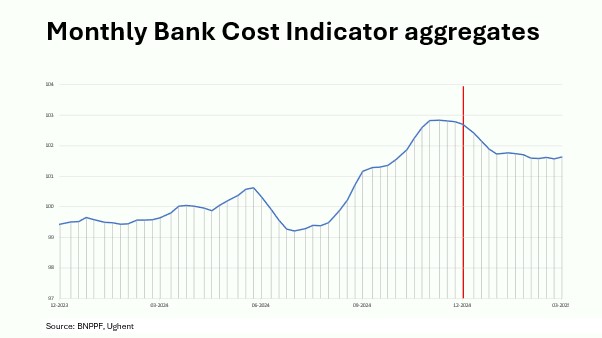

Our own, aggregated transaction figures show how Belgian companies saw their activity levels temporarily rise sharply at the end of last year*: both expenditure and turnover rose sharply. The graph below shows how the cost indicator - which correlates the most with traditional GDP - capped at the end of 2024 and has fallen considerably since then.

All in all, last year's disappointing fourth quarter in particular is slowing down growth this year, due to the base effect**. We expect the slowdown in growth as a result of the deteriorating international context to be gradually offset by increased domestic and foreign public spending (see this previous publication). Unfortunately, the uncertainty surrounding these outlooks remains much greater than normal.

* Perhaps surprising, given the rather low growth in Q4. But since we are relying on transaction figures and not, say, VAT returns, there is a timing difference with quarterly growth in the national accounts, which do lean on that data source.

** See this excellent explanation by the NBB on (among other things) that base or overhang effect.

The opinions in this blog are those of the authors and do not necessarily reflect the position of BNP Paribas Fortis.