Insurance that gives you peace of mind

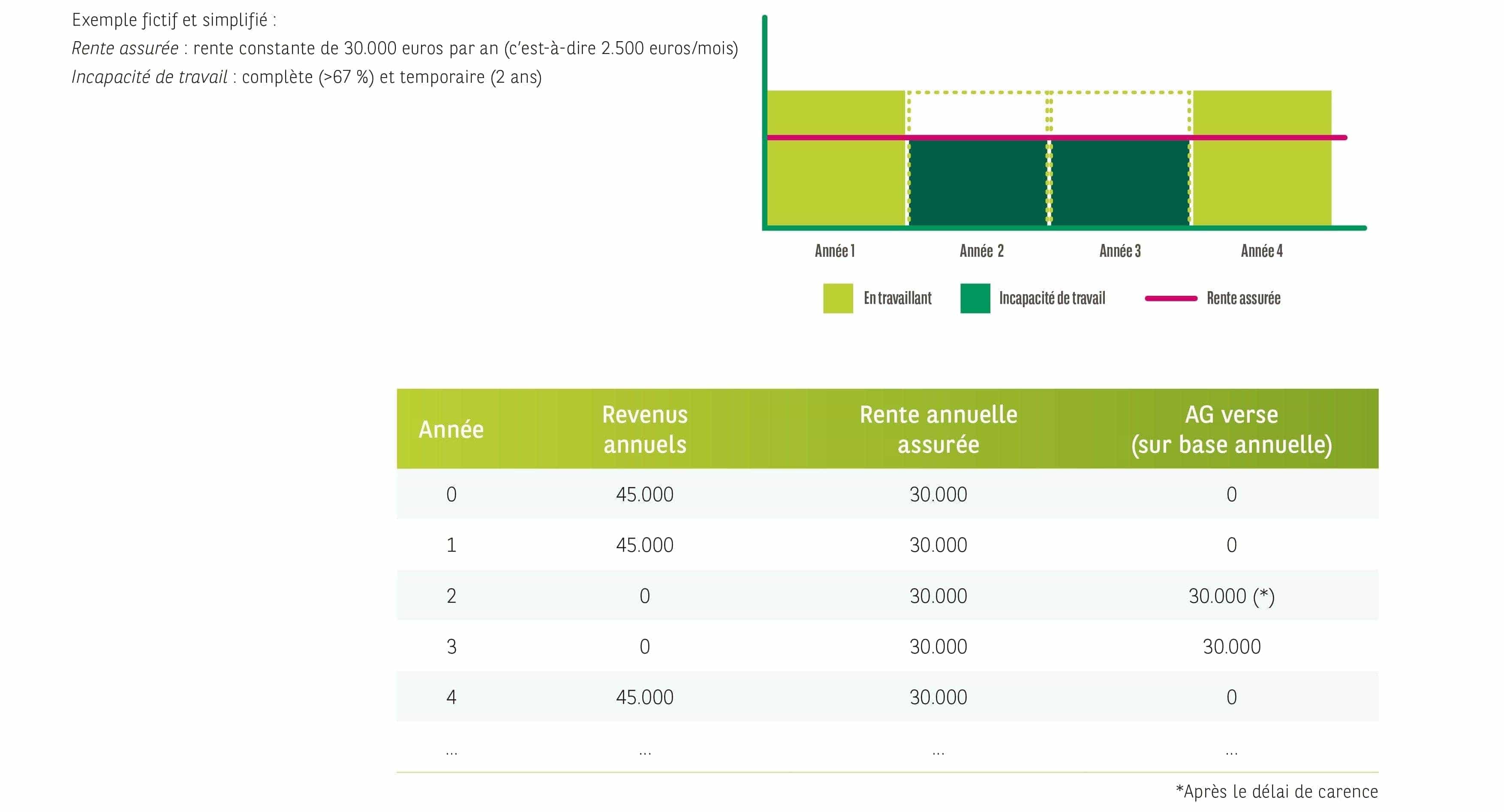

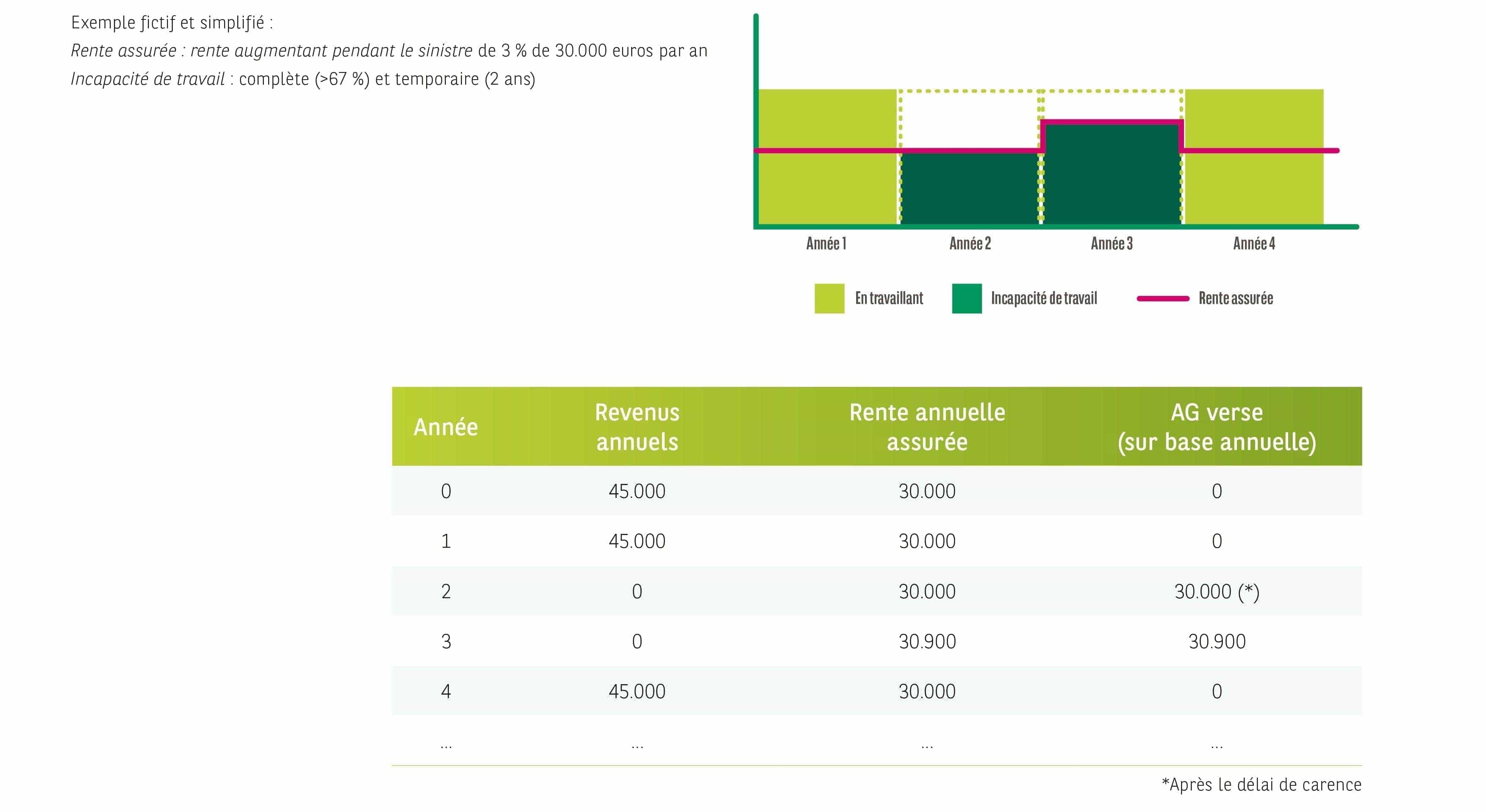

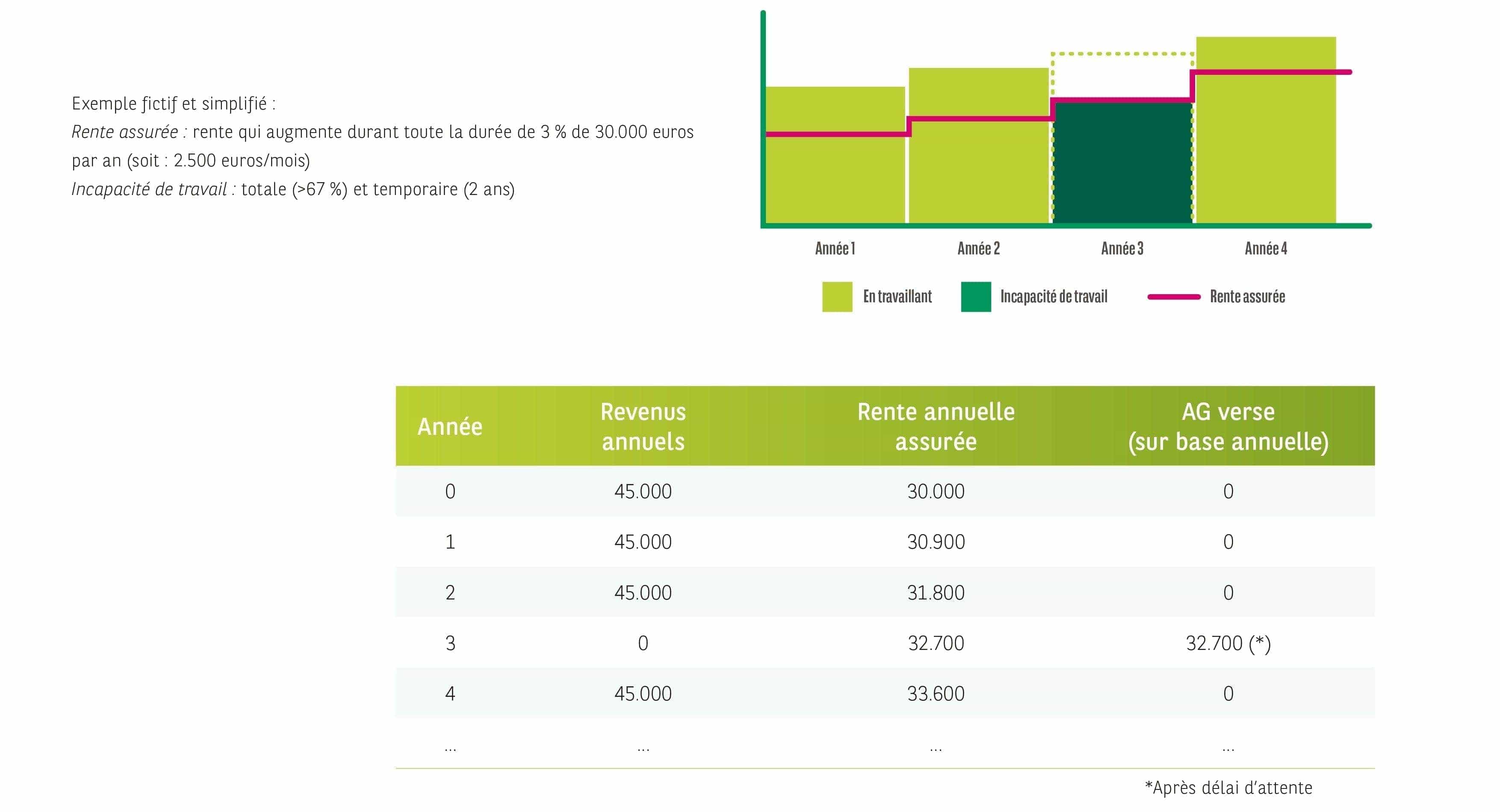

As a self-employed person, you could find yourself without income from one day to the next if you suddenly become unable to work due to an illness or accident. The money you get from your mutual health insurer – to which you’re entitled from the eighth day of being unable to work – is often not enough to maintain your standard of living.

So additional protection may be useful. You can arrange this without taking out another policy, simply by adding cover to your chosen pension plan, such as:

- the PLCI, which is a branch 21 personal pension plan for self-employed individuals, whether or not they’re running a company

- the CPTI, which is a branch 21 pension plan for self-employed individuals who don’t run a company

- the EIP, which is a branch 21 or 23 insurance-based company pension plan for self-employed people who run companies