What if Belgian exports rose by €10 billion within the EU?

4 min

While the international order is being shaken to its core, the financing of Europe’s prosperity model is coming under increasing pressure. More growth could provide relief, but where can it be found? One possibility is stronger intra-European trade. Our analysis shows that Belgian exports to other EU member states are €10 billion lower than expected. Recognising this missed export potential could encourage entrepreneurs to take action and even inspire policymakers to organise an intra-European trade mission.

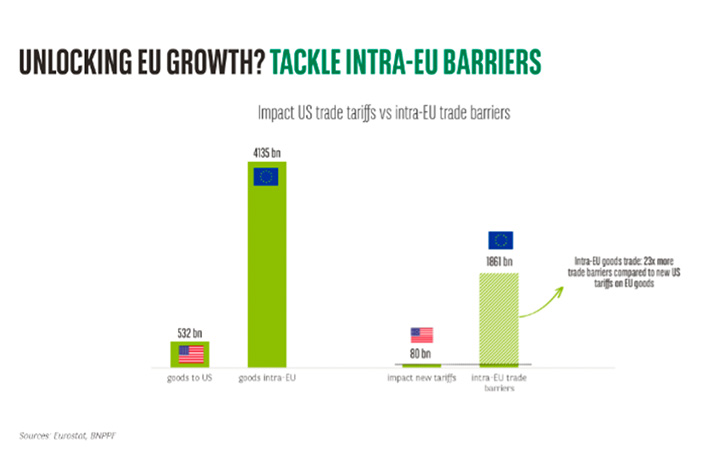

When Donald Trump launched his tariff war in April last year, an International Monetary Fund study from the previous year quickly resurfaced. In that study, IMF economists had calculated that significant trade barriers also existed within the EU itself. These so-called non-tariff barriers (NTBs) were estimated at 45% for trade in goods. This suggests that the total impact of such barriers, applied to a much larger intra-European trade flow, may be substantially greater than that of U.S. tariffs on EU exports.

Without non-tariff barriers (NTBs), European countries would trade far more with one another. Even the most conservative assumptions about the price sensitivity of these trade flows suggest a potential increase in intra-EU trade of at least 45% in this hypothetical scenario. This would be an extremely attractive prospect, given that such an increase in exports could significantly accelerate economic growth.

Not all barriers are regulatory

Given this potential impact, it is hardly surprising that the IMF figure sparked considerable debate, particularly in academic circles. This is especially the case when it is cited as evidence of inefficient European regulation. However, this is a misreading.

The figure was derived from the fact that intra-European trade falls short of the ideal scenario of a perfectly integrated single market. The United States comes much closer to this ideal, which is why the IMF estimated NTBs there to be less than 15%.

In a critical contribution, researchers Head and Mayer explain why Europe has not yet realised this ideal scenario. Among other things, they point to a strong preference for domestic suppliers in public procurement. They also cite significant differences in consumer preferences as an important factor. Recent research by Belgian academics Hoste and Verboven has quantified this effect, demonstrating that taste differences for supermarket products across borders are more than twice as large as those within national borders. By comparison, taste differences between U.S. states are only around 3% greater than within states. Finally, network effects also play a major role. Europeans have far more contacts within their own national borders than beyond them.

There is also a growing number of cases in which national policymakers are influencing international trade directly. For example, economist Luis Garicano* points to a Danish ban on breakfast cereals available elsewhere in the EU and Italian and Spanish rejections of certain chocolate products. Closer to home, Belgian milk exports collapsed following the introduction of mandatory origin labelling for French supermarkets. Perhaps the most striking example cited by Garicano concerns a paint producer. The combined labelling requirements imposed by the French, Italian, and Spanish authorities cannot be displayed in a sufficiently large font on one-litre paint cans. The result is that the company must maintain separate inventories for identical products in each of these countries.

… yet they still have a significant impact on the single market.

NTBs therefore encompass far more than initially appears, and the figure may well be even higher. In November, European Central Bank President Christine Lagarde announced that ECB researchers had recalculated the figure for goods and arrived at 65%. At the very least, this is further evidence that something is not functioning properly in the EU single market. But can it be fixed?

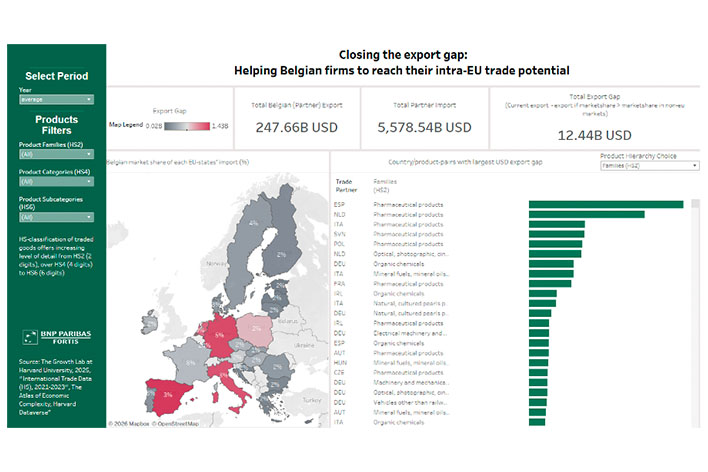

To clarify the impact of NTBs on Belgium, we took a slightly different approach. Based on bilateral trade flows, we analysed Belgium’s market share of global non-EU imports.

We established a benchmark by examining the share of the total global market outside the EU served by Belgian exporters. It is reasonable to expect Belgium’s market share within the EU to be higher than its share outside the EU, or at least not lower. After all, intra-EU trade offers many advantages, such as shorter distances, established agreements, and often a common language and currency.

Mapping Belgium’s missed export potential

An example helps illustrate our approach:

- In 2023, non-EU imports of pharmaceuticals totalled around €200 billion.

- Belgian exporters supplied €11 billion, accounting for 5.6% of that demand. - EU member state Poland imported more than €4 billion.

- €125 million of this came from Belgium, giving it a 3% market share. - That share is 2.6 percentage points below our benchmark.

- For this single product and country, therefore, Belgium misses out on around €100 million in exports.

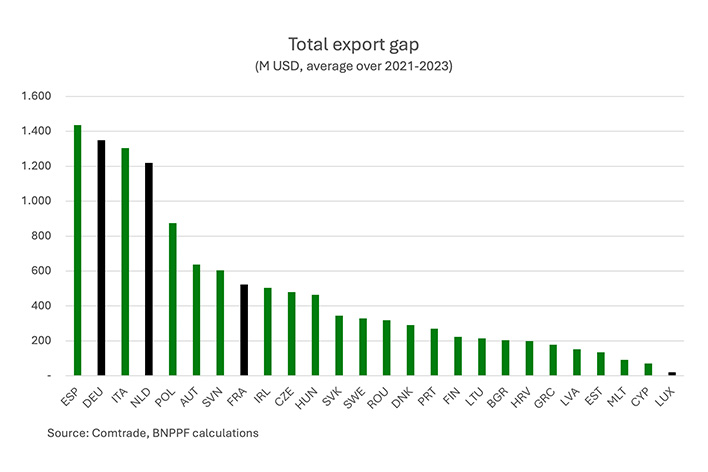

When this exercise is applied to all product categories in the Comtrade database, a striking picture emerges of product-country combinations where the market share of Belgian exporters is lower than expected. Over the period 2021–2023, this amounts to around $12 billion (€10 billion at current exchange rates) in missed exports. This is much higher than the extra Belgian exports the new Mercosur deal could bring at best

Case 1: Pharmaceuticals

Belgium’s market share of the pharmaceutical industry is smaller than in several large countries outside the EU, notably Spain and Italy. Belgian exporters miss out on hundreds of millions of euros in these countries. This is not surprising, given that pharmaceuticals account for almost half of all Belgian exports and that Italy and Spain are among the largest importers in almost every category. Therefore, a few percentage points of market share add up very quickly.

More interesting is the low market share of Belgian pharmaceutical exports in Poland. With a population of nearly 40 million and strong GDP growth, Poland is a large and growing market. Yet entering it remains challenging. There are two strong local producers, a high degree of brand loyalty, and a fragmented distribution landscape. Negotiating reimbursement conditions with the government is also far from straightforward.

According to the experts we consulted, an innovative product combined with strong marketing and sales could succeed. A stronger presence in Poland could also serve as a gateway to the rest of Eastern Europe.

Case 2: Benelux 2.0

Which EU countries account for Belgium’s largest missed export potential? Once again, major importers such as Spain, Italy and Germany top the list. It is notable that near-neighbour France, like the much smaller Luxembourg, does not make the top five.

Belgium’s export share to Germany is low across several product categories. For organic chemicals, electrical machinery and optical equipment alone, missed exports exceed €100 million. The low market share in the 'vehicles' category also stands out. Germany is, of course, renowned for its domestic car production, but it also imports vehicles and components. Belgian exporters account for a remarkably small share of that import volume.

Finally, we estimate that more than €1 billion worth of exports to the Netherlands has been missed. In addition to vaccines and medicines, medical instruments, pacemakers and other prostheses also feature prominently on our list.

Is it time for a trade mission to our northern neighbours?