The spring offensive of defence

2 min

Our government is investing in defence. What does this mean for our economy? It will provide only a slight short-term boost. However, we are also expecting a significant positive spillover from Germany, which will largely offset the negative impact of the trade war. Despite this, uncertainty remains high.

2% of GDP by the summer - Belgium is finally in line with its NATO commitment. At least on paper. If the country spends 2% on defence on a quarterly basis from the third quarter, that still means only a paltry 1.6% for all of 2025. After that, Prime Minister De Wever is reportedly aiming for 2.5% by 2029, while other Member States are already openly discussing 3.5%. What does this mean for our growth prospects?

Trickling-down German defence expenditures

Last month, the German parliament approved the relaxation of the debt brake. In addition, the Germans also established a brand-new investment fund, which would spend an additional €15 billion this year. By 2036, it would invest a total of €500 billion.

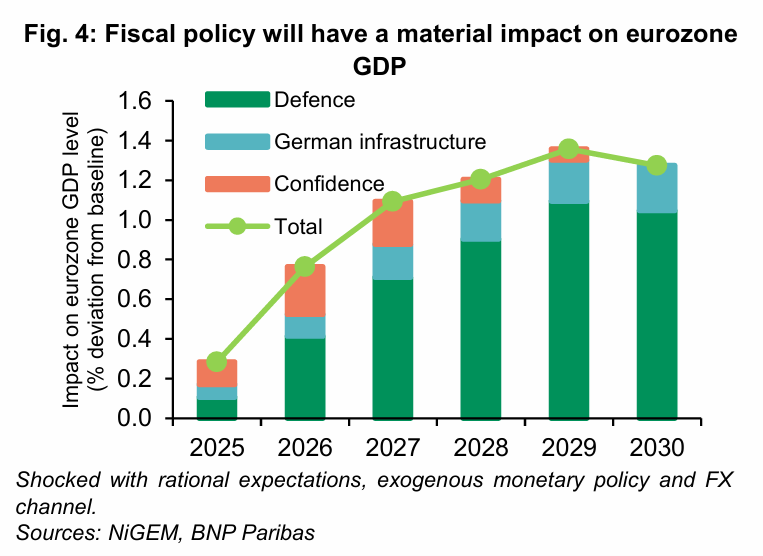

This combination is giving a considerable boost to our outlook for German growth, and consequently, European growth. We expect growth to accelerate by 0.4 percentage points this year and by 0.8 percentage points next year. For the entire euro zone, our growth forecast increases to 1.3% this year and 1.5% next year.

Belgian boost remains limited

Belgium ranks at the bottom of the NATO spend-per-GDP ranking, alongside Spain and Luxembourg. Over the past decade, the defence sector in our country has experienced a significant decline, with total employment decreasing by around a quarter. In contrast, the workforce in neighbouring countries has remained stable or even expanded.

Despite this, the share of the defence budget allocated to personnel costs is the highest in our country. Conversely, we spend proportionally the least on materials.

So that will have to change. But will higher defence spending also lead to higher economic growth?

The answer - as so often in economics - is "it depends". Growth is at its highest when that extra expenditure does not need to be reimbursed, creating a large wave of spending that finances goods and services produced locally.

This nicely sums up the essence of the Keynesian multiplier, which argues that the growth contribution of a fiscal stimulus - additional government spending - is inversely proportional to three characteristics of an economy: propensity to save, tax and import.

The hard-to-measure multiplier

What does the extensive economic literature teach us about multipliers?

First and foremost, they work best when the economic situation lends itself to it. Not surprisingly, this is also the insight with which Keynes made himself immortal: an economy running below its rpm benefits most from a good dose of (fiscal) gas. In other words, government spending contributes the most in times of low economy. The latter already seems to be the case for our country (with its cooling labour market) and, by extension, the rest of Europe, where the ECB is lowering interest rates further now that the inflation ghost seems to have been tamed.

But even in such a case, it depends heavily on what the government is actually spending money on. Recent research (Saccone 2022) shows that investments in education and other public services have the highest multiplier. Investments in defence are doing much worse and could even have a negative impact on growth.

And the three components of the multiplier also play their part, of course, with at the head the share of imports in total (arms) spending. If most of the money goes to imported equipment, the impact on our own GDP will be limited anyway.

Growth outlook: steady rise

To conclude, we expect the import quota for military equipment expenditure to be relatively high. Although there is some uncertainty surrounding the exact figures, the EU imports a significant proportion of its weaponry from abroad, particularly from the US. While Belgium has a defence sector, it will not be able to meet all of the country's needs.

Also, Belgium is under pressure to address its budget deficit, which limits the potential for fiscal stimulus. As a result, we estimate the multiplier effect to be relatively low in the current situation. For example, the announced defence spending is expected to contribute only 0.1 percentage points to annual GDP growth this year and 0.2 percentage points next year.

Fortunately, growth is being boosted by our German neighbours. As a small, open country sharing a border with Germany, Belgium can benefit from significant spillover effects. We assume an additional 0.1 percentage points of growth this year and at least as much again next year, with upside risk.

The planned military spending also largely offsets the impact of expected trade tariffs. Our scenario still assumes a 12.5% tariff increase on European imports in the US, followed by a gradual decline. However, the uncertainty surrounding this scenario is higher than usual.

We forecast 1.2% growth this year and 1.3% next year. At the same time, we are revising our monetary policy outlook, expecting the European Central Bank (ECB) to tighten again from the end of 2026. This will make borrowing more expensive, including for the Belgian state. The question remains whether the budget deficit will not increase further by then.

* See this recent publication by the Bruegel Institute.

The opinions in this blog post are those of the authors and do not necessarily reflect the position of BNP Paribas Fortis.