The stick, the carrot and the aspirin

5 min

The pharmaceutical sector is complaining about the uncertainty created by Trump. Reducing trade tariffs is beyond the power of EU companies. So what is the key?

Last month, President Trump announced a 100% import tariff on branded medicines. Exempt from this measure: pharma companies that already have part of their production in the U.S. or had plans to do so.

The markets barely reacted to the news. Many manufacturers had already announced plans to invest more in the U.S. As always, the Trump administration’s goals are difficult to pin down. However, it is clear that an increasing number of people in the U.S. are calling for medicines to be recognised as a critical sector.

The combination of the tempting carrot of subsidies under the Inflation Reduction Act and the stick of new tariffs could convince more companies to set up operations in the U.S.

Belgian pharmaceutical exports

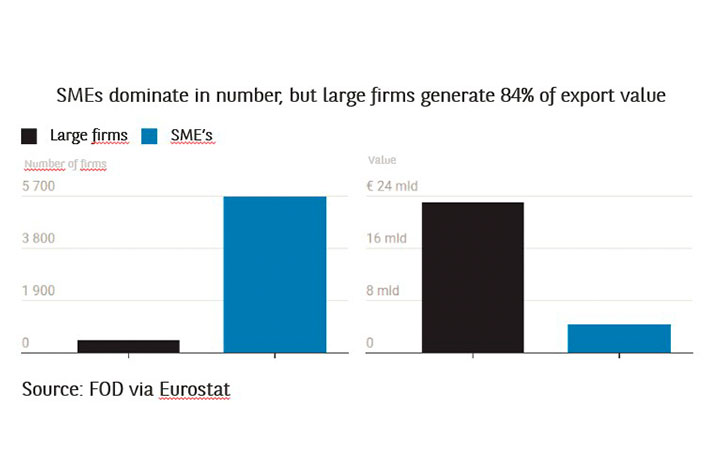

The US is an important trading partner for Belgium. While it accounts for a smaller proportion of our total sales market than our neighbouring countries and the rest of the EU (40% and 20%, respectively), it is still a significant export destination, accounting for 6%. It is also worth noting that, of the thousands of Belgian companies that export to the US, the largest employers account for the lion's share.

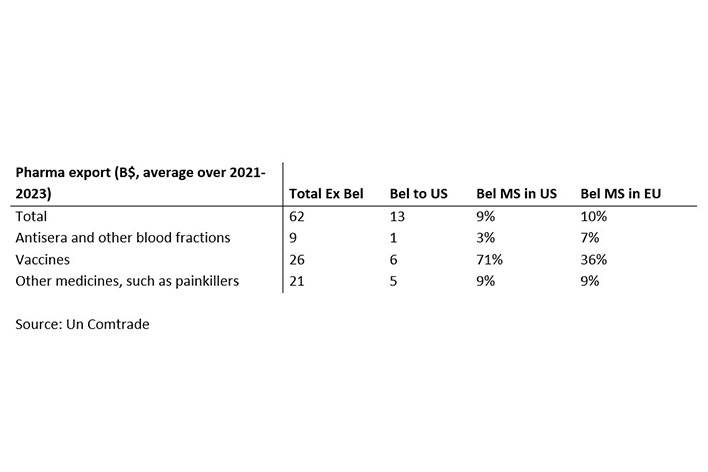

A detailed look at Comtrade figures from the 2021–2023 period reveals that the pharmaceutical industry accounts for nearly half of this trade flow. During the pandemic, Belgium's vaccine production was in full swing, with the US being a major customer. At that time, Belgium accounted for more than 30% of the global vaccine market. Even more striking: Belgium accounted for over 70% of all vaccines imported by the United States.

The table below summarises the key figures for total Belgian pharmaceutical exports (averaged over the 2021–2023 period), both overall and for the three main export categories to the US. These three categories account for 90% of our total global medicine exports.

Pharma and GDP

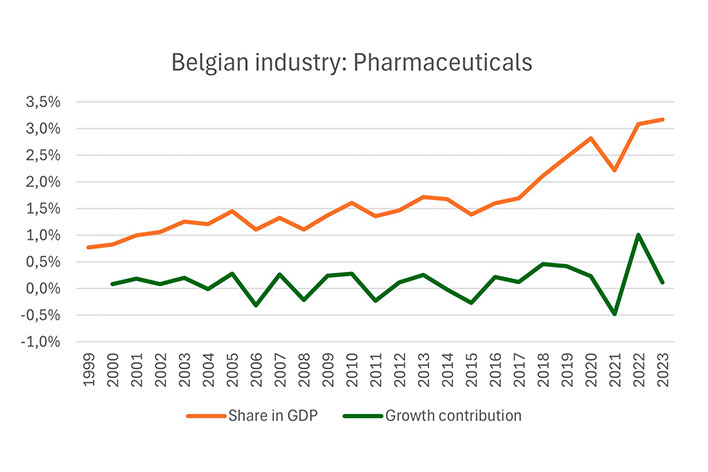

International trade figures clearly show that the temporary increase in vaccine production had a positive impact on the Belgian economy. Historically, these products accounted for around 40% of total exports to the US before the pandemic. This temporary increase led to a significant boost in exports and, consequently, economic growth.

The graph below shows the growing share of the pharmaceutical sector in total GDP (in orange). It also illustrates that the sector accounted for one percentage point of total GDP growth in 2022.

The sector is right to complain about the high degree of uncertainty that the White House and its occupants will undoubtedly continue to stir up. Lowering — or even just stabilising — US tariffs is partly beyond the control of European business leaders and policymakers.

So what can be done? An IMF study shows that non-tariff trade barriers make intra-European trade in goods more than 40% more expensive. Reducing these barriers would therefore be a much more worthwhile target than the additional costs currently imposed by American customs officials. Who will rise to the challenge?