Rising interest rates weigh on property activity, but not on price growth

3 min

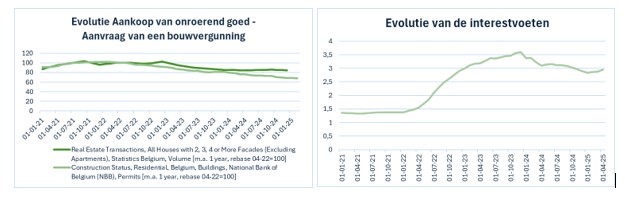

Since the European Central Bank (ECB) began raising interest rates in mid-2022, the Belgian property market has slowed. The number of sales of existing homes has dropped by nearly 15%, and building permits have fallen by as much as 30%. Yet property values have remained stable. In fact, over the same period, housing prices in Belgium have risen by 6%.

How rising interest rates affect the real estate market

Interest rates on new mortgage loans have increased significantly since the ECB began its fight against inflation in summer 2022. As the central bank raised its benchmark rates, mortgage rates rose by more than 2 percentage points in just two years. However, this has not led to a drop in property values, not in Belgium, at least. Homes in Belgium and the Netherlands have gained more than 5% in value since monetary tightening began. By contrast, the market corrected in France (-4%) and Germany (-10%).

That said, higher borrowing costs have had an impact here too. The number of secondary market transactions (excluding new builds) has dropped sharply. In the last quarter of 2020, there were still over 30,000 such transactions. Since summer 2022, the quarterly average has fallen to around 20,000.

The same trend can be seen in building permits, although seasonal effects play an even greater role here. At the end of 2021, monthly permits peaked at almost 2,700 units. At the start of this year, the monthly average had dropped to below 1,800.

All of this is largely a result of rising interest rates. For fixed-rate loans with a term of ten years or more, the average interest rate on new mortgages was below 1.5% from 2020 onwards. But in summer 2022, the ECB launched a sharp rate-hiking cycle. This pushed mortgage rates up by 2 percentage points, peaking at the end of 2023.

Since then, rates have edged down slightly, but this decline appears to be slowing too. This matches our forecast that the ECB may opt for another (modest) rate hike by the middle of next year. We expect property price growth to return to around 3% by 2027.

Arne Maes,

BNP Paribas Fortis Economist