First nowcast Q1: 0.3%

5 min

Our forecast of the current year, in collaboration with Ghent University, has quarterly growth at 0.3%. This represents a slight improvement on the NBB’s most recent flash estimate for Q4, which stood at a mere 0.2%.

Sentiment & intentions

First, a look at the traditional high frequency indicators. Consumer sentiment is buoyant, having recently reached a 4-year high. Unemployment is slowly improving, in line with our long-held view of a soft landing. Business sentiment however paints a murkier picture. Overall, confidence is slightly below average, with trade-sector executives significantly more negative in their assessment. The main drivers are a downward revision of expected market demand and of their own activity.

The NBB’s biannual investment survey provides further insight into the diverging fortunes of different sectors. Manufacturers are indicating increased investment intentions, with further improvements expected throughout this year. Replacement remains the main motive for investment, but expansionary spending has increased from 16% to 21% of all projects. The message from contacts in the business-related service sector was quite the opposite, with the NBB’s investment indicator recording a sharp drop from the previous assessment in spring 2025.

Bankindex

As is customary, the nowcast models behind this monthly exercise do not just include publicly available indicators. They also incorporate our bankindex, an anonymised aggregation of transaction data from our business clients.

Examining the monthly evolution of total costs, which is a subset of all outgoing transactions, we observed a slowdown of activity in October that was only reversed in December. With only one month of data available, January remained consistent with the stronger year-end level. Sector-level data shows that flows related to the construction business remain volatile, with both turnover and costs dipping lower again in recent weeks.

All things considered, the various models we employ suggest median and mean growth of 0.3%.

Zooming out

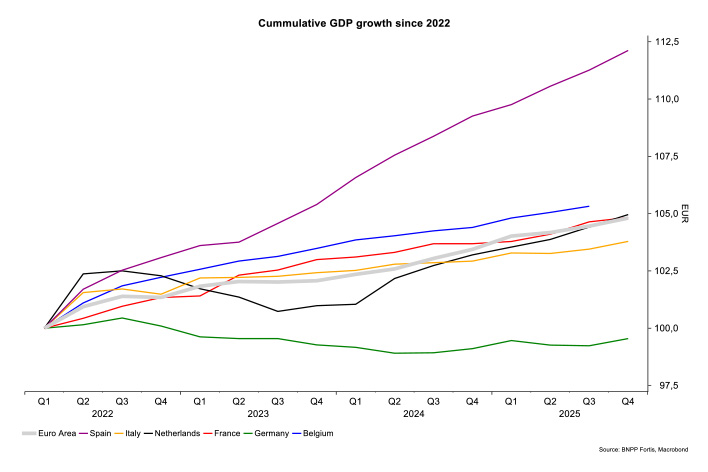

In retrospect, the Belgian economy has performed relatively strongly compared to most other European stalwarts. In fact, since 2022, when the ECB commenced its hiking cycle, Belgian growth has outpaced that of neighbouring countries France, Germany and the Netherlands. Notwithstanding the Spanish boom, the Belgian economy grew faster than the Euro Area as a whole.

As growth prospects in Europe, especially in Germany, improve, the Eurozone is expected to grow faster than Belgium. Our colleagues in London are predicting Eurozone growth of 1.6% over the next two years, whereas we estimate the Belgian economy will grow by just 1.1% in both years*.

As growth prospects in Europe, especially in Germany, improve, the Eurozone is expected to grow faster than Belgium. Our colleagues in London are predicting Eurozone growth of 1.6% over the next two years, whereas we estimate the Belgian economy will grow by just 1.1% in both years*.

This once again reaffirms the reputation of our small open economy, which is better able to withstand tough times than most EA peers, albeit at the cost of lower dynamism when times are good.

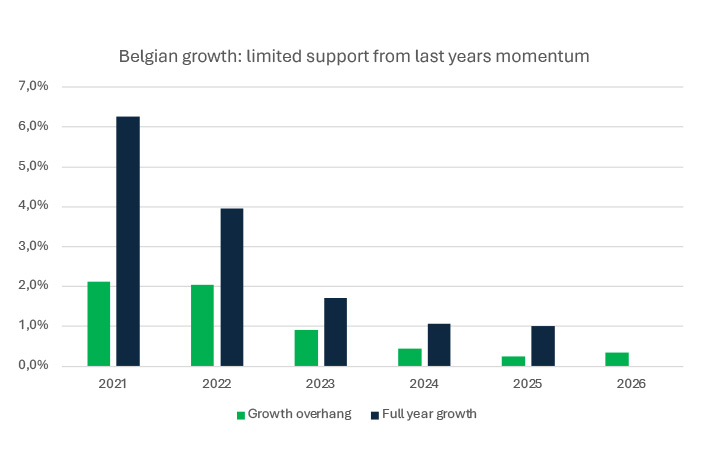

* The typical boost of “growth overhang” is likely to be only 0.3% this year, assuming the NBB’s Q4 flash estimate is accurate. A quick reminder: growth overhang provides a baseline for next year’s economic growth, assuming GDP remains unchanged throughout the year. Essentially, it shows us what annual growth would be like if all four quarters equalled last year’s Q4. In the wake of the pandemic, significant quarter-on-quarter improvements helped fuel our expectations for subsequent annual growth. However, as the graph below shows, this effect has been declining in magnitude for a while now.