NOWCAST 3 Q4: Belgian growth continues

3 min

Our latest nowcast, which looks back at the recently concluded fourth quarter, indicates continued growth in the Belgian economy. At 0.3%, growth remains resilient, but the models used nevertheless indicate a slight slowdown.

Perspective

Our own banking index shows a slight slowdown compared with the high peaks seen earlier in the fourth quarter. This is also reflected in business confidence, which is particularly low among retailers and service providers. Across all sectors, there was a decline compared with the previous month. Consumers, however, tell a very different story: they are just as optimistic today as they were at the end of 2021.

At 0.3%, Belgian quarterly growth remains below the long-term average of 0.4%. The same is true for the majority of EU Member States: Fifteen countries are currently growing more slowly than average. Nevertheless, expectations for EU growth remain positive. Our economists are forecasting growth of 1.6% this year. This is largely due to the rebound in the German economy, where fiscal stimulus is being rolled out on a significant scale, as well as Spain’s continued strong performance.

What is driving Belgian growth?

Over the first three quarters of this year, it was, once again, the consumer. Net trade weighed on growth, with the deteriorating balance with the U.S. standing out in particular. Government spending also contributed, while investment was disappointing.

Due to the ongoing consolidation effort, we expect government spending to slow next year. The contribution from trade is also likely to remain negative in the coming years. However, household consumption is expected to remain robust, supported by the aforementioned high level of confidence and the persistently low unemployment rate.

Can investment recover?

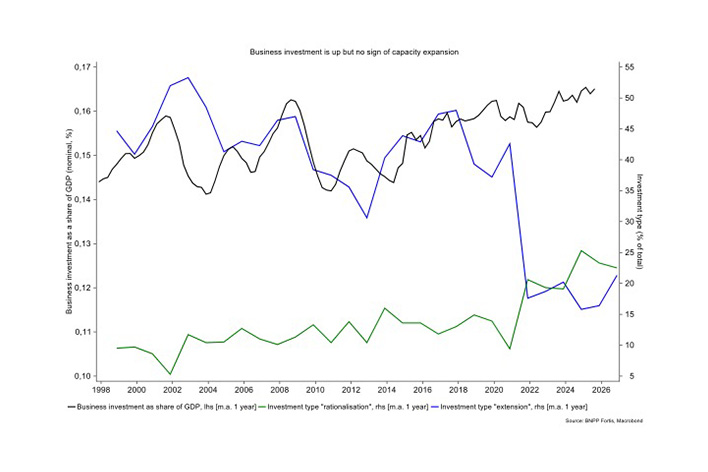

In our country, companies account for the lion’s share of capital expenditure, but they are currently very cautious. Relatively low capacity utilisation is limiting appetite for expansionary investment. In any case, Belgian companies have mainly invested to cut costs rather than expand production in recent years, as shown in the chart below.

At first glance, this situation contrasts sharply with that in the U.S., where investment, particularly in AI, has recently been a key driver of GDP growth. Economist Jason Furnam calculated that without AI capital expenditure (capex), there would hardly have been any U.S. growth in the first half of the year.

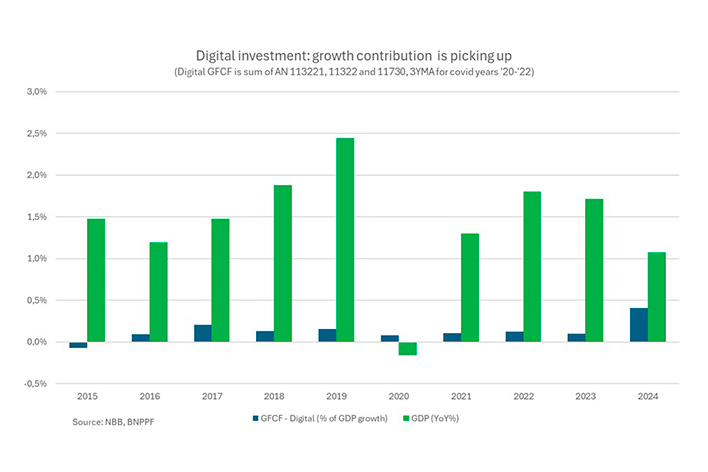

Here, too, the contribution of AI and other digital investments is increasing. The National Bank provides annual figures up to and including 2024 for the various types of investment. These figures show that digital capital expenditure accounted for 0.4% of the 1.1% GDP growth in 2024. Will we soon reap the benefits of this?