Nowcast T4: 0,3%

5 min

The most recent figures confirm our view from last month: Belgian economic growth continues. However, we are seeing increasing downside risks, particularly among businesses. For the year to come, we are forecasting annual growth of 1.1%.

At the beginning of December, the National Bank of Belgium released its latest nowcast (https://www.nbb.be/nl/media/23545). The conclusion? Quarterly growth of 0.3% once again. At the same time, NBB economists noted that they mainly see upside risk to this outlook. Their nowcast is significantly lower than the consensus of the supporting statistical models, which suggest a greater likelihood of accelerated growth, albeit with considerable variation. While our own analysis confirms this greater variation, we see a number of downside risks.

Warm and cold

The cooling labour market is pushing unemployment towards 6.5%, which is in line with our view of a gradual slowdown. Fear of unemployment, a component of the NBB’s household survey, continues to decline. Overall, consumer confidence is currently at a very high level.

It is a different story for businesses, however. Service providers and retailers in particular are noticeably more pessimistic, although overall sentiment among companies has improved compared with earlier this year. During discussions with corporate leaders (https://www.nbb.be/nl/media/23515), it was striking that prices and employment were mentioned less frequently, with more attention going to margins and overall activity levels instead./p>

Diverging predictions

For our nowcast, produced in collaboration with Ghent University, we combine traditional indicators with our own banking index. This index aggregates (and anonymises) the total expenditure and revenue of our corporate clients. These indices rebounded strongly after the summer, with costs rising more than revenues.

Today however, we are seeing a slowdown in the most recent figures. At the same time, the statistical models, which use this data as input, disagree more on quarterly growth at the end of this year.

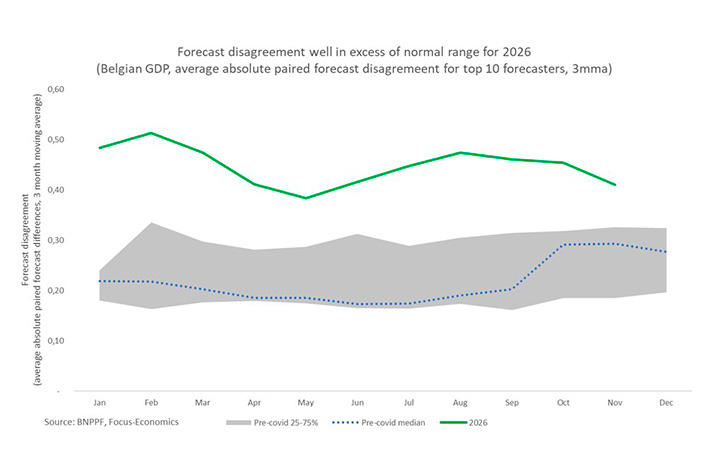

This notable disagreement is also reflected in the annual outlooks for 2026. The ten most productive forecasters have much more divergent expectations for the Belgian economy next year than usual. The green line shows the average absolute difference* between each pair of forecasters. At just over 0.4 percentage points, this difference is currently almost twice the normal level.

We therefore maintain our quarterly growth estimate of 0.3%, but predominantly see downside risks. For next year, we expect year-on-year growth of 1.1%.