Nowcast Q3: Belgian economy grows by 0.3%

5 min

According to our latest nowcast, the Belgian economy grew by 0.3% in the past quarter. Both we and the National Bank of Belgium forecast annual growth of 1.1% for 2026. But opinions differ. Forecasters are sharply divided over investment, government spending and, above all, the outlook for international trade.

The Belgian economy is performing better than expected this year. This is the conclusion of our latest nowcast for the third quarter of this year. Growth of 0.3% confirms that the dip in the second quarter was not the beginning of a structural slowdown.

Q3

In collaboration with Ghent University (UGent), we have just completed our monthly nowcast. This combines publicly available high-frequency indicators, such as household and business confidence, with our own bank index. The latter is based on the costs and revenues of our corporate clients. By aggregating this data on a large scale and in anonymised form, we can create a ‘live’ picture of activity levels among these firms. So, what does it show? That activity levels have mostly increased this quarter.

But what about 2026?

A few days ago, FocusEconomics published its September consensus forecasts. It surveyed dozens of banks, think tanks and international organisations such as the IMF. For Belgium, the current consensus is 1.0% for 2026. This is slightly below the 1.1% projected by us and the National Bank project. However, there is a wide range of views, with forecasts ranging from 0.5% to 1.8%.

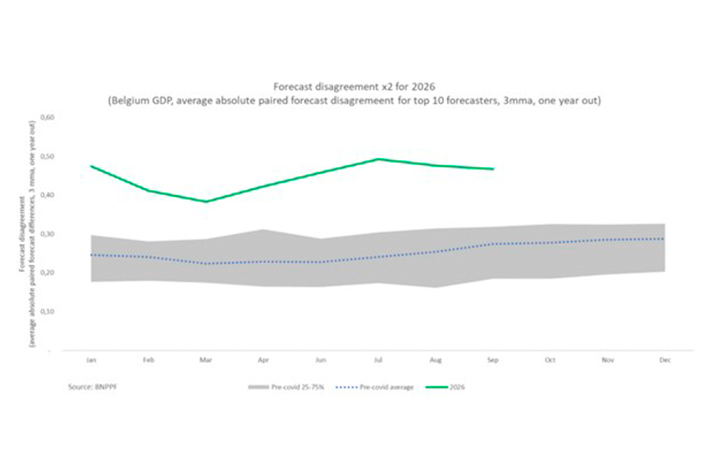

Disagreement on 2026 twice as high as normal

“Put 10 economists in a room and you will get 15 opinions” as the saying goes. However, the current divergence is strikingly greater than usual. This is evident in an interesting analysis that we conducted using an extensive dataset from FocusEconomics (see our earlier publication ‘Forecast fragmenting’).

The chart below shows the average disagreement in paired forecasts one year ahead of the year in question. In the recent past, it hovered around 0.25%. Today, however, it is clearly much higher.

What are forecasters disagreeing about? Government consumption, investment and, most of all, international trade. They assess the impact of current and future tariff changes on exports and imports very differently. This is understandable, given the uncertainty surrounding the implementation and stability of these tariffs.

Belgian growth after the Covid period was never really driven by international trade, which weighed on GDP as global activity slowed. In that context, consumers will once again be crucial in keeping the economic engine running through private spending. On a positive note, consumer confidence has recently peaked.