Manufacturing under pressure

3 min

Are Belgian manufacturers more pessimistic?

According to estimates by the National Bank of Belgium (NBB), Belgian industry made no contribution to economic growth in the first quarter of this year. This matches the sector’s most positive – or rather least negative – contribution since the end of 2022. The outlook for these companies is being weighed down by a complex geopolitical environment. So how are they really doing?

Problems, problems, problems

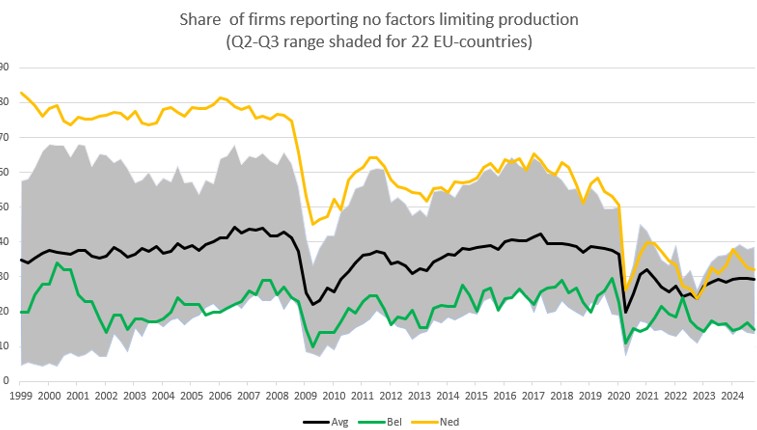

Each quarter, the European Commission surveys manufacturing firms across Europe about the obstacles they face in their production process. Companies can report difficulties accessing materials, machinery, staff or financing. They can also point to weak demand, which results in underutilised capacity. Finally, those experiencing none of these issues can simply indicate that they are not facing any obstacles.

The chart below tracks the share of companies reporting “no obstacles” in a group of European countries. It shows that, prior to the pandemic, manufacturers in the Netherlands and Germany scored significantly better than their counterparts in other EU countries. In 2019, over half of Dutch manufacturers reported facing no production constraints. For Belgium, that figure was considerably lower throughout almost the entire period under review.

The impact of the pandemic

Since 2020, however, far fewer manufacturers in the Netherlands and Germany have reported being free of production constraints. These firms are increasingly struggling with labour shortages. Interestingly, measured by the job vacancy rate in the manufacturing sector, Belgium sits right between the Netherlands (4.5%) and Germany (2.5%), at 3.5%. Yet twice as many manufacturers in the Netherlands and Germany say they are losing sleep over it compared to those in Belgium.

Since the pandemic, we have also seen a downward convergence across the 22 EU countries surveyed. More and more firms are pointing to disappointing demand. Outside of the pandemic period, the proportion of producers citing weak demand is at its highest level in over a decade. At the same time, capacity utilisation remains very low.

Investments on hold

This deterioration is consistent with the signals picked up by the NBB in its most recent round of quarterly interviews with business leaders. Managers in the manufacturing sector highlight the structural decline in business conditions across Europe. Key challenges include persistently higher energy costs in Europe compared to Asia and North America, significant regulatory and compliance burdens, and increasingly expensive environmental regulations. On top of that come growing concerns about protectionist policies.

Recently, sentiment among Belgian manufacturers has improved slightly thanks to fuller order books, but it is still very much in question whether this improvement will last.

Overall, it seems highly likely that manufacturers will become much more cautious about investment decisions in the months ahead.

Read the full report: https://www.nbb.be/doc/ts/publications/bcm/2025_03_bcm_publication.pdf