Let's keep a close eye on US commercial property

2 min

The sector has been struggling since the health crisis, a trend that's true in both Europe and the US. The return of Donald Trump and, more significantly, the creation of the Department of Government Efficiency (DOGE) risk exacerbating the situation across the Atlantic. We need to monitor this situation closely, as the consequences could be unpleasant for everyone.

Since the 2020 pandemic, working habits have changed radically. The rise of remote working and decline in city centre footfall have harmed commercial property, a phenomenon that's well-known and affects many cities worldwide. The re-election of Donald Trump could make things worse for this already struggling sector. We need to follow developments closely, as US regional banks are extremely exposed to this sector, which has been in difficulty since Covid. We don't want a banking crisis to add to the already complex picture of the global economy in 2025. Let's not forget the shockwave caused by the collapse of Silicon Valley Bank in March 2023.

The DOGE, part of the Trump administration, plans to get rid of a large part of the office space leased by the General Services Administration (GSA), an independent agency that helps manage and operate other federal agencies by providing workspaces for federal employees. The DOGE plans to sell office space owned by the government, as well as terminate leased office space, as soon as the lease can be terminated – as early as this year for several buildings. The government owns nearly 10,000 buildings across the country and pays $5.2 billion annually in rent for these offices.

Abandoned property

A significant portion of these offices is currently vacant (17%), underused, and poorly maintained due to a lack of funding. A study from the DC Policy Center published in April 2024 revealed that only 12% of federal offices in Washington DC were occupied, reflecting a low presence of employees on site. For example, at the Department of Agriculture, where over 7,000 people work, the office occupancy rate was a mere 6% and has likely not increased since. Washington DC will be particularly affected by the measures taken by the DOGE, as the federal government alone occupies around 10% of the total office space available.

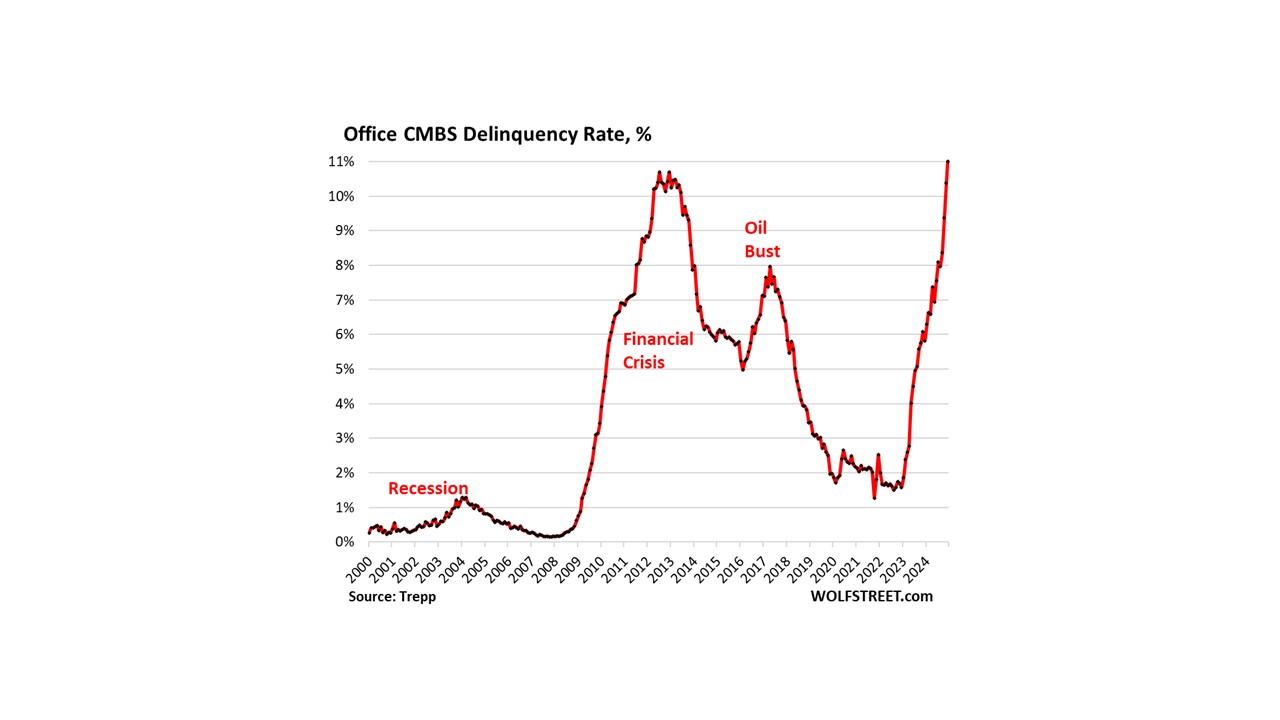

The office sector is already in depression across the country, with default rates exceeding those of the worst moments of the financial crisis. The sale of this inventory will inevitably weigh on the already low prices of former office buildings – prices 50 to 70% lower than the last sale before the pandemic are now common.

Price drop

The termination of leases will cause even more stress for property owners and the organisations that financed these office buildings, leading to more defaults and forced sales. This is a necessary but bitter remedy to reduce government waste.

An analysis by Trepp, one of the leading providers of data, analysis, and technology solutions for commercial real estate (CRE) financing markets, examined the office space leased, whose leases can be terminated in 2025 and up to 2028. And their findings are striking:

- By the end of Donald Trump's term in 2028, the GSA has the right to terminate the leases of 35% of the leased space, spread across over 2,500 properties.

- In 2025 alone, the GSA can terminate the lease of over 9% of the leased space, spread across over 500 properties.

- The termination of all leases that can be terminated by 2028 would save the government $1.87 billion in annual rent after 2028.

The commercial property sector is in full depression, and office debt is worsening. The default rate of securitised office mortgages (CMBS) in the US reached a record 11% at the end of 2024, surpassing the peak of the 2008 financial crisis. The deterioration seems spectacular compared to the low point reached in 2022 (default rate of 1.6%). However, we must remember that at the time, amid the inflationary turmoil, the mantra in the office property sector was to survive at all costs, hoping for better days and, above all, lower interest rates. Property owners and their bankers had stuck their heads in the sand, thinking that the crisis would eventually pass. As in Spain in 2008, banks had opted for the "extend and pretend" technique, which involves extending credit to avoid having to declare it. This explains why defaults were so low in 2022, even though the sector was in crisis.

We are now in 2025, and the DOGE has been created to make savings in the operating expenses of the federal government... a situation that needs to be closely monitored!