Japan: an ambitious stimulus plan amid high public debt

5 min

If there is one country whose public debt story deserves our attention at the end of 2025, it is Japan. Despite its astronomical size, Japanese debt usually attracts little interest. This situation has persisted for so long that the recent turbulence has taken many by surprise.

What is happening with Japan’s debt?

Japan’s debt has been rising inexorably for decades. Economic growth remains weak, often falling below levels seen in Europe. However, the country can rely on its robust companies and financial system, which is willing to purchase all the government bonds issued. What is the result? Despite its enormous public debt, interest rates remain low and there does not appear to be any imminent threat to the country.

One might be tempted to conclude that a huge debt is not a problem. Yet it is important to remember that Japan is an island nation that manages its own affairs independently, and that it has a central bank, the Bank of Japan (BoJ), which takes measures for the good of the country without needing to abide by external rules. This is very different from Europe, where debt levels are closely monitored by the European Commission, and where each country must comply with centrally defined rules.

A Japanese stimulus plan that worries the markets

The new Prime Minister, Sanae Takaichi, has recently decided to address the issue of weak growth by introducing a substantial stimulus package, which suggests that public debt will rise further. Her aim is to build a strong economy and boost household purchasing power. She also intends to revitalise strategic sectors such as artificial intelligence, semiconductors, and shipbuilding in order to bolster the country's competitiveness and economic prospects.

The first measures announced include the removal of the temporary fuel tax, support to reduce gas and electricity bills, and increased assistance for small and medium-sized enterprises (SMEs). These measures rely on subsidies and financial support, particularly in local communities, to stimulate activity at every level of the economy and prepare for long-term growth.

However, this massive spending could increase public debt, which is already extremely high. Achieving a balance between economic stimulus, social support, investment and fiscal sustainability will be challenging. This is why the markets reacted nervously, causing a sharp rise in long-term interest rates and another fall in the yen.

The central bank at the heart of the game

For decades, the Bank of Japan has kept government bond yields artificially low by purchasing large quantities of bonds and implementing a unique yield curve control policy that caps rates at a target level. This policy remained in place even during the period of high inflation that followed the Russian invasion of Ukraine. While interest rates surged worldwide, the increase was much more limited in Japan, resulting in the yen depreciating sharply against other currencies.

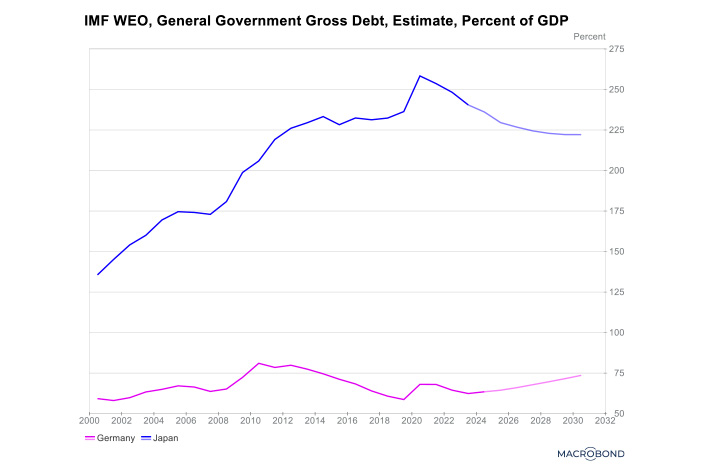

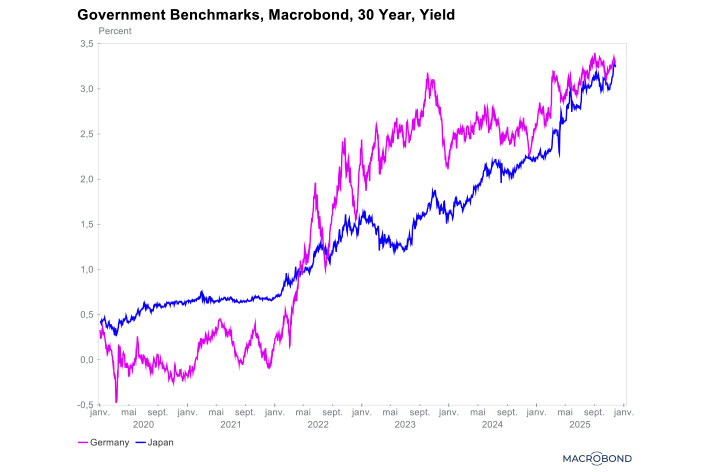

Recently, however, markets have had to adapt to the prospect of rising Japanese interest rates. Since late 2021, for example, the yield on 30-year Japanese government bonds has risen from 0.7 per cent to 3.3 per cent. This radical change has been managed by the central bank without major disruption. Nevertheless, the 30-year yield remains significantly lower than it would be in a free market. Comparing the gross public debt of major advanced economies with their 30-year government bond yields shows that Japan’s rate is the same as Germany’s, even though Japan’s public debt is expected to be 3.5 times higher by the end of 2025 (229 per cent versus 64 per cent). The only explanation for Japan’s low yields is that the Bank of Japan (BoJ) remains a major buyer of government bonds.

Where is Japan’s economy heading?

If the Prime Minister wants to influence economic developments, she must accept that fiscal space is extremely limited. Boosting economic growth will inevitably require stabilising the exchange rate and introducing tax increases to offset new spending.

Against this backdrop, Japan has just established its own version of Donald Trump’s Government Efficiency Office, a move that could allay concerns in the financial markets. Planned spending has pushed up bond yields and weakened the yen to the extent that traders expect the government to intervene to stabilise the currency. Officially named the Office for Review of Special Tax Measures and Subsidies, this new government body could reassure investors worried about Sanae Takaichi’s fiscal expansion and its long-term impact on the yen.

Only time will tell how things will develop in the Land of the Rising Sun, where everything once seemed so calm and predictable.