5 signs to understand the state of the housing market

2 min

How is the Belgian housing market faring? The climate transition remains a major challenge, while monetary easing is providing a boost. In this article, we discuss the latest developments using five graphs. Building and renovation permits are stagnating, mortgage production is stable, and apartments are selling well. However, household investments are contributing less to GDP growth. Nevertheless, Belgian property continues to appreciate.

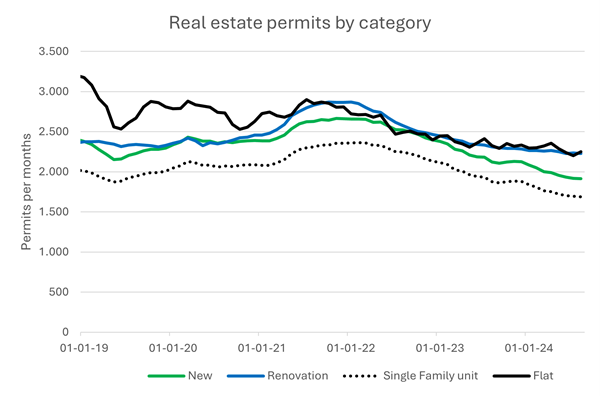

Permits are stagnating

Anyone who wants to build or renovate needs a permit. The number of permits issued for residential buildings is significantly lower than the record level of 2021-2022, according to the latest figures from August 2024. At the beginning of this century, there were more applications for single-family homes than for apartments. Today, the total number of applications in the latter category is around 30% higher per month. Renovations have been (slightly) more popular than new builds for a long time. This was only different just before the major financial crisis of 2008. The total number of applications is currently around 20% lower than two years ago.

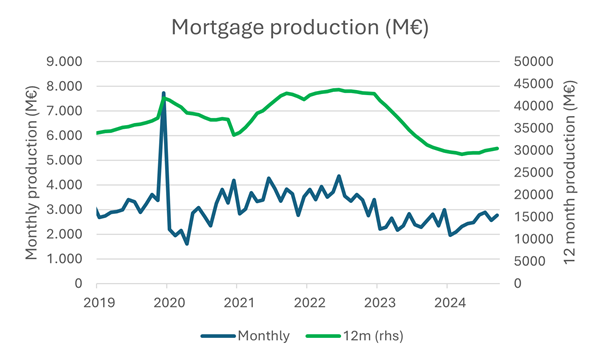

Mortgage production is stable

Except for the mortgage bonus peak at the end of 2019 and at the end of 2014, the monthly mortgage production in our country has been between €2 billion and €4 billion in recent years, according to the figures from the credit federation. However, these figures include significant seasonal effects. It is more interesting to look at the 12-month rolling production. This peaked in 2022 with over €43 billion. A year later, it was only €30 billion, and this year, the total production is unlikely to exceed that level.

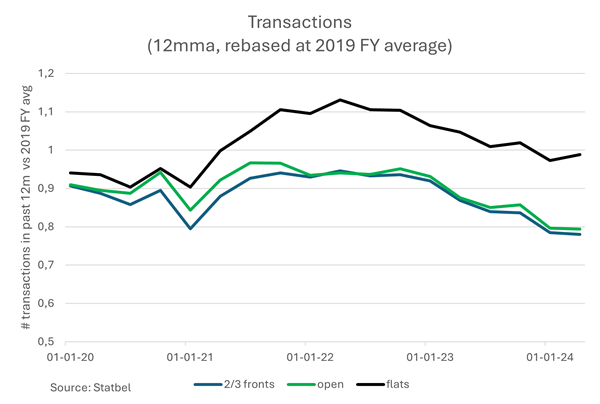

Transactions are underwhelming, except for apartments

In 2023, the number of property transactions was significantly lower than in previous years. In the first half of this year, transactions are still lagging behind that level. Except for apartments, which are being sold more quickly than semi-detached and detached houses. At the beginning of 2024, around 20% fewer houses were sold on the secondary market than before the coronavirus pandemic.

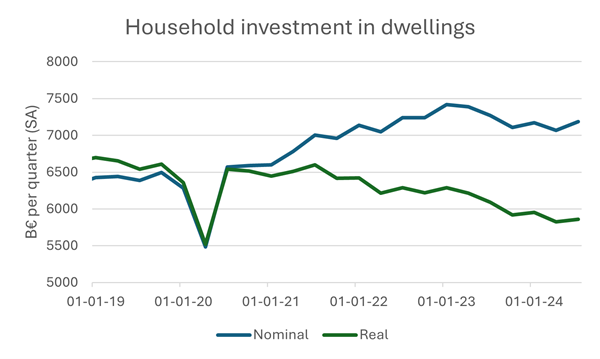

Investments in buildings are slowing growth

Households that buy homes contribute to the gross domestic product (GDP). So do businesses and the government when they invest. Investments account for around a quarter of our total GDP. Within that group, businesses are responsible for almost two-thirds. The share of household investments in GDP is currently around 5%. However, this does not contribute to positive growth. In volume or real terms, these investments are around 12% lower than their peak in 2021.

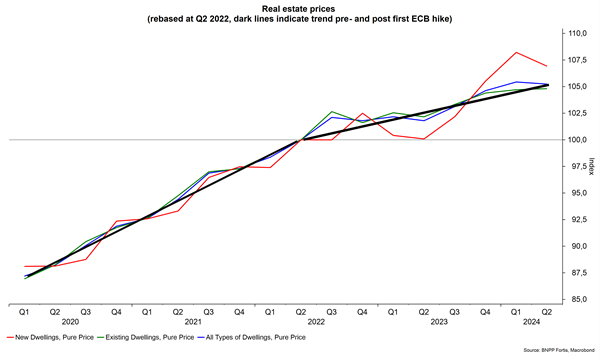

Prices continue to rise

Historically, the Belgian property market has shown a very stable price trend. In nominal terms, there has been 3-4% growth per year over the past half-century. The blue line on the graph below shows how this trend even accelerated slightly during the COVID-19 years. It is also noticeable how the price of new-build homes is slightly more volatile but does not increase faster than what is paid on the secondary market. Since the European Central Bank (ECB) raised its interest rates for the first time in the summer of 2022, there were fears of a slowdown, especially in neighbouring countries, but less so in Belgium. The black trend line has been slightly less steep since then, but despite the increasing tightening, prices have still risen by around 2.5% over the past two years.