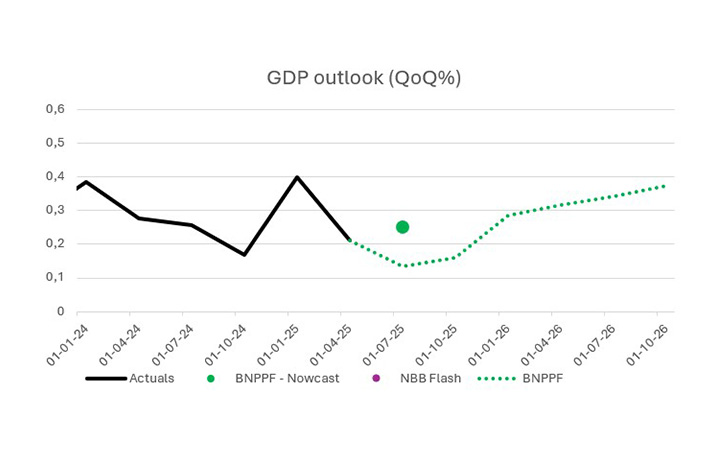

First nowcast Q3: 0.25%

5 min

The first update of our monthly nowcast points to growth of 0.25%. Although this is below the long-term average, it is higher than the slowdown recorded in the second quarter. How should this data point be interpreted?

The risks are slowly moving to the positive side.

With the quarter still in its early stages, our first nowcast came in higher than expected. Business spending, a key indicator of economic activity, has rebounded strongly in recent weeks. Historically, such an increase has been closely linked with GDP growth in the wider economy. For now though, we are maintaining our more conservative growth path, but see the risks gradually tilting to the upside.

The first update of our monthly nowcast indicates growth of 0.25%. This is below the long-term average, but above the figure recorded in the second quarter, which saw a slowdown. How should this be interpreted?

Warm and cold…

The traditional high-frequency indicators have mostly moved in the right direction in recent weeks. Overall business confidence has risen slightly, with almost all sectors now approaching their long-term averages. One exception is the more negative sentiment among service providers. At the same time, there has been an increase in bankruptcies, with notable rises in the construction and logistics sectors.

Consumer confidence is slightly above its long-term average. The labour market continues to cool, with the unemployment rate up by 1 percentage point over the past 12 months. Retail spending is climbing again, and the property market is also picking up.

…but warmer than feared

On top of this, business activity seems to be increasing. Our own transaction data show a rise in business spending. Revenues, however, are not yet following the same trend, although historically, the two have tended to move in parallel. Our nowcast models generally place more weight on spending figures, as these correlate more strongly with economic growth.

For now, the growth outlook is therefore better than anticipated. Both the median and the average estimate from our set of models came in at 0.25%, neatly between last quarter’s 0.2% and the long-term growth rate of 0.3%. As we are only one month into the third quarter, we are maintaining our existing growth path. However, following this nowcast, we are giving slightly more weight to the possibility of a positive surprise scenario.

We therefore still expect slower growth in the second half of the year, followed by a return towards the long-term average. This implies annual growth of 1.0% for both 2025 and 2026.