Economic outlooks in uncertain times

3 min

Taking a long-term view can help make sense of today’s chaos

It is a challenging time to be an economist. The models they rely on to understand the world are faltering. These models work best when there is a broad consensus. For example: structurally profitable companies deserve a high stock market valuation; government bonds from heavily indebted countries carry higher risk premiums; and free international trade benefits everyone.

Today, however, these rules are being rewritten at breakneck speed. Or more accurately: they have been thrown out, and a flurry of provisional replacements is emerging.

And that is a problem. Economics helps different actors – businesses, households, countries – coordinate, align, and collaborate. Clear rules are essential to this process. They allow us to speak the same language. But when confusion arises – say, because a dominant player decides that government deficits (and therefore debt) no longer matter, or that trade agreements are invalid – the consequences are felt by everyone.

We’re seeing that confusion play out today in the divergence between economists’ growth forecasts. These forecasts influence both corporate investment plans and household saving strategies. In that sense, they affect us all.

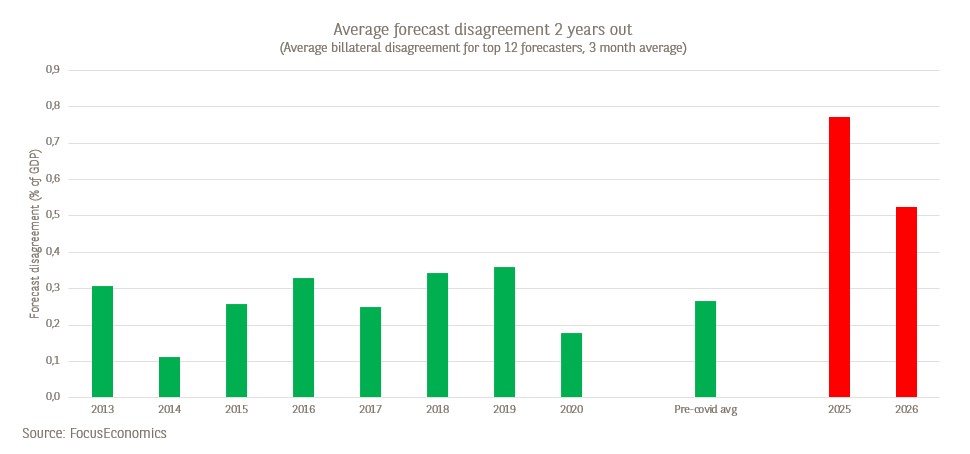

An analysis using data from the FocusEconomics forecast aggregator reveals how wide this divergence is when it comes to Belgian growth. The chart below shows the average gap between projections submitted by different panel members – such as banks and think tanks – for the years shown on the horizontal axis.

From 2013 to 2022, this divergence fluctuated between 0.1% and 0.3%. These are relatively small differences, considering that Belgium’s average growth rate over that period was around 1.5%. However, the peaks for 2025 and 2026 are much higher, at nearly 0.8% and over 0.5%, respectively*. Forecasting economic growth even a few quarters ahead has always been difficult, but today it is clearly more challenging than ever.

Should economic forecasters take a back seat for now?

The daily stream of often contradictory policy signals coming out of the Oval Office is exhausting – and not just for journalists and financial analysts.

Now more than ever, it pays to take a longer-term view. What will the world look like ten years from now? What would we like to change? And what steps should we already be taking today to make that happen?

Economists can truly add value through this kind of scenario thinking not by producing monthly point estimates for GDP growth, which are often outdated as soon as they are published, but by helping to illuminate the different paths ahead and the trade-offs they involve.

Time to get to work.

Arne Maes’s new book, 2034, a novella: Mental time travel for thinkers and doers, will be available in bookshops from 13 May.

* The high value in 2023 also stands out at first glance. These forecasts were made during the pandemic, at a time of major uncertainty around the timing and effectiveness of vaccine availability.