Economic Outlook 2025 – The EU must reduce its dependence on the US

2 min

In his outlook for 2025, Koen De Leus, Chief Economist at BNP Paribas Fortis, examines macroeconomic developments with a particular focus on Europe. He argues that Europe must take steps to achieve greater independence from the United States. His analysis of Belgium’s growth potential shows that improving productivity is the key to the country’s economic prospects.

A gradual recovery in Europe and a soft landing for the US economy were the expected scenarios until the election of Donald Trump as US president. Geopolitical uncertainty has remained very high over the past three years, and BNP Paribas Fortis does not expect much to change in the near future. The fourth turning[1], is here and is about to reach its peak.

“The evolution of inflation and, more importantly, economic growth depends on the measures that Trump ultimately implements,” says Koen De Leus, Chief Economist at BNP Paribas Fortis. “Raising import tariffs and enacting stricter migration policies are both inflationary. An expansionary fiscal policy is also inflationary, but it does stimulate economic growth. This could deter the Federal Reserve from cutting interest rates further. Meanwhile, the European Central Bank will have to watch helplessly as higher US import tariffs, and, more importantly, the uncertainty surrounding them, hurt European growth.”

A wake-up call for Europe

Trump’s election is a wake-up call for Europe, which has long been overly dependent on the United States for its defence. In recent years, this dependence has deepened with the shift from Russian gas to American LNG, and from Chinese to American exports.

Mario Draghi’s report, The Future of European Competitiveness[2], stresses the urgent need for Europe to act. Key recommendations include reducing energy costs for businesses, investing to close the massive innovation gap with the US and simplifying regulations. Specific strategies are needed to boost the international competitiveness of Europe’s industrial and service sectors while continuing to reduce carbon emissions. Increased investment in defence is also essential, as is reducing dependency on strategic raw materials and technologies.

Belgium

Belgium’s economic growth continues, supported by a slight increase in business confidence. The latest BNP Paribas Fortis nowcast, based on a limited sample size, forecasts growth of 0.3% in the final quarter. Consumer confidence is also gradually improving and the housing market is showing the first signs of recovery. However, Belgium will not remain immune to the potential impact of the new US president’s policies.

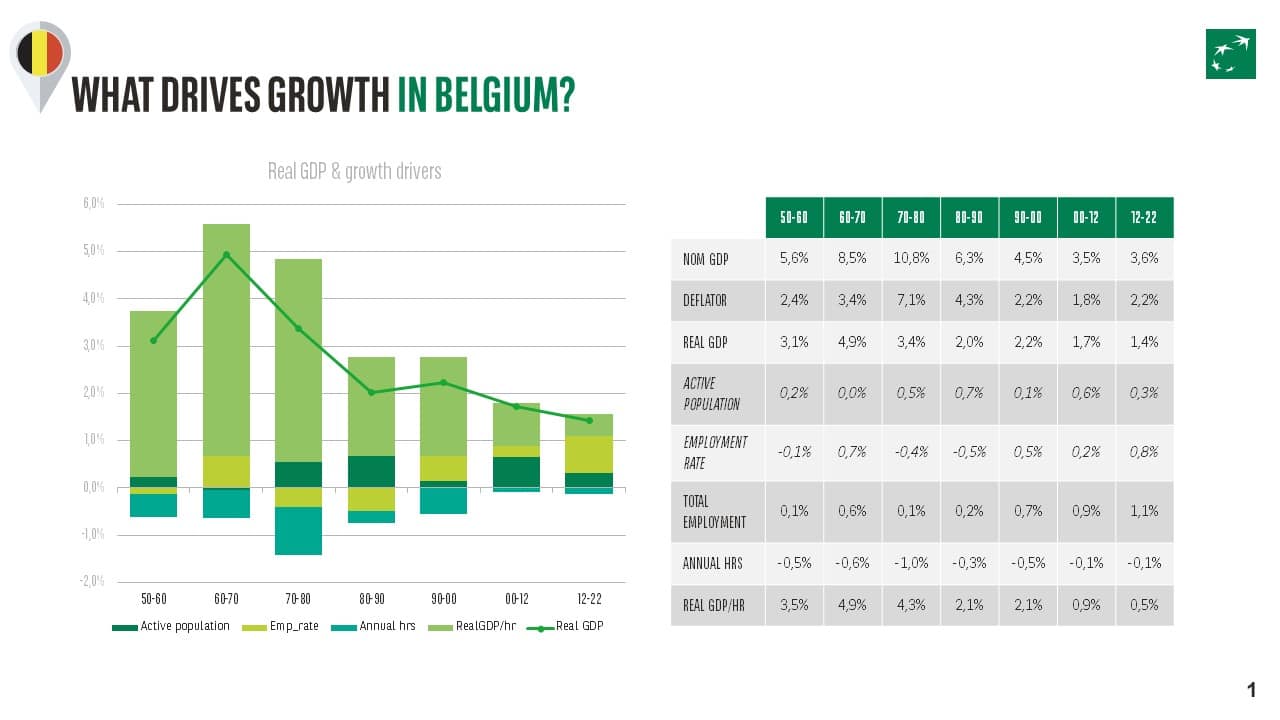

What is Belgium’s long-term growth potential? BNP Paribas Fortis has analysed this question using the four components of GDP:

- The size of the working age population;

- The employment rate of this population;

- The average number of hours worked per year by those in employment;

- Productivity growth per hour worked.

Koen De Leus: “The slower growth of the labour force and the employment rate are important factors weighing on future growth potential. In fact, according to United Nations forecasts, Belgium’s labour force will start to shrink as early as 2025. In addition, the significant increase in the employment rate over recent years is expected to gradually slow. In line with the findings of the Federal Planning Bureau’s Study Committee on Ageing, we expect a ceiling of around 75% by 2034. This combination alone reduces real growth to barely 1% per year or even lower, compared with the current trend growth rate of 1.4%.”

The main driver of Belgium’s economic growth lies in improving productivity, which currently stands at around 0.5% per year. Technologies such as artificial intelligence (AI) and other potential exponential innovations could increase this figure. However, opinions on their impact remain deeply divided. A recent report by US investment bank Goldman Sachs estimated a cumulative effect on GDP of 9 percentage points over a ten-year period, in line with BNP Paribas Group’s forecast for 2030.

Daron Acemoğlu, winner of the 2024 Nobel Prize in Economics, predicts a much smaller impact – barely half a percentage point of additional growth over a ten-year period. According to him, AI adoption is progressing more slowly and automation is less widespread than US investment bankers assume. This explains the divergence in growth forecasts.

Growth and inflation forecasts

BNP Paribas Fortis estimates that AI-related advances could add an average of 0.5% per year to productivity growth, resulting in an overall productivity increase of 1% per year over a ten-year period. This would bring Belgium’s real trend growth back to 1.4%.

In the short term, the bank expects Belgian economic growth to pick up slightly from 1% to 1.2% in 2025, supported by monetary stimulus and a rebound in momentum in key neighbouring countries that are important trading partners. Inflation, which remains high at 4.2% in 2024 due to the normalisation of energy prices, is forecast to fall to 2.1% in 2025. However, there is a significant risk that these projections could be revised downwards, in particular due to the uncertainty surrounding Donald Trump’s threat to raise import tariffs.

References

[1] Howe, N. (2023). The Fourth Turning is Here. Simon & Schuster. In this book, the author outlines his theory, which posits that historical events can be associated with generational cycles, each spanning the length of a human lifetime. During the fourth turning, society finds itself in a state of crisis.

[2] The Future of European Competitiveness: A report by Mario Draghi emphasising actionable strategies for Europe’s economic resilience. https://commission.europa.eu/topics/strengthening-european-competitiveness/eu-competitiveness-looking-ahead_en?prefLang=nl