Do falling interest rates encourage companies to invest?

2 min

Today, Belgian manufacturing companies are pessimistic. After several years of investing, the utilisation rate of production capacity is historically low. At the same time, many companies are reporting a decline in demand. Combining this with international uncertainty, we believe that business investments will be 1% lower this year than last.

In 2023, business investments were the main driver of Belgian growth. They continued to rise after the first interest rate hike by the European Central Bank (ECB) in the summer of 2022. Companies mainly invested in automation and greening, encouraged by rapidly rising labour costs and high energy prices.

The investment rate - the share of investments in the added value created by companies - was still at 27.5% in the first three quarters of 2024. Barely lower than in 2023, but there was a clear downward trend. Will this continue this year?

Appetite and capacity

Investments comprise around a quarter of the total GDP in our country. Companies typically account for two-thirds of this in real terms, households 20%, and the government the rest. At the sectoral level, industry invests the most. And that sector has been struggling lately. This is evident from the confidence barometer published by the National Bank of Belgium (NBB) every month. The outlook is bleak across all sectors, except for construction, which is showing signs of recovery. However, the industrial sector is facing particularly challenging conditions.

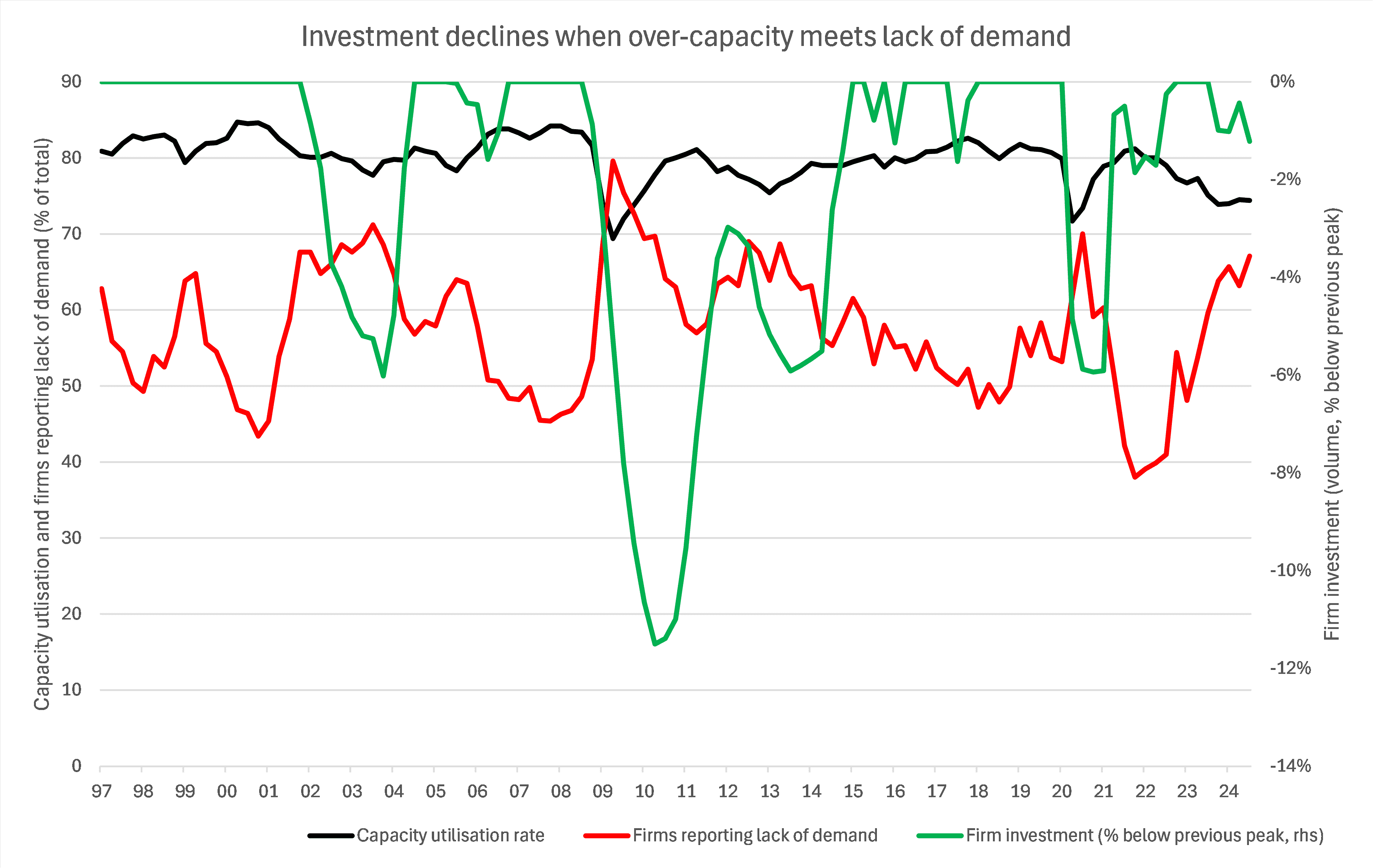

The same survey also asks about the factors that limit manufacturing companies from increasing production. Business leaders can indicate whether they have difficulties in attracting personnel, materials, or financing. Today, manufacturing companies report a low demand for their products. And what stands out? In the latest survey, more than two-thirds of companies indicate that they are in this situation (red line in the graph below).

At the same time, these same companies report that production is currently at a low level. It averaged around 74% last year, significantly lower than the long-term average of almost 80% (black line).

The graph below shows how sustainable business investments evolved during similar episodes in the past. The short answer? Not well. Every time a growing number of companies signals a decline in demand and the utilisation rate falls, business investments decline. This was the case during four episodes since the turn of the century: just after the dot-com bubble, the Great Financial Crisis (GFC), the Debt Crisis, and of course during the coronavirus pandemic. It is striking that, except during the GFC, the maximum decline was around 6%.

What now?

The question now is what the (near) future holds. The international environment is challenging (see earlier article ) and the ongoing government formation is also causing extra uncertainty. On the other hand, there is renewed attention to European industrial policy and declining interest rates.

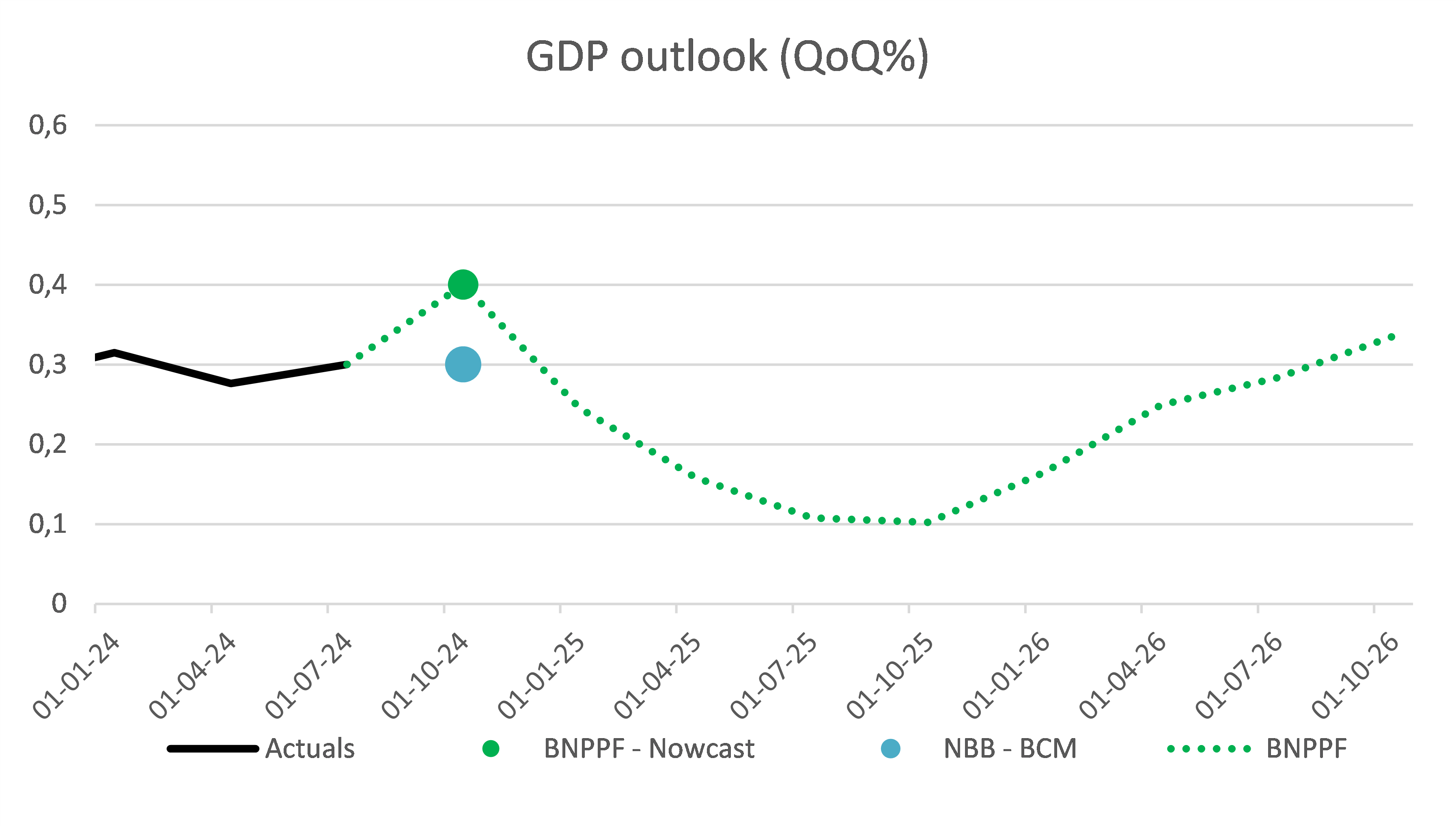

Now, we are assuming a growth slowdown rather than an economic contraction. In such a scenario, a slight decline in investments over several quarters seems the most likely scenario. Combined with a stabilisation of household investments (as the activity level on the property market recovers) and a slower growth of government investments (traditionally after high spending in election years), we see total investments falling by almost 1% in 2025.

The result? We expect 1% GDP growth this year and 0.8% next year. It is essential to note that we mainly see downward risks associated with this outlook.