Cryptocurrencies: a term that covers many things (Part 1)

5 min

The week of 14–18 July was dubbed “Crypto Week” in the U.S.A., as three bills were passed by the House of Representatives to finally provide the crypto world with a legal framework. The centrepiece was the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins). This bill sets out strict rules for stablecoin issuers, digital tokens that are pegged one-to-one to sovereign currencies, in 99% of cases the U.S. dollar.

Also approved by the House were the Clarity Act (to increase transparency to other crypto assets) and the Anti-CBDC Surveillance Act, which aims to ban the launch of a digital dollar. While the GENIUS Act has already been approved and signed by the President, these other two bills still need to pass the Senate.

Bitcoin

The best-known branch of the crypto tree is undoubtedly Bitcoin, often referred to as digital gold. In functional terms, it can mainly be used for payments: I can buy a product or service and pay you in Bitcoin, and this transaction is neatly recorded on the blockchain. Think of it as a digital vault: safe and anonymous, but with limited functionality. Some even say it is functionally worthless.

But is it really? Its anonymity makes bitcoin especially attractive to the underground economy. As Kenneth Rogoff, a professor at Harvard and former Chief Economist at the IMF, wrote in Our Dollar, Your Problem: “Bitcoin may have little legitimate value in regular transactions […] But if it is widely used to facilitate black market trade, it cannot be dismissed as a purely speculative asset.”

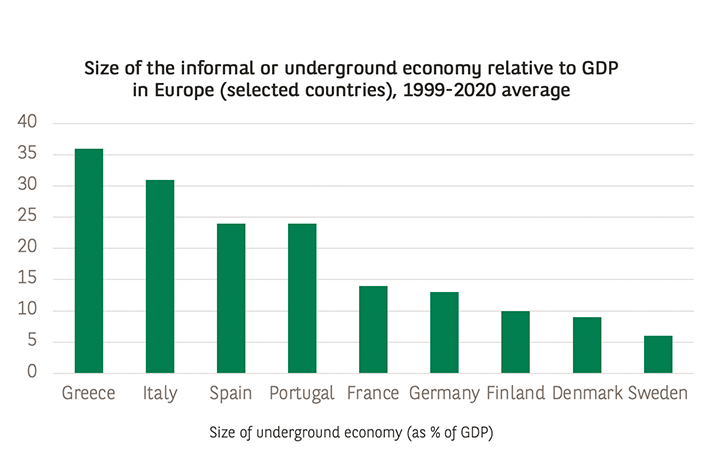

In 2021, the World Bank estimated that the shadow economy accounted for up to 17% of GDP in developed countries and 32% in developing ones. According to Rogoff, in Europe the figure ranges from 6% in Sweden to 36% in Greece, so not insignificant.

Those who hold Bitcoin directly on the blockchain effectively store them like $100 or €500 notes under the mattress. Those who hold them through an exchange are placing trust in a kind of bank, but one that is not always as strictly regulated. Unlike traditional banks, crypto exchanges do not always offer the same transparency, making it difficult for tax authorities and legal bodies to trace transactions. This makes bitcoin and other cryptocurrencies appealing for transactions in the underground economy. As long as governments struggle to efficiently trace such payments, bitcoin will retain this “fundamental” value. But if that changes, Rogoff warns, the price could collapse.

Ethereum and open-source platforms

After Bitcoin, the next most important cryptocurrency is Ethereum. It is more than just a coin; it’s a programming platform for smart contracts and decentralised apps. Think of it as a global digital infrastructure that developers can build on. Ether, the currency, is the payment method within that ecosystem. The greater the demand for applications, the greater the demand for Ether. Like Bitcoin, Ethereum also benefits from investor speculation.

There are now dozens of competitors: Cardano, Solana, Binance Smart Chain… all trying to stand out through speed, lower fees or better scalability. It is a tech race reminiscent of the early days of the internet.

The memecoin hype

And then there are the memecoins, the Wild West of crypto. What added value do they offer? None. Their appeal? Pure hype.

Take $TRUMP, for example, which was launched to celebrate Donald Trump’s leadership and his “Fight, fight, fight” slogan. The coin peaked at $75, reportedly generating at least $350 million in profits for its issuers, including family members. It currently trades at around $8. In April, its value doubled after organisers announced that Trump would invite the top 220 holders to a gala dinner, with a VIP reception for the top 25. A few days later, additional $TRUMP tokens were released. No joke.

Other classics include Dogecoin (featuring the Shiba Inu dog), Pepe (based on the internet meme frog), and yes, even Fartcoin (the name says it all). When the music stops, whoever’s holding these worthless tokens will be left footing the bill.

Bitcoin treasury companies

Another curious niche is that of bitcoin treasury companies. They raise fresh capital via debt or shares and invest it entirely in crypto. In effect, they are hedge funds with Bitcoin as their sole strategy.

MicroStrategy, now called Strategy, was the pioneer. Its CEO, Michael Saylor, one day decided to convert all of the company’s cash reserves into Bitcoin and other crypto assets. The move paid off: since 2020, its share price has risen twentyfold. Today, around 160 companies have followed this example, with a combined market capitalisation of over $100 billion. However, in recent weeks, their shares have plunged as the hype has faded.

Stable stablecoins

Finally, there are stablecoins, the stars of the show and the big promise behind the GENIUS Act. Issued by private companies, they are fully backed by liquid assets, often U.S. government bonds or cash. Their value remains stable relative to the U.S. dollar or another reference asset, sometimes even gold.

The idea is simple: combine the benefits of crypto (fast, global, 24/7) with the stability of traditional currencies. There’s no need to open a foreign bank account to send money abroad; you can just transfer stablecoins from your wallet to someone else’s.

In practice, many of these transactions occur via exchanges such as Coinbase or Binance, or apps such as PayPal USD. In such cases, a “payment” is often no more than an update to the platform’s internal balance, not an actual blockchain transaction. The distinction between a blockchain-based system and a fintech’s spreadsheet is therefore becoming increasingly blurred.

What’s next?

Stablecoins are gaining momentum. But the questions are piling up: why would companies issue them, how safe are they really, and could they disrupt the traditional banking model? And might they even replace sovereign currencies one day? We will explore all of these questions in our next instalments.