Chinese stock market boom

2 min

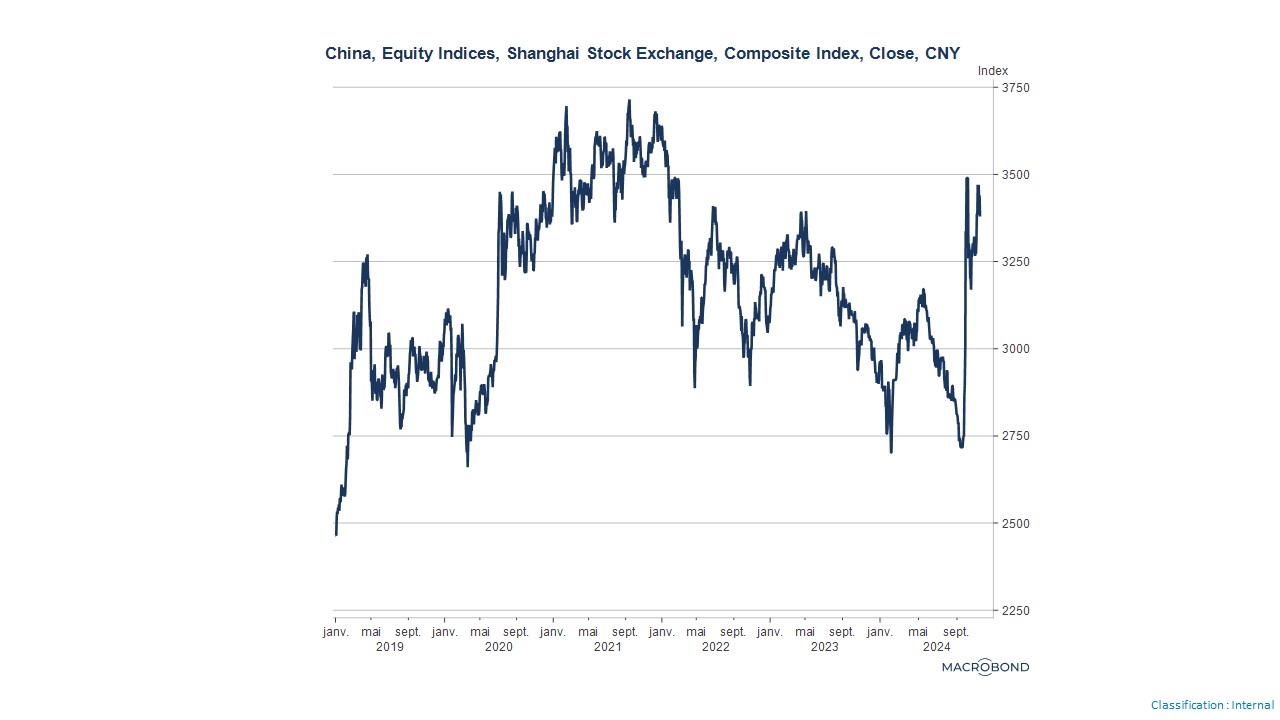

The Chinese stock market soared following the announcement of a new plan aimed at addressing the finances of local governments, which have traditionally been the engine of economic growth in China. The market has returned to levels last seen in January 2022, and the central bank has even been forced to dip into its foreign exchange reserves to prevent the yuan from appreciating too much. But will this trend continue?

A major fiscal plan

Chinese authorities have unveiled their most significant fiscal programme in years, part of a renewed effort to boost economic growth amid trade tensions and the threat of new tariffs from Donald Trump. The much-anticipated 10 billion RMB plan (approximately $1.4 billion), which follows a monetary policy package introduced in September, focuses on paying down billions of dollars in debt owed by local governments – key players in the country’s sluggish growth. However, the plan is noticeably lacking in measures to boost household spending.

The new initiative primarily targets the struggling real estate sector by addressing the financial problems of local authorities. However, experts remain sceptical about its chances of success, especially with the re-emergence of Donald Trump on the global stage. Despite these concerns, financial markets have reacted positively, with the stock market rising more than 20%, and the yuan strengthening significantly, prompting the central bank to cut interest rates and draw on its reserves to prevent the currency’s appreciation from harming exports.

Why a focus on local governments?

Attention is centred on local governments because the plan seeks to restructure their "hidden" debt. Much of this debt is tied up in off-balance-sheet financing vehicles used by local governments to fund infrastructure projects. Why the focus on local finances? Simply because these administrations are vital to China’s economy. However, the ongoing real estate crisis has limited their ability to play their usual role of driving regional growth through critical investment – especially as the central government remains reluctant to significantly increase its debt. China's debt-to-GDP ratio is still relatively low at 85% compared with 60% pre-COVID.

In many regions, the authorities have relied on local government financing vehicles (LGFVs) to fund investments in areas such as real estate, infrastructure, technology, and financial assets. However, many of these investments are high risk and yield low returns. As the slowdown in China’s real estate sector worsened, LGFV debt became unsustainable, straining public finances and slowing growth. In response, local governments resorted to levying additional fines and taxes on private companies, further dampening investor confidence. With household morale still low following the pandemic, it is clear that the Chinese economy is in urgent need of a strong stimulus.

Superficial restructuring?

The International Monetary Fund (IMF) warned last year that a third of LGFVs were "commercially unviable", having generated insufficient revenue to cover their interest payments over the past three years. It called for deeper debt restructuring, including asset sales at a loss and debt write-offs.

Beijing claims that restoring the financial health of local governments will lay the foundations for sustainable growth. However, analysts argue that debt swaps do little to stimulate the economy, as they do not significantly increase spending. Investors had hoped for policy adjustments, such as buying some of China’s millions of unsold homes or providing direct support to households. Unfortunately, these measures have not been forthcoming, and the lack of consumer-focused initiatives has been disappointing.

As the situation unfolds, all eyes will be on how this will affect China’s exports, especially with the spectre of Donald Trump looming once again over trade relations.