Chinese exports fall amid renewed trade tension

2 min

Chinese exports fell for the first time since April, surprising analysts and underscoring the impact of ongoing trade tensions. Despite a temporary truce with the United States, China faces fragile confidence and structural headwinds. Export performance remains essential to sustaining growth.

Keeping an eye on the Chinese engine

In October, Chinese exports fell for the first time since the famous “Liberation Day” in April. This unexpected downturn caught analysts by surprise. Yet the one-year truce between Xi Jinping and Donald Trump could provide China’s export-driven economy with some breathing space. After all, a trade war between China and the United States would leave only losers.

Since the 2020 Covid crisis, something has cracked in China: after three years of extremely strict lockdowns, consumer confidence has clearly been shaken. Add to that the impact of the ongoing property crisis, and it is clear why export dynamics are vital for sustaining growth in the world’s second-largest economy. President Xi understands this, which is why he has been travelling the world to open up new markets for Chinese products.

Unexpected drop in Chinese exports in October: a shock!

In October, Chinese exports fell for the first time since the U.S. triggered new customs duties on “Liberation Day” in April, highlighting the impact of months of trade tension. According to Chinese customs data published on 7 November 2025, exports from the world’s second-largest economy dropped by 1.1% year-on-year in October, measured in U.S. dollars. The last contraction occurred in February.

This unexpected fall in October follows months of strong export growth, including an 8.3% increase in September. Analysts had also expected an increase last month, hence the shock of these figures.

A truce

Last week, Presidents Trump and Xi Jinping agreed on a one-year ceasefire. This followed Beijing’s threat to tighten controls on its exports of rare earth metals. The U.S. badly needs these critical materials, so the agreement between the two economic powers quickly gained momentum.

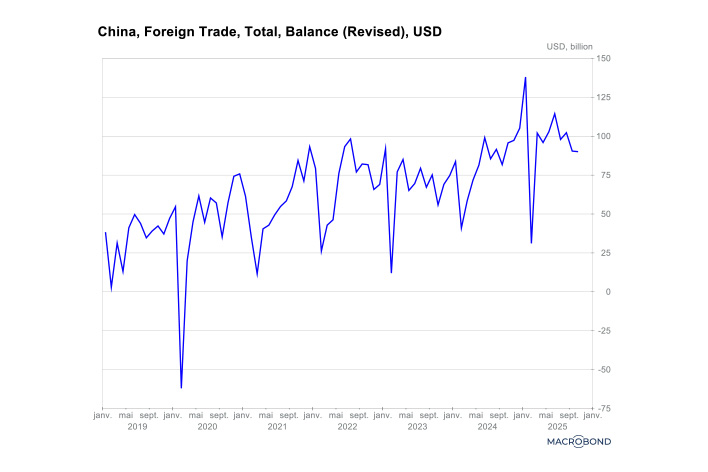

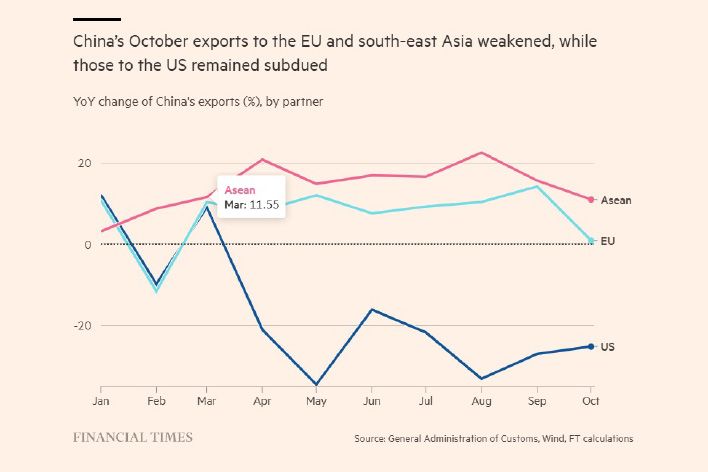

The accord prevents an all-out trade war that would benefit no one. However, Donald Trump’s erratic decisions and the escalating tensions between the two countries likely prompted Chinese exporters to rush shipments before there was any new flare-up occurred. Chinese exports to the U.S. have fallen in recent months, this has been offset by increased sales to Southeast Asia and Europe. China’s trade balance remains remarkably positive: despite a slight decline, it still posted a surplus of 90 billion U.S. dollars in October.

In October, exports to Europe and Asia rose at a more moderate pace of 0.9% and 11% respectively, the weakest growth since Donald Trump’s returned to the White House. By contrast, exports to the U.S. have been hit hard by the trade conflict, with the latest figures remaining deeply negative.

Rare earth metals

China needs to export to sustain its growth. The threat to restrict exports of rare earth metals was a masterstroke that (temporarily) halted the escalation between the two countries. It now remains to be seen how trade flows will evolve, given that the ceasefire lasts only one year.

The U.S. will probably not be able to curb its voracious imports of low-cost Chinese goods. Meanwhile, China will not hesitate to flood the rest of the world with its products, as evidenced by the textile and automotive exports that have inundated Europe for several months. The truce between Donald Trump and Xi Jinping should pave the way for exports to the U.S. to recover.

The battle will be fierce, but the stakes could hardly be higher for those involved.