China and its public finances

5 min

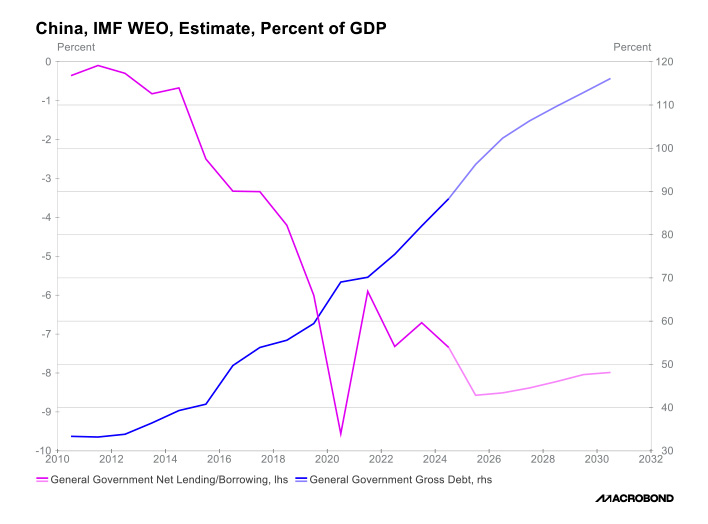

China may dominate rare earths, but its public finances are under growing strain. Rising debt, widening deficits, weak consumption and a faltering property market are forcing Beijing to reform tax collection and rein in spending. Welcome to the realities faced by developed economies.

China and its public finances

While China appears well positioned to face today’s global challenges thanks to its control of rare earths, the country also needs to keep its public finances under control. Welcome to the world of developed economies!

China is often discussed, but rarely in relation to its public finances. That, however, appears to be changing. This year, the country plans to hire the largest number of tax officials in more than a decade, as Beijing seeks to rein in a widening budget deficit and mounting debt. Ensuring the fiscal sustainability of China is a major challenge for President Xi Jinping’s government, which has increased spending for at least five years in an attempt to stimulate weak consumption. This has occurred at a time when a property recession and crackdowns on fee collection have left many local authorities in dire financial straits. In 2026, central and local government tax departments plan to recruit more than 25,000 people, marking the fourth consecutive year of large-scale civil service hiring.

Large-scale recruitment of civil servants

These hires in the tax administration come as many officials recruited in the 1980s retire, in an ageing country where the pension age is 55 for women and 60 for men. China must keep a close watch on its finances as both the deficit and debt continue to rise.

The country must reform its tax collection system as new industries have emerged, creating new tax bases that struggle to generate real revenues without appropriate tax reform.

Capturing AI revenues through taxation

The central government is stepping up efforts to collect revenue from the rapidly expanding digital economy, which was previously lightly taxed, particularly in areas such as e-commerce and livestreaming. According to the secretary general of an association of tax officials, the growing number of people generating taxable income through such activities has made the country’s old model, whereby a single official managed specific taxpayers, untenable. He added that new recruits with accounting and AI-driven data analysis skills are needed to handle the significant tax workload linked to the booming online economy. The tax authorities have also announced measures to strengthen tax collection and curb the use of tax breaks for companies by local governments, which are accused of fuelling industrial overcapacity.

The authorities are broadening the tax base by collecting more from high earners, including individuals realising capital gains on offshore investments. According to a Financial Times article published this summer, Chinese investors holding overseas portfolios are now subject to a 20% tax on their worldwide income. China’s tax revenues have fluctuated sharply in recent years, in line with weak domestic demand and a loss of public confidence since the onset of the pandemic.

A faltering domestic economy

Youth unemployment remains high and consumption is sluggish. Since October, the leadership of the Communist Party has been calling for new reforms as part of the country’s economic plan for the five years starting in 2026. In a politically sensitive move, Beijing is considering taking a larger share of tax collection away from local authorities, which have been severely affected by the long-lasting property downturn that has deprived them of crucial revenues from land sales. Local government revenues have also been reduced by a decade of Beijing-led campaigns to cut taxes and fees. Not so long ago, the crisis in China’s property market led to a collapse in local government revenues and brought down major developer Evergrande, triggering shockwaves across global markets.

The whole world is watching China, which holds 60% of the world’s rare earth reserves and 90% of rare earth refining capacity, placing the country in a strong position for the future. Yet the spectre of public finance management now looms large over the country, with runaway debt, a yawning deficit and an urgent need for reform to maintain control.

Welcome to the reality of developed economies!