Belgian property: the market has bottomed out, but new builds remain under pressure

3 min

The Belgian property market has finally reached a low point, but there are encouraging signs of a recovery. In the first half of 2025, the number of transactions rose by 16.7% compared with the same period last year. Flanders outpaced the national figure with an increase of 18.2%, according to Fednot’s Property Barometer.

And what about prices? They are lagging slightly behind. House prices in Flanders rose by 2% in nominal terms, while apartment prices edged somewhat lower (-0.4%). At the national level, prices remained stable, except for the Walloon region, where the average house price jumped by 13.4%. The reason is simple: many buyers delayed their purchases last year to benefit from the reduced registration duty (from 12.5% to 3%) this year. Sometimes, waiting does pay off.

But does this mean we’re returning to the good old days of 3 to 4% annual price growth? Two factors could throw a spanner in the works: interest rates and affordability.

Interest rates: from stairlift down to escalator up

For the past four decades, mortgage rates have only moved in one direction: down. That gave the property market wings. But the tide has turned. Key factors contributing to this include the ageing population, the climate transition, deglobalisation, and soaring public debt, all of which point to a higher structural risk of inflation. That long-term uncertainty, along with geopolitical shocks, is pushing the risk premium up. Since 2020, this premium has driven long-term interest rates up by 2 percentage points. Could we see a return to 1% mortgage rates? Highly unlikely. Long-term rates of 3 to 4% are set to become the norm.

Affordability: the elastic is stretched to its limit

Housing affordability is now at a historic low. The average household spends around 28% of its income on a 20-year loan, almost as much as it did in 2008. The reasons for this are clear. House prices have barely corrected since the COVID boom. Combine that with mortgage rates that rose from 1% to a peak of 3.6% in December 2023, and still hover around 3% today, and it is clear why the pressure is mounting.

In terms of affordability, Belgium is around the international average. Italy, France and the Netherlands face similar challenges, while countries like Australia and Hong Kong fall into the category of 'unaffordable for ordinary households.’

Correction or just a pause?

Should we fear a crash like in 2008? Probably not. Other valuation indicators, such as the ratio of house price growth to income, show an amber light globally, not red. What we can expect, however, is a more gradual pace of price increases, around 2 to 3% annually in the near term. This is just above inflation, but below the historical average. What’s missing is the additional boost from falling interest rates, which we’re unlikely to see in the coming years.

New construction: the sick canary in the coal mine

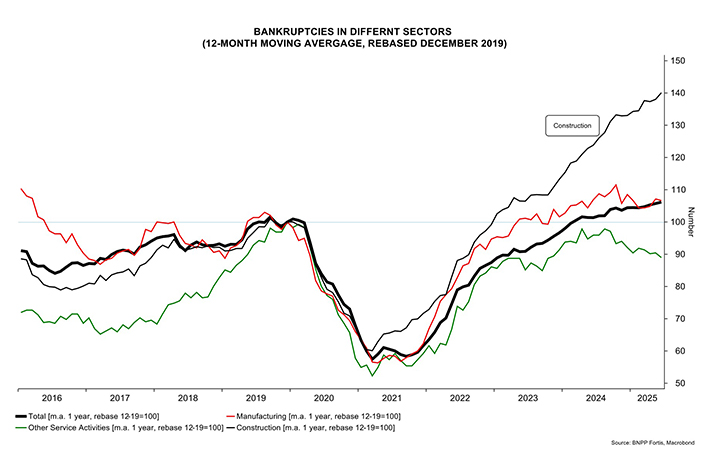

It is the new-build market that is really under pressure. Construction costs are rising faster than sale prices, and making a home energy-efficient requires new technologies. During periods of low rates, extended waiting times for permits were a minor inconvenience. However, with financing costs exceeding 3%, these delays can prove detrimental to business operations. The result is a net loss of 770 construction companies so far this year, and a 21% drop in new company registrations in the sector.

On the buyer’s side, the situation is equally bleak: just 4.2% of households can currently afford a newly built flat, and only 2.4% a new house. For both categories, that’s half what it was in 2021. This creates a vicious cycle where rising costs make new builds unaffordable, but without higher prices, projects are no longer viable.

What now?

The government could take two important steps:

- Permanently reduce VAT on new builds to 6%.

This would make homes more affordable, although safeguards would be needed to prevent developers from pocketing the margin.

- Speed up the permitting process.

Time is money, especially when borrowing costs exceed 3%.

In the meantime, the renovation market continues to run at full speed. But there too, another issue looms: a shortage of labour.

Conclusion

The Belgian property market is no Titanic, but it is a large vessel adjusting its course. Prices are likely to keep rising in the future, but at a slower pace. New construction is stagnant, while renovations continue to thrive. And interest rates? They’re going nowhere, like a strict landlord standing in the doorway.