American employment figures take centre stage

2 min

Contrary to expectations of a cooling labour market, job offers and resignations increased in October. This development could have implications for the Federal Reserve.

October surpasses expectations

The US labour market showed unexpected strength in October, making it a trend worth monitoring. According to the Bureau of Labor Statistics' Job Openings and Labor Turnover Survey (JOLTS), the data diverges from recent months. Although the numbers are still influenced by the Boeing strike, which ended in early November, and three hurricanes (Francine, Helen, and Milton) that temporarily shut down construction sites, a closer look is warranted.

The Fed is watching

Could the Fed reconsider the pace and depth of the planned interest rate cuts? The interest rate cut in September, which was 50 basis points, was surprisingly large, but it now appears to have been triggered by a false alarm on the labour market, when job creation fell short of expectations. This development is certainly food for thought for those speculating about the Fed's next move at its meeting on 18 December 2024.

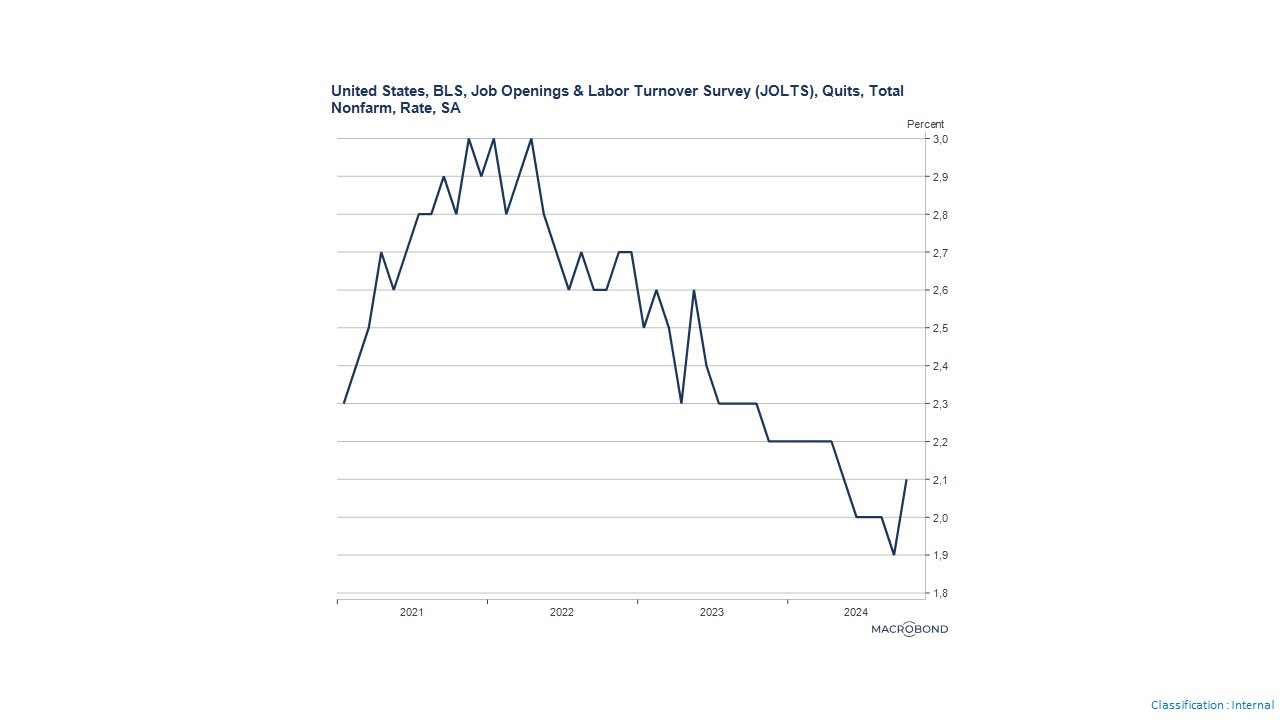

The high workforce turnover of 2021 and 2022 had seemingly subsided, with fewer people resigning, resulting in fewer job openings and a smaller pool of candidates to fill them. However, October's data suggests a potential turning point, indicating a possible uptick in labour demand and a tightening of the labour market.

The Fed's favourite ratio

The number of job openings per unemployed person, a labour market metric closely watched by the Fed President, has increased to 1.1 job openings per unemployed person. This indicates that there are still slightly more job openings than unemployed individuals seeking work.

This ratio had stabilised for a few months after a sharp decline until June 2024. The decline had partly prompted the Fed to cut interest rates by 50 basis points in September, as it sought to prevent the labour market from cooling too rapidly.

In recent months, the number of voluntary departures had decreased, resulting in fewer new job openings, job offers, and hires. This trend had benefited employers, as longer-tenured workers tend to be more productive and require less aggressive compensation packages to retain.

However, the uptick in resignations observed in October, if sustained, could be an early indication that workers are regaining confidence in the labour market. This could lead to more job-hopping, as employees are lured away by more competitive employers, and a renewed perception that better opportunities exist elsewhere. These developments could be the first signs of a labour market that is tightening once again – a scenario that contradicts the expectations of the Fed and many analysts.

To be continued…