2025 : a year of monetary policy or fiscal prudence?

2 min

After a year of interest rate cuts in many countries in 2024, every word from central banks was closely watched, making 2024 a year dominated by monetary policy. However, the deterioration of public finances in many regions of the world has been significant, and several countries will need to address this pressing issue in 2025. For these nations, 2025 is likely to be a year focused on budgetary policy.

The year 2024 will be remembered for the significant actions taken by central banks worldwide. In the United States, Europe, and China, interest rates were lowered on several occasions as the inflationary pressures caused by the surge in energy prices and the post-pandemic economic rebound gradually subsided. In China, where inflation never gained traction, the central bank implemented rate cuts to stimulate growth.

However, in a seemingly paradoxical move, several central banks, including the US Federal Reserve and the European Central Bank, simultaneously pursued a policy of reducing liquidity by shrinking their balance sheets. The amounts withdrawn from circulation were substantial. While this might be described as a "restrictive policy" in monetary terms, it is more accurately characterised as a normalisation effort. This follows years of extraordinary expansion in balance sheet size, which had led to an oversupply of liquidity and a devaluation of money (as evidenced by the negative interest rates that were in place in several countries not long ago).

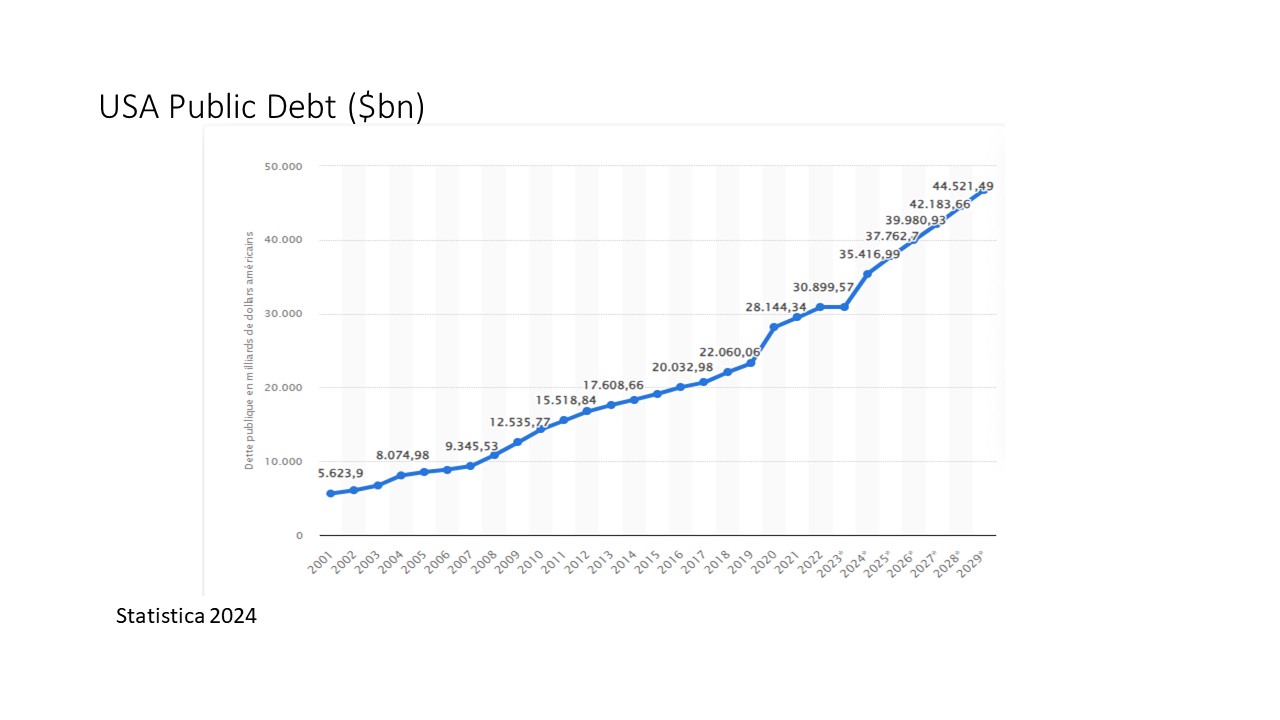

Deterioration of public finances

2024, however, will be remembered for a significant deterioration in public finances in many countries. Across the globe, public spending has increased, often resulting in alarming public deficits. In the United States, the situation has taken a turn for the worse, as the economic support measures introduced by President Biden, combined with the rising cost of debt, have led to a staggering deterioration in public debt. By the end of this year, the US public debt is expected to reach $35 trillion, a staggering increase of almost $3 trillion in just one year. This is an unprecedented development.

2025: a monetary or budgetary year?

There is a broad consensus that interest rates will continue to fall on both sides of the Atlantic in 2025, although the extent and pace of these rate cuts will likely depend on the direction of Donald Trump's second term. If protectionist measures are implemented and the US economy benefits from them, there may be fewer rate cuts in the US and potentially more in countries that will be most affected by this new environment. The global community is eagerly awaiting the impact of future tariffs on their own economic growth.

In Europe, several countries are currently in a precarious position due to the absence of a government, and it is clear that it will take time to gain clarity on the situation. In Germany, the government has collapsed due to disagreements over public finance management, and it is uncertain how the future will unfold. The need for public investment is pressing, but it will require compromise to move forward. The European situation has taken a dramatic turn in recent weeks, and pessimism is widespread among both consumers and business leaders.

The question remains whether 2025 will be a "monetary" year, with economies boosted by falling interest rates, or a "budgetary" year, with public sector measures that will either support the economy or prevent a new debt crisis from emerging.

The opinions in this blog are those of the authors and do not necessarily reflect the position of BNP Paribas Fortis.