A flash in the pan?

3 min

The National Bank of Belgium expects stronger growth in Q1, but uncertainty remains in Q2.

The nowcast, which is produced in collaboration with the University of Ghent and BNP Paribas Fortis, is about to celebrate its fourth anniversary. With the motto “never waste a good crisis,” we launched this real-time barometer in mid-2020. At that time, traditional quarterly GDP figures were still being published with their usual months-long delay. With the economy flip-flopping between lockdowns due to the pandemic, many decision-makers were flying blind. Enter the nowcast: a monthly reading of the economic pulse, based on high-frequency indicators and our banking data.

In retrospect, the aggregated revenue and cost trends among our business clients closely mirrored the quarterly evolution of GDP. Today, our second nowcast points to 0.3% growth. This results from a recovery in bank data and ongoing weakness in high-frequency indicators. But this time, the unusually high flash estimate also plays a key role.

What is the flash estimate telling us?

Earlier this year, we were still expecting below-average growth for Q1. But last week, the NBB published a surprisingly strong flash estimate. As usual, it was released at the end of the month following the relevant quarter*. The result: 0.4% – significantly better than expected.

Is that reason enough to revise our scenario upwards? Possibly. But first, we need to understand how meaningful that data point actually is.

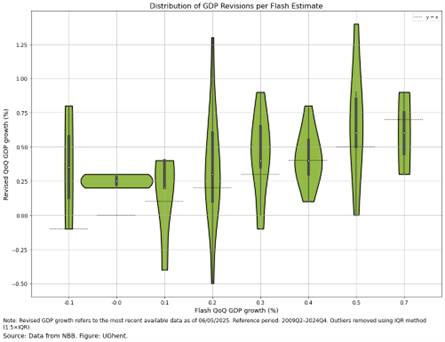

How closely does the flash estimate reflect the final GDP figures? Laura Verbeken and other researchers at the University of Ghent put it to the test. They compared the flash estimate with the current** final quarterly growth figures for 2009–2024.

They concluded that, on average, the flash estimate was lower than the final GDP figure, particularly when the flash estimate was negative or zero. In three out of four cases, the final figure ended up being more positive.

Mixed signals

But what about above-average flash estimates, like the one for Q1?

Laura Verbeken’s analysis shows that in 35% of such cases, the flash overestimates growth*. On average, the final estimate in these cases is 0.3 percentage points lower. Perhaps more striking, however, is that in half the cases, the final growth figure is higher than the flash estimate – again by an average of 0.3 percentage points.

In today’s context, a significant acceleration in growth still seems unlikely. This is also reflected in our latest nowcast for Q2, in which the Q1 flash estimate plays an important role. The nowcast points to 0.3% growth for the current quarter, with around 0.05 percentage points of this coming from the very positive flash estimate***.

All things considered, we remain on the path where the slowdown triggered by the new U.S. administration is gradually being offset by increased (fiscal) spending in the EU, particularly in Germany.

For 2025, we forecast growth of 1.1%, rising to 1.2% the following year.