A few certainties in an ocean of uncertainty

5 min

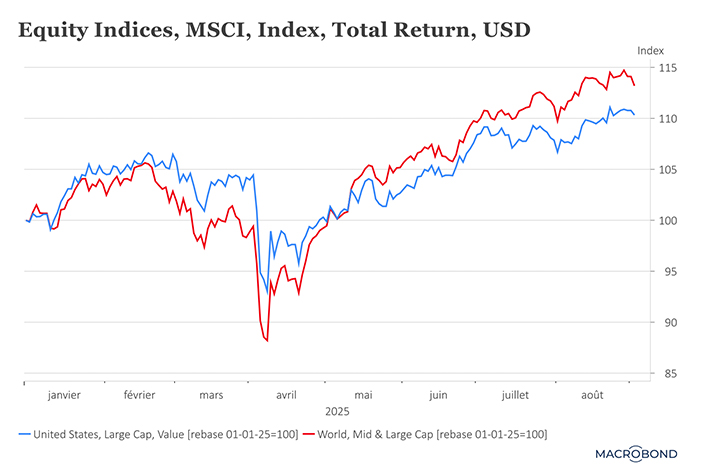

At the time of writing, there are few certainties and many uncertainties. Financial markets had expected a “hot” summer, but it turned out to be relatively smooth sailing. Stock markets remained well supported and bond markets showed no major signs of stress, despite a steady stream of bad news. This included the ongoing and escalating trade war between the United States and the rest of the world, repeated failures to bring peace to Ukraine, and worsening public finances almost everywhere. Threats from Donald Trump to interfere with the independence of the central bank were an additional concern, as this would take us into uncharted territory, with consequences that are difficult to predict.

Pressing questions

As autumn approaches, markets are being driven by the following concerns: will U.S. inflation accelerate due to the impact of tariffs on consumer prices? How will the Federal Reserve respond? Will the economy slow down as a result of these price increases and the generally challenging environment? For now, U.S. consumers remain optimistic about the future, partly thanks to the resilience of stock markets, which has a consistently positive effect. Business leaders, however, appear more worried. And with good reason. Since Donald Trump returned to the White House, the pace of change has been enough to unnerve even the most seasoned executive.

What about Europe?

In this ocean of uncertainty, it is hard to look too far ahead. But let us try to get a clearer picture. In Europe, inflation seems to be under control. This could pave the way for a final interest rate cut by the European Central Bank, should a stimulus be required to support economic growth. The German Chancellor recently admitted that Germany’s difficulties are more serious than previously thought. This suggests that it will take more time and more money to pull the country out of the rut caused by 15 years of budgetary austerity. That in turn could affect other European countries that are relying on a German recovery to boost their own growth. A final gesture from the ECB would no doubt help.

Cheap oil, costly whims

Another relative certainty is the price of oil, which looks set to remain low over the coming months due to oversupply. Many analysts now expect oil to fall to around USD 50 per barrel in the near future. It is across the Atlantic that the future appears more unpredictable. Donald Trump’s sudden U-turns could change the game at any moment. India has just experienced this first-hand, with tariffs adjusted overnight.

A new world order?

Against this backdrop, the recent Shanghai Cooperation Organisation (SCO) summit, held in China on 31 August and 1 September and aimed at strengthening ties between several countries including India, China, Russia, North Korea, Turkey and Iran, has cast a long shadow over the emerging world order. Who will be the winners? Who will be the losers? And at what cost? These are the questions that will need to be answered in the months ahead.