A deep dive into central bank vaults

2 min

With the U.S. elections fast approaching, we’ve taken a closer look at the role of the dollar as a reserve currency for central banks, a topic that regularly resurfaces, particularly when global geopolitical tensions rise, as they are today. The struggles of the Chinese currency also offer revealing insights.

Dollar: the eternal number one. Euro: the eternal number two

The US dollar remains the number one reserve currency held by central banks but continues to lose market share gradually to a mix of other reserve currencies as central banks diversify their holdings. Gold, too, is playing an increasingly significant role. The latest figures have recently been released by the IMF.

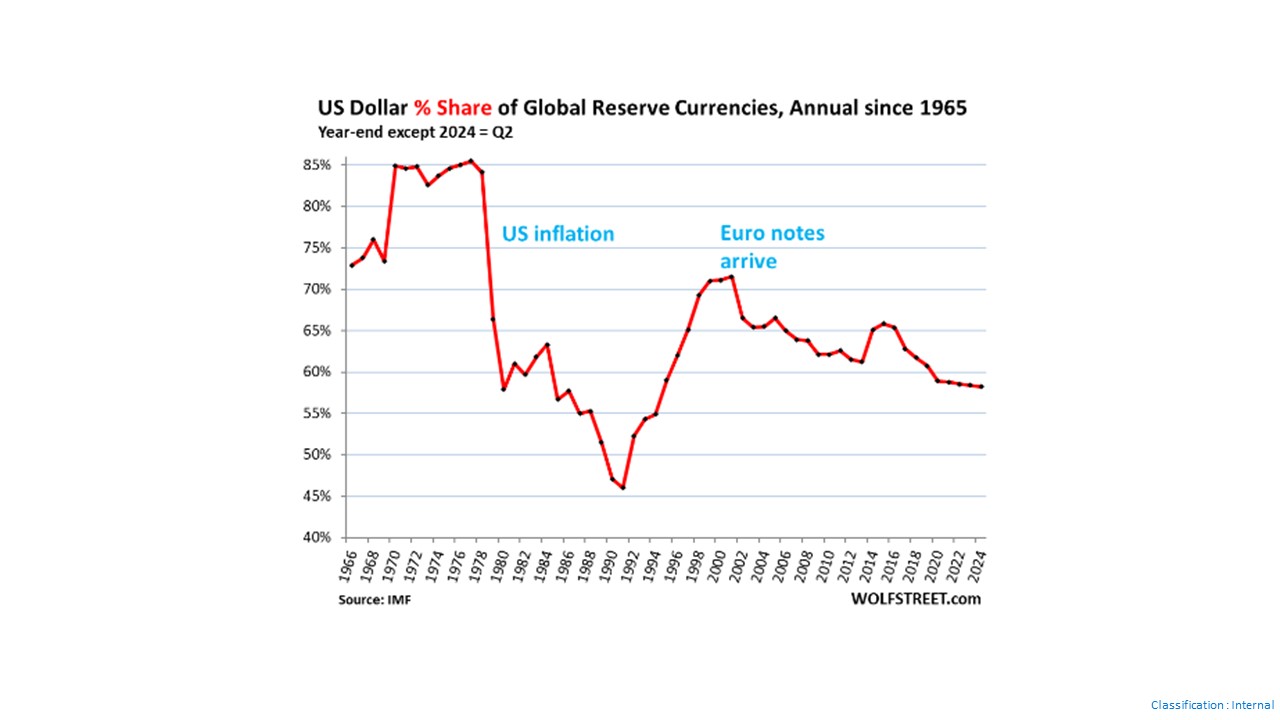

The share of foreign exchange reserves denominated in US dollars – assets held by central banks other than the Federal Reserve – dropped to 58.2% of total reserves in the second quarter of 2024, its lowest level since 1995, according to new IMF data.

Over the past decade, the dollar’s share has fallen by around 8%, from 66% in 2015 to 58.2% in Q2 2024. If this pace continues, the dollar’s share could dip below 50% within the next 10 years.

Fear of inflation

If we go back to the 1960s, the dollar’s share of global reserve currencies was much lower during the 1970s and 1980s. Its dominance dropped from 85% in 1977 to 46% in 1991 as inflation soared in the US during the 1970s and 1980s, eroding confidence in the Fed’s ability to control it.

In the 1990s, as inflation declined for a decade, confidence returned, and central banks once again stocked up on dollar-denominated assets. This trend lasted until the advent of the euro, which consolidated key European reserve currencies into a single robust alternative.

Central banks have not shed their dollar assets outright, but as global foreign exchange reserves increase, they are incorporating assets denominated in various alternative currencies, reducing the dollar’s share of the total.

Euro: the eternal number two

The euro has remained the consistent runner-up, with a share stuck around 20% for years. The primary alternatives to the USD and EUR are what the IMF refers to as “non-traditional reserve currencies.”

Rather than any single currency or asset overtaking the dollar, multiple currencies have gained market share. The IMF calls them “diversifiers” and has identified 46 such currencies.

The RMB: perennial loser?

The Chinese RMB (renminbi) remains an exception, and not in the way many expected. When the IMF added the RMB to its basket of currencies underpinning Special Drawing Rights (SDRs) in 2016, it was seen as a potential challenger to the dollar’s dominance as the global reserve currency. Given that China is the world’s second-largest economy, it seemed logical for its currency to rise to prominence as a reserve asset.

But that hasn’t happened. The RMB remains constrained by capital controls and convertibility issues. Central banks seem wary of holding RMB-denominated assets, leaving the Chinese currency to play a minor and shrinking role as a reserve currency. Even the Australian dollar now accounts for a larger share than the RMB (2.2% compared to the RMB’s 2.1%). It remains to be seen if China can change this dynamic in the years ahead.

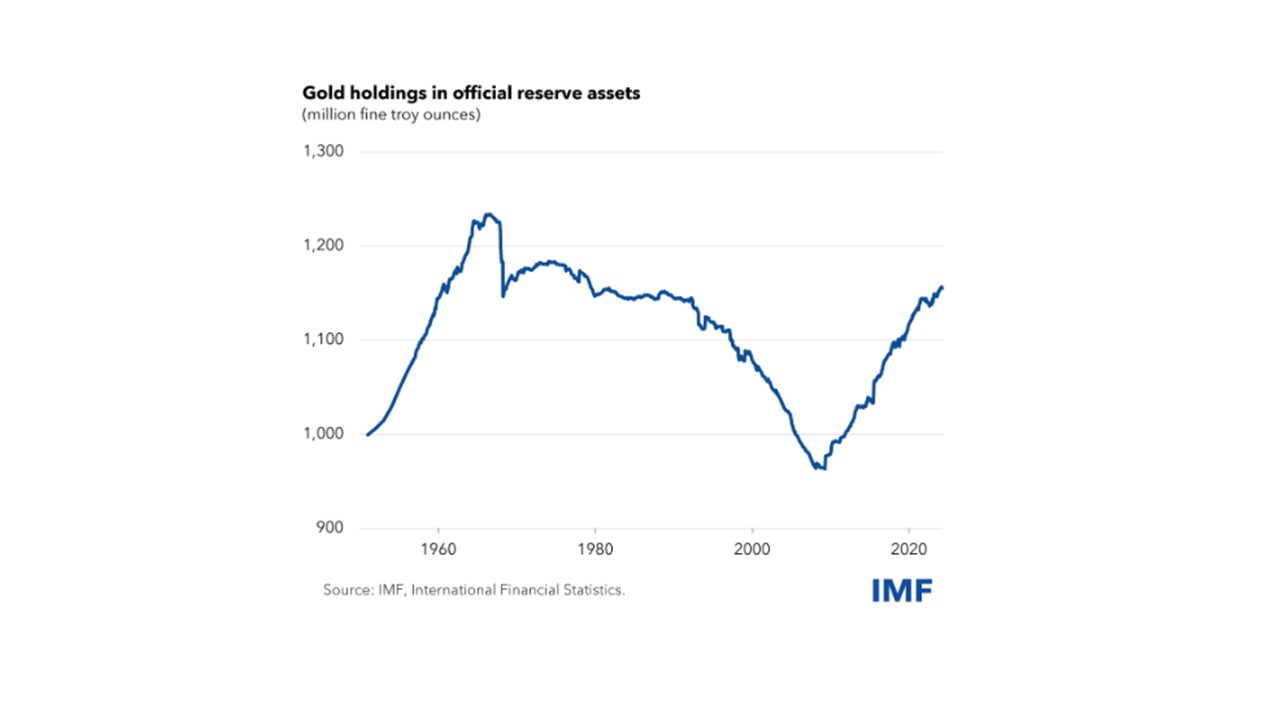

The resurgence of gold

Gold bullion is not classified as a “foreign exchange reserve” but as a “reserve asset” for central banks. While it doesn’t feature in reports on foreign exchange reserves, it’s worth examining given its remarkable resurgence. Central banks appear to have decided that gold can be an effective substitute for foreign exchange reserves such as Treasury securities, and they haven’t held back. Macroeconomic factors like the surge in inflation since 2022 and heightened geopolitical tensions have likely contributed to this trend.

For 50 years, central banks steadily reduced their gold holdings. However, over the past decade, they’ve reversed course, rebuilding gold reserves to 1.16 billion troy ounces (1 troy ounce equals 31 grams of gold), roughly the same level as in the 1970s. At today’s prices, this equates to $3.1 trillion in gold compared to $12.35 trillion in foreign exchange reserves – around a quarter. This is another argument to the recent surge in the price of gold...