Where is the US labour market headed?

2 min

The latest Job Openings and Labour Turnover Survey (JOLTS) conducted by the Bureau of Labor Statistics confirms that the job market remains tight. What impact will this have on monetary policy in 2025?

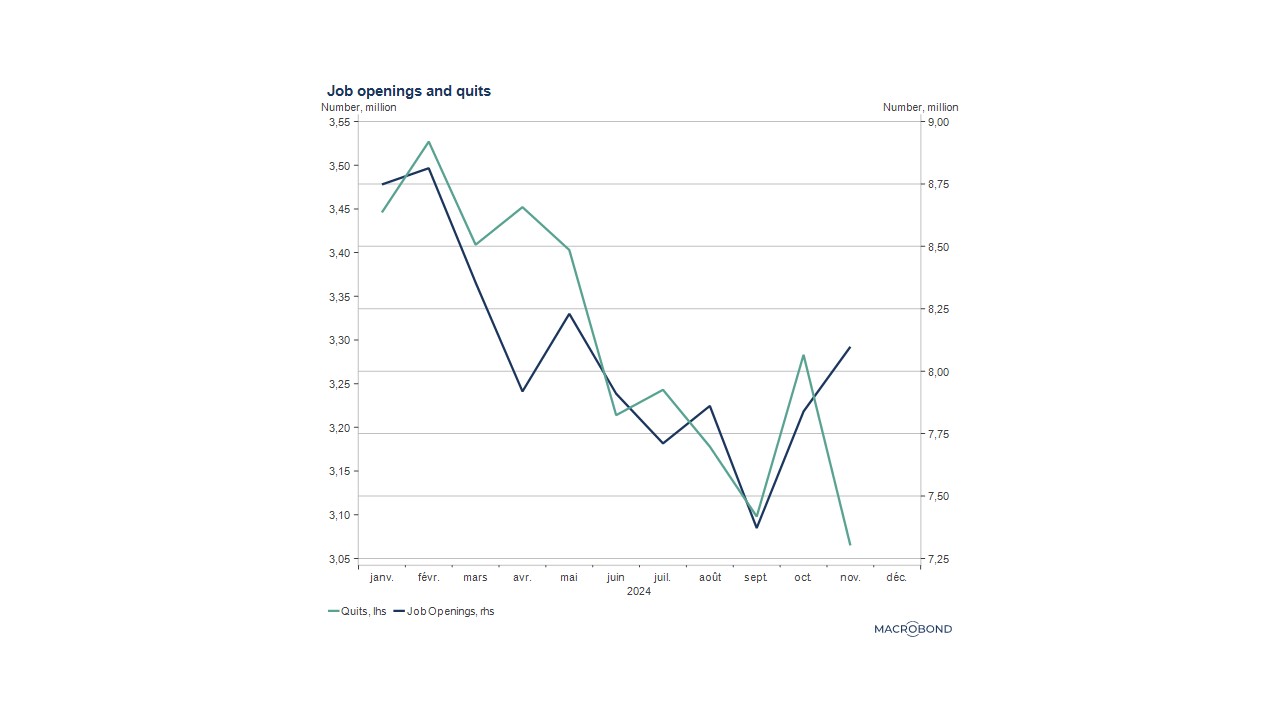

Understanding the state of the US labour market is crucial for anyone trying to gauge whether and when the Fed might cut interest rates again. The stronger-than-expected increase in job openings in October 2024, which had caused so much volatility in the markets, has since been revised upwards. Meanwhile, in November, an additional 259,000 job openings were posted, bringing the total number of openings to 8.10 million, significantly above the pre-pandemic record of late 2018. The latest Survey covers around 21,000 workplaces and provides valuable and often insightful information on the state of the market, including resignations and layoffs. It also indicates the job creation figures for the following month, the eagerly awaited "non-farm payrolls" that financial markets watch every month.

Resignations and job openings: the paradox

The findings from the latest survey for November are as follows: fewer people are leaving their jobs - voluntary resignations have decreased significantly from their pandemic highs - which means they are leaving fewer "vacant positions" behind. This should logically lead to a reduction in job openings to fill these "gaps", but the opposite appears to be happening: in November, job openings (to be filled) increased significantly despite fewer resignations. This means that new job openings that did not exist before are emerging. Labour demand is therefore increasing!

When considering Trump's plans to reduce dependence on imports and promote industry development on American soil, the current and future scale of the phenomenon becomes clearer. It’s also apparent that the debate on immigration may be more complicated than expected. Many sectors currently rely on this workforce and would not welcome their staff leaving.

Change of tone at the Fed

Not surprisingly, these closely watched figures have led to a change of tone at the Fed: at its December meeting, the central bank announced that it no longer expects more than two interest rate cuts, down from four. Inflation is not falling as expected, so the Monetary Policy Committee (FOMC) has raised its inflation projections for the end of 2025. The combination of these factors has logically led the Fed chairperson to announce that "there is still work to be done", which means fewer interest rate cuts, at least for now.

The Fed's preferred ratio

The number of job openings per unemployed person is a measure of labour market tightness that Jay Powell frequently comments on. This ratio has risen to 1.13 openings per unemployed person: 8.098 million job openings in November for 7.145 million unemployed people looking for work. It is worth remembering that the sharp decline in this ratio in the first half of 2024 was one of the reasons the Fed chairperson justified the massive 50 basis point cut in interest rates in September. At the time, we were all convinced that this indicator illustrated the cooling of the US labour market. This cooling may no longer be the case. In meteorological terms, one could even speak of a new warming trend.

To be continued...