Trade war causes oil woes

2 min

Oil prices have been falling for several weeks and the recent decision by OPEC+ to raise output over the next 18 months further increases the gloomy outlook for the industry.

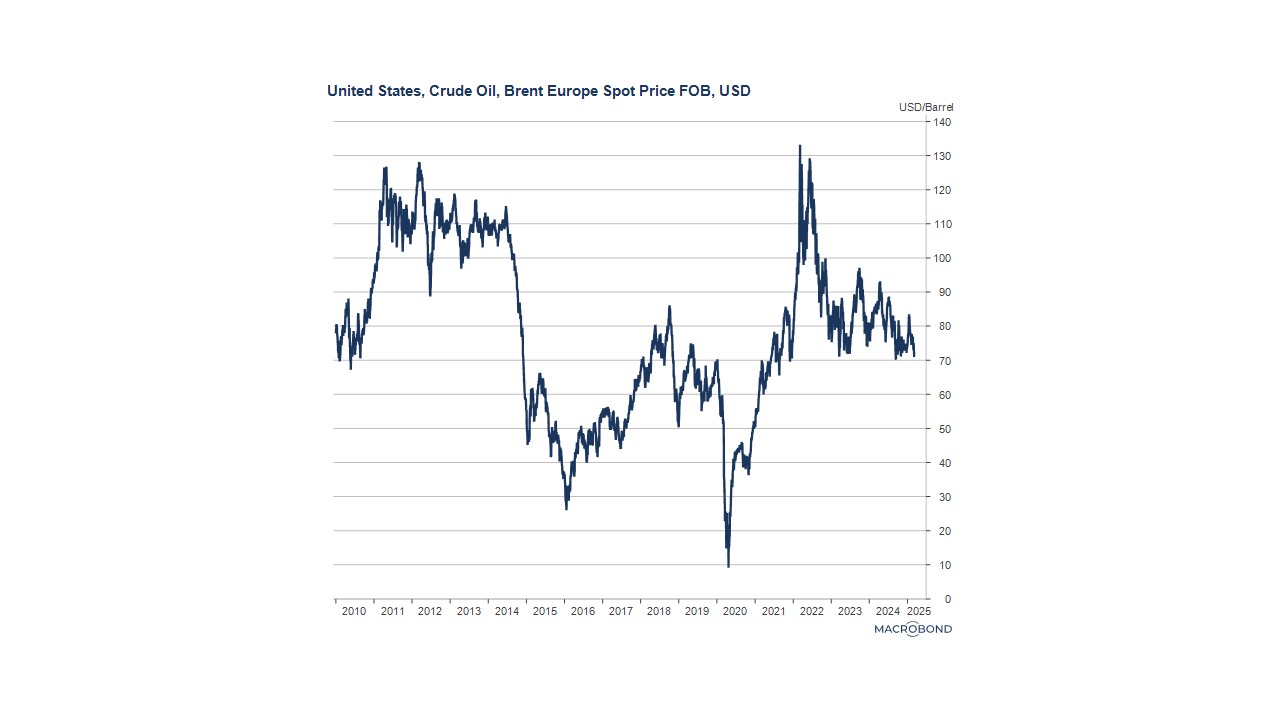

The OPEC+ oil cartel (an alliance of the OPEC countries and 10 other oil-producing countries, including Russia, Kazakhstan and Mexico) unexpectedly announced that it will start increasing crude oil output from April. Saudi Arabia and seven other OPEC+ members had repeatedly postponed an earlier plan to end the long-term voluntary output cuts. And many expected this decision to be postponed again. Unfortunately, the opposite is true. OPEC+ has now announced that it will proceed with the ‘gradual and flexible’ return of 2.2 million barrels per day of oil production over the next 18 months. The price of Brent crude has fallen to its lowest level in nearly three months following this announcement.

The oil price had already slumped due to concerns about the possible impact of U.S. tariffs on the economy. As a result, the price of crude oil had already plunged by 10% in a relatively short period of time. But OPEC+'s decision reinforced this trend.

Double hit due to the trade war

Moreover, in early March, President Trump confirmed that the U.S. would impose 25% tariffs on goods from Canada and Mexico. As a result, the market faced a double hit.

Eight countries will increase their output from April: Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria and Oman.

At the same time, efforts are being made in the U.S. to prevent the market from being flooded, especially since the re-election of Donald Trump, who wants to 'drill, baby, drill' as part of his economic programme! The fact is that U.S. crude oil production and exports reached a new record high in 2024. If we want to avoid a plunge in oil prices, a bit of discipline would be more than welcome. So yes, we need to drill, but not too much.

According to the latest figures from the International Energy Agency, U.S. crude oil production surged to 13.3 million barrels a day, up 2.5% year on year and more than 160% since 2008. That year, fracking started to ramp up on a large scale. This method, which uses high pressure injection of water to open layers of rock with low permeability, means it is now possible to extract oil in places where this was previously impossible.

Avoiding overproduction

We know how important the price of a barrel is for the profitability of hydraulic fracturing. Who has forgotten the surge in bankruptcies in the sector when the oil price suddenly fell in 2015, when global demand slowed and oil supply was excessive? Let's remember that the barrel had fallen to USD 26, a level that was unsustainable for U.S. producers. This must be avoided at all costs.

Today, it is estimated that hydraulic fracturing is profitable at around USD 70 per barrel, and it appears that non-US oil producers also need a minimum level to balance their accounts. The days when OPEC produced and got by with a barrel around USD 15 to 20 are long gone...

What are the implications?

At a time when we continue to aim for lower inflation in both Europe and the U.S., the prospect of oil prices falling (or at the very least remaining stable around the current levels) is very good news! A rare occurrence in today’s world, as we navigate unprecedented political tensions and a merciless trade war.