The yield curve is returning to normal

2 min

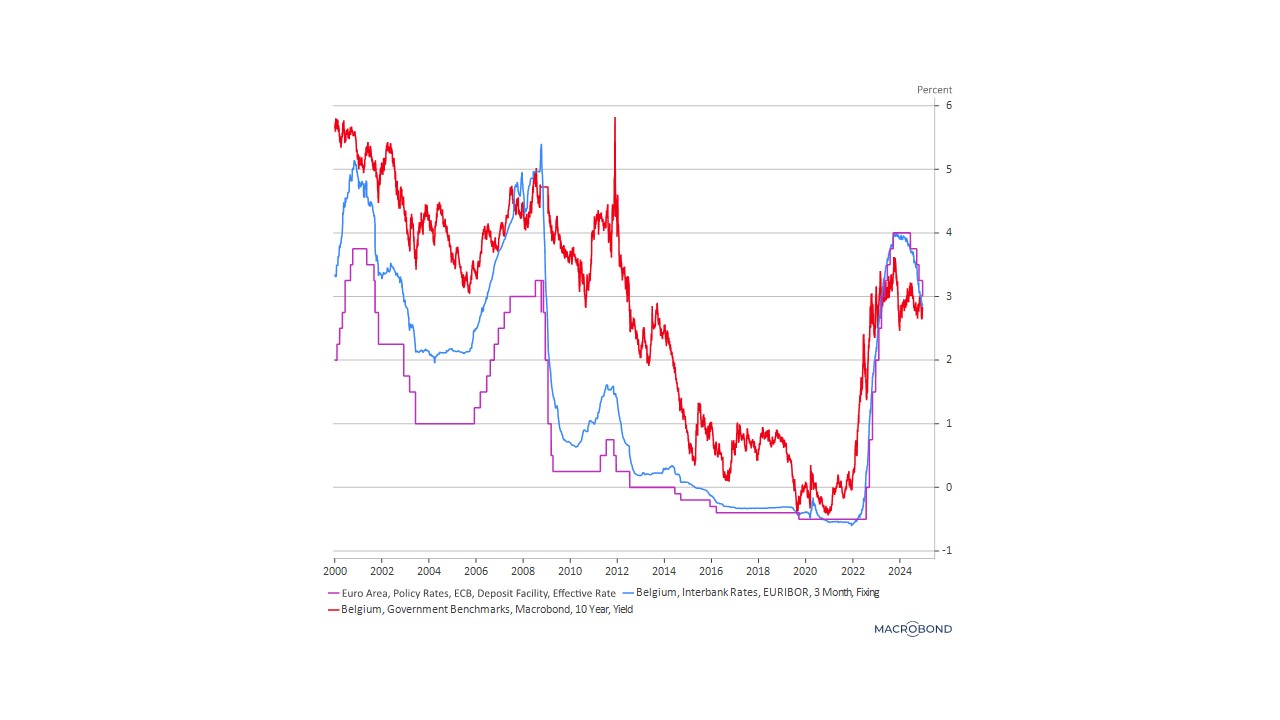

For over a year and a half, several European countries, including Belgium, have been experiencing an unusual phenomenon: an inverted yield curve. This means that short-term interest rates have been higher than long-term interest rates. However, this situation appears to be coming to an end, and a return to normal is expected by 2025.

The European Central Bank (ECB) has just lowered interest rates for the fourth time in six months. The deposit facility, the main interest rate, now stands at 3%. This decision was largely anticipated by the market, as evidenced by the recent evolution of the 3-month Euribor rate. Inflation is no longer a major concern in Europe, although it remains too high in the service sector. Furthermore, new priorities have emerged since Donald Trump's victory in early November, including increased defence spending and the potential impact of import tariffs on businesses. As a result, confidence is crumbling in several countries, and a monetary boost will be needed to mitigate the damage. Most analysts agree that European interest rates will continue to fall in 2025, with a rate of 2% being a realistic target. This would require four more rate cuts of 25 basis points.

Stabilisation of long-term interest rates

The stability of long-term interest rates in Europe is also a cause for concern. While they have risen again in the United States since Donald Trump's victory, they remain stable in Europe. In Belgium, the "risk-free" interest rate on 10-year bonds is currently fluctuating around 2.5%. This is in contrast to the United States, where there are fears of higher inflation in 2025.

The combination of these two trends has brought the yield curve - which shows all interest rates for all maturities (from 3 months to 10 years) - back to a situation that is close to normal. This means that short-term interest rates will no longer be higher than long-term interest rates. An inverted yield curve is a rare phenomenon, and it has only occurred a few times since the introduction of the single currency in 1999. However, since March 2023, several European countries, including Belgium, have been experiencing it. This unusual situation has resulted in savers earning a higher return on their short-term investments than if they were to invest for longer periods. Borrowers are also experiencing unusual times, as borrowing long-term costs less than borrowing short-term.

Abnormal times since 2023

We have been living in abnormal times for a long time. The inflation shock following the exit from the coronavirus crisis and the war in Ukraine has clouded the situation. This forced central banks in 2023 to overreact when they realised that price increases were a persistent phenomenon, rather than a temporary one. As a result, they pushed short-term interest rates to very high levels, causing them to exceed long-term interest rates in some countries.

The situation appears to be returning to normal now. Belgium has had a nearly flat yield curve for several days, and everything suggests that with the next cut in base interest rates, possibly in the first quarter of 2025, the yield curve will rise again. This means that long-term interest rates will once again be higher than short-term interest rates. A return to normal for everyone, and a victory for economic logic.