The world according to Trump: chaos unleashed

3 min

To say the least, we have never experienced this kind of chaos. And who knows what the future holds… The situation changes from hour to hour, as we press on through a dense fog, not knowing what lies ahead. Steps have been taken that seemed unthinkable until recently, because an unprecedented situation leads to unprecedented decisions. Below is a summary of the storm of recent days.

The return of Trump: Phase One

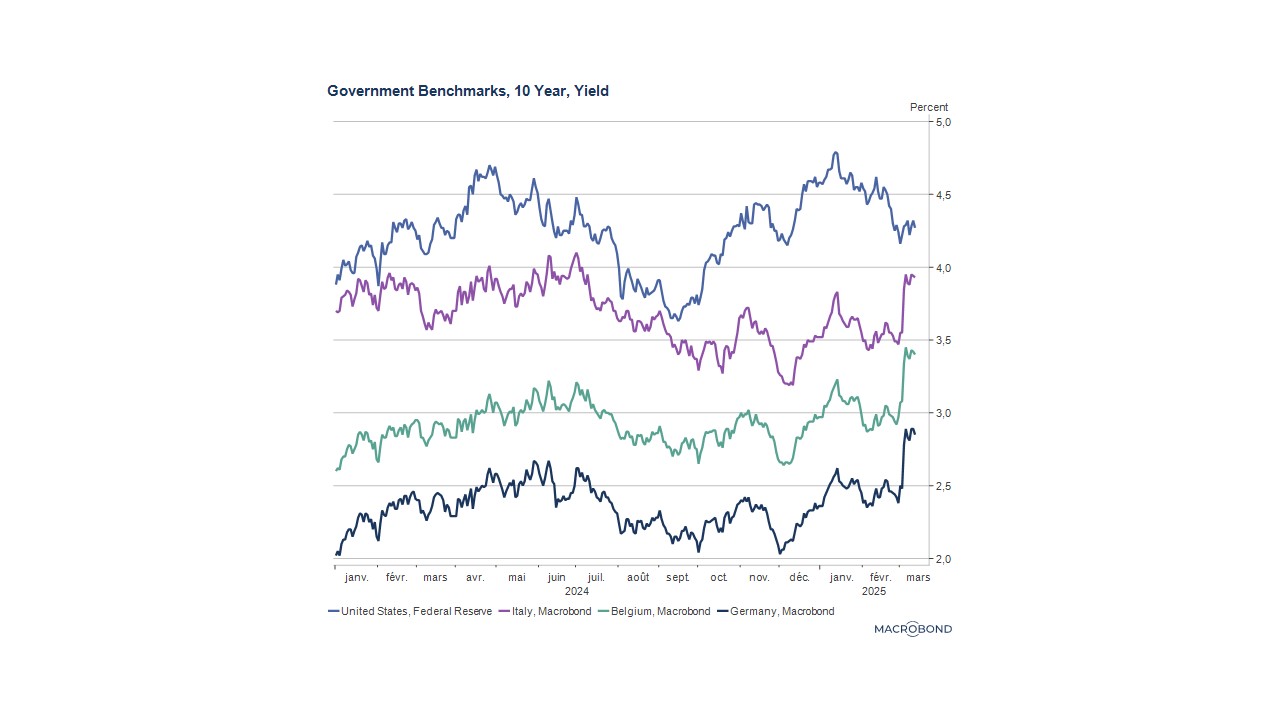

A whirlwind appears to have swept through the financial markets since Trump’s return to power just a few weeks ago. This initially led to a stronger dollar with share prices soaring. But investors soon feared inflation would return. Because Trump already threatened there would be a trade war at the start of his re-election campaign. Soon long-term interest rates rose in the U.S., but this did not spread to Europe. Here, interest rates continued to fall against the backdrop of a reassuring slowdown in inflation.

The return of Trump: Phase Two

The chaos caused by the U.S. president was a spectacular wake-up call for Europe. The future German Chancellor decided to deviate from the strict debt ceiling, to free up large sums for strengthening military autonomy and the capacity for self-defence. This resulted in a rise in long-term interest rates in Germany, which spread across Europe. This is a significant turnaround, which means that additional capital must be raised on the financial markets, leading to a rise in interest rates.

The return of Trump: Phase Three

Shortly after, panic broke out on Wall Street. The threat that the country would fall into recession due to the sudden changes in policy that could potentially destabilise U.S. companies and citizens, prompted investors to turn away from stocks. They sought refuge in 'risk-free' investments, namely U.S. government bonds. As a result, long-term interest rates in the U.S. were eased, just as they began to rise in Europe! In just a few days, the situation radically changed radically on both sides of the Atlantic. Note that the fear of Donald Trump's aggressive policy causing a real economic slowdown led to a weakening of the dollar, which lost 5% against the euro.

So, what's next?

At this stage, it’s impossible to know which way the wind will blow. In Europe, hopes of increased military spending bring a sense of benefit for economic growth. This would be good news for lagging countries like Germany, whose GDP has declined over the past three years. However, these hopes come with multiple fears: how to finance these additional expenses? What will the impact on budgets be? What if long-term interest rates continue to rise, especially for the most indebted countries?

In the rest of the world, uncertainty about the scale of the tariffs that will actually be applied makes predictions impossible. Currently, the craziest figures are being floated, which are re-evaluated in a matter of hours. It’s too early to know who the losers and winners will be. Assuming there can be winners in a 21st century trade war, which seems less likely every day.