Mixed signals from Germany cloud hopes of a European investment revival

5 min

Europe is pinning its hopes on the knock-on effect of Germany’s commitment to increasing public investment to modernise the country and bolster its defence capabilities. But less than a year after the new German chancellor took office, doubts are beginning to emerge.

Mixed signals from Germany

As a reminder, Friedrich Merz’s arrival as German Chancellor in May 2025 triggered a wave of optimism across Europe when he significantly reshaped the management of public finances by overhauling the famous 'debt brake' so dear to Angela Merkel. Germany announced that it would dip into its reserves to modernise its economy and rearm in order to compensate for the United States’ retreat from European defence. At the time, the prevailing view was that the “German locomotive 2.0” was back on track, with neighbouring countries set to benefit, as in the good old days.

Cold shower

However, the German government has just revised its GDP growth forecasts downwards for the next two years, as Europe’s largest economy struggles to recover from a prolonged period of stagnation. In its latest economic outlook, published a few days ago, the Federal Ministry for Economic Affairs predicted that German GDP would grow by 1.0% in real terms this year, down from an October forecast of 1.3%. Growth is now expected to reach 1.3% in 2027, compared with 1.4% previously.

This deterioration inevitably fuels concerns about the strength of the German recovery, despite the chancellor's stated intentions. There are growing questions as to whether a more expansionary fiscal policy in Germany will be sufficient to restore confidence in an economy that is structurally weak and facing major challenges, such as high energy costs, administrative burdens, and crises in key sectors, including the automotive and chemical industries.

The Minister for Economic Affairs has acknowledged that the expected fiscal stimulus has not materialised as quickly as anticipated. However, she also points to increasing signs of progress, including improvements in industrial production and rising order books. The narrative has now shifted towards modest growth after years of stagnation.

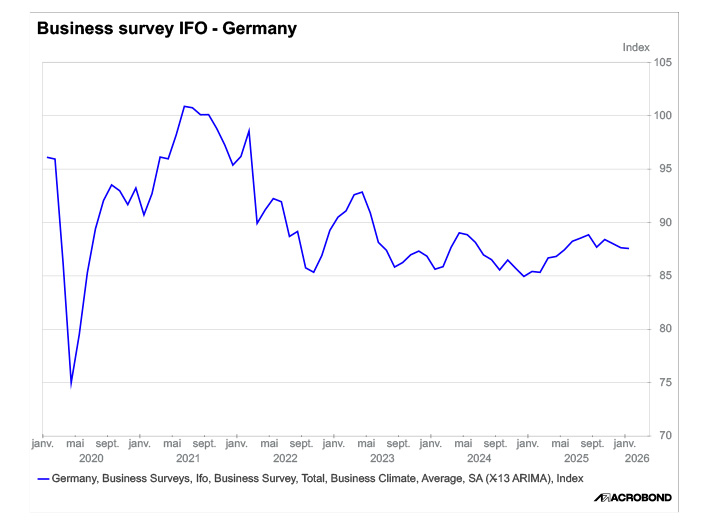

However, this historic stimulus plan has not led to a strong rebound in private-sector confidence. The closely watched Ifo business climate index stagnated in January following two months of decline, dampening hopes of an exceptional recovery for the German economy.

Government caveat

Despite the downgrade to growth prospects, the government is more optimistic than the Bundesbank. In December, the Bundesbank warned that the country had been 'clearly in recession since the end of 2022' and forecast growth of just 0.9% this year. Recent government figures on public spending in 2025 also show that Berlin is struggling to implement its public investment plans. While federal investment was expected to reach €115 billion, it ultimately amounted to just €86.8 billion. While this represents a year-on-year increase of 17%, it still falls short of expectations.

Why?

Most analysts believe these delays are due to the late adoption of the budget following the elections, limited administrative capacity, particularly with regard to launching and completing tenders and complex projects, and institutional constraints. Despite the “debt brake” being eased, strict procedures still govern the commitment and disbursement of funds.

Looking ahead, the outlook remains promising as these obstacles should eventually be overcome, and the willingness of the public sector to increase investment remains strong. But what about the private sector, and what about the spill over effects expected by Germany’s European neighbours?

Several sectors are reporting major difficulties in continuing their investments in Europe and, consequently, in Germany. This is particularly the case for the chemical industry, where investment in Europe has reportedly declined by over 80% since 2025, and plant closures are becoming increasingly common. The European Chemical Industry Council (Cefic) attributes these figures to high energy prices, suffocating European bureaucracy and the spectacular growth of Chinese imports.

European ambition, major challenges

In July, the European Commission presented a policy paper outlining the actions it intends to take to support the chemical sector. These include designating critical products and production sites to help coordinate funding, speed up permitting for industrial facilities, and improve monitoring of trade flows.

However, energy prices, which surged after the invasion of Ukraine, currently account for around 75% of petrochemical production costs and remain stubbornly high. The EU's plan to ban Russian gas by 2027 has left the bloc dependent on more expensive liquefied natural gas from global markets. Companies are also struggling to cope with the bloc’s ambitious environmental agenda, which commits EU countries to achieving carbon neutrality by 2050, but which has introduced extensive administrative requirements.

The road ahead will be long and full of obstacles, but if the political will is there, all is not lost.