Liberation Day, but not for uncertainty

2 min

Liberation Day: the day the US would shake off the injustice of the world. However, one person was feeling chuffed: President Trump was clearly delighted at the announcement of his two-stage missile. From 5 April, tariffs of 10% will apply to almost all goods imported to the US. In addition, reciprocal rates will apply from 9 April.

The formula used to calculate the rates is as bizarre as the declaration of war itself. It takes into account the trade deficit in goods as a proxy for the alleged unfair trade practices, and divides that deficit by total imported goods. The result is divided by two… as a sign of goodwill from the President. Low-income countries in particular, which export a lot of goods to the US but import little (due to limited domestic consumption), are being subjected to very heavy tariffs as a result. For Vietnam and Cambodia, for example, the rate actually applied is 46 and 49%, respectively. Countries with a trade deficit in goods are still subject to the minimum rate of 10%. Good luck making any sense of any of this.

Significant cost

As long as the US consumes more than it saves, the trade deficit will persist. In addition, there will always be things that need to be imported, which countries cannot produce themselves… such as bananas to the US. Ultimately, if everyone applied this formula, there would no longer be trade deficits or surpluses. A dream in Trump’s world; nonsense in the real world. There is no economic reason why this would be ideal; in fact, on the contrary.

Trump’s ultimate goal is to bring industry back to the US, at any cost. And that cost is increasing. Research firm TS Lombard calculated that the rates imply an additional tax of USD 530 billion or 1.8% of GDP, an 8.4% tax on household consumption, an 18% tax on US industrial production and a 77% tax on US industrial profits. “This is not a stagflation event, but one that will cause a recession … if the tariffs remain in force.”

Things probably won't turn out as extreme as they initially sound. Negotiations must lower these tariffs.

But what if there is no negotiated solution?

- Confidence in the US has been badly damaged. Even if the ultimate trade tariff drops, the heydays of globalisation are over. In addition to diversification of the supply chain, diversification of the sales markets is now also becoming increasingly important. One country that has understood this message well is China. It is exporting more and more finished products to the Global South.

- Due to globalisation, the price of goods remained stable on average over the period 2000-2020. If you look at everyday things you buy, such as washing machines, cars or even clothes, the prices of these goods have fallen due to international trade. They have now become much more affordable (despite their higher quality) for many people around the world. Prices of services, which are more difficult to trade (excluding digital services), rose by 60% on average between 2000 and 2020, just before the Covid shock. Deglobalisation points to more expensive products and therefore a much slower increase or even decrease in consumer purchasing power.

- Some companies will be inclined to settle in the US in order to escape tariffs. Anecdotal news points to pharmaceutical companies that are currently benefiting from the extremely favourable Irish tax treatment. This is especially true if US corporate tax were to fall further from 21% to 15%. This drop must be financed through the higher income from import tariffs. Whether this will succeed is doubtful. Trump’s tariff hikes during his previous term of office were countered by targeted measures from China and other countries, causing considerable damage to US sectors such as the agricultural sector. The income from import tariffs was then hardly enough to make the compensation payments.

- The battle in the face of low-wage countries is double. Following the increase in tariffs during Trump’s first term, China invested heavily in intermediate countries such as Vietnam, Thailand and Cambodia, to which China then exported intermediate goods and commodities. They were assembled there - labour costs are also significantly lower than in China - and then exported to the US. From 2019 to 2024, Vietnamese exports to the US more than doubled from 64 billion dollars to 136 billion dollars. China’s assumption was that the US would probably not involve all its partners and allied countries in the trade war. That illusion has now been shattered. Even the closest allies such as Australia (10% rate) or Japan (24%) have not been spared. The door to the US is now firmly closed for the Southeast Asian transit countries. The trade deficit with the US is large. How these countries can be expected to ever get their consumption of US products close to the consumption of their products by the rich Americans is crazy.

No good news for the US economy

- US companies are affected because intermediate products are also affected. 40 per cent of Chinese imports are intermediate products. This will suddenly result in 50% higher costs and more expensive US end products!!

- Take the example of cars with the current import duty of 25 per cent. This increases the cost of foreign cars by a quarter, but also risks pushing up the price of American cars. In North America - the US, Mexico and Canada - there is a fully integrated value chain. NAFTA, and since 2020 the USMCA free trade zone has ensured this, until tariffs were also imposed on partners Mexico and Canada. Parts cross the border dozens of times before finally being assembled in the US. But all cars, even those made entirely in the US, contain small parts that come from all over the world: drive axle from Korea, chips from Belgium, etc. It is impossible to suddenly start producing all these parts in the US. Many estimates point to additional costs of $3,000 and more per car.

- Although Trump promises a lot of employment and investment, US consumers can expect significantly higher costs in the short term. There are simply not enough US factories to replace the imports. An average US household will pay thousands of dollars extra per year.

What is the effect on Europe’s growth?

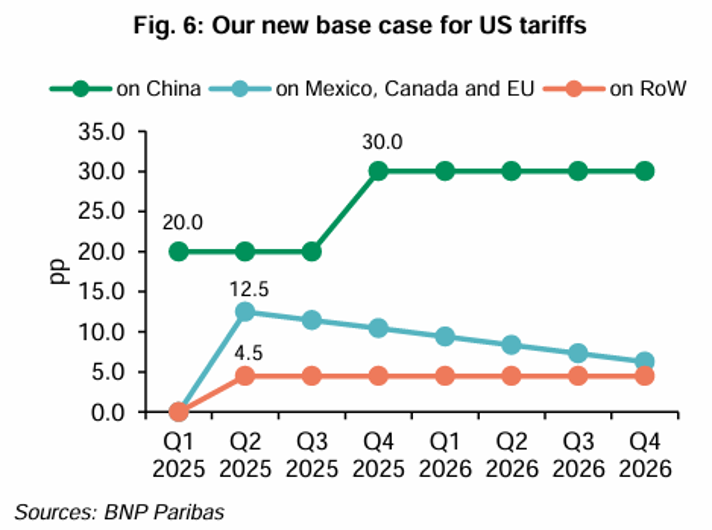

The European Union is charged a rate of 20%. BNP Paribas 360 in London expects the additional import tariff to be reduced to 12.5 per cent after negotiations. The direct and indirect impact would lower Eurozone GDP levels by 0.7 percentage points in 4Q26. This year, 0.4 per cent of the growth will be pinched off and 0.3 per cent next year. This brings the expected growth to 1.3 per cent and 1.5 per cent, thanks to the positive effect of the German 500 billion euro in public investment for the next 12 years and huge defence spending across Europe. The ECB’s cut in interest rates has also boosted lending in recent months. Is this beautiful growth written in the stars? Definitely not. If Trump sticks to his guns, the chances are high that the US will suffer a recession. Traditionally, the European Union has therefore had the same fate. At that time, the ECB could cut its interest rates even further than the 2% we have so far pushed forward. But maybe those old rules no longer apply in this New World Economy?

The opinions in this blog are those of the authors and do not necessarily reflect the position of BNP Paribas Fortis.