Focus on the economic situation in the Netherlands

2 min

The Dutch economy accelerated in 2024, driven by strong consumer confidence and the easing of financial conditions following the European Central Bank's (ECB) three interest rate cuts.

The labour market remains tight, with many unfilled jobs, leading to significant increases in real wages and further supporting private consumption. Business investment declined since the beginning of 2023, but a new easing of monetary policy in Europe in 2025 may help it recover. Public investment growth contributes to a deterioration in the public deficit, although this does not pose a concern given the country's comfortable position compared to its main neighbours.

The main downside risk approaching 2025 stems from the impact of weaker global growth due to the increase in US tariffs and the decline in EU demand.

Growth should improve with private consumption and investment

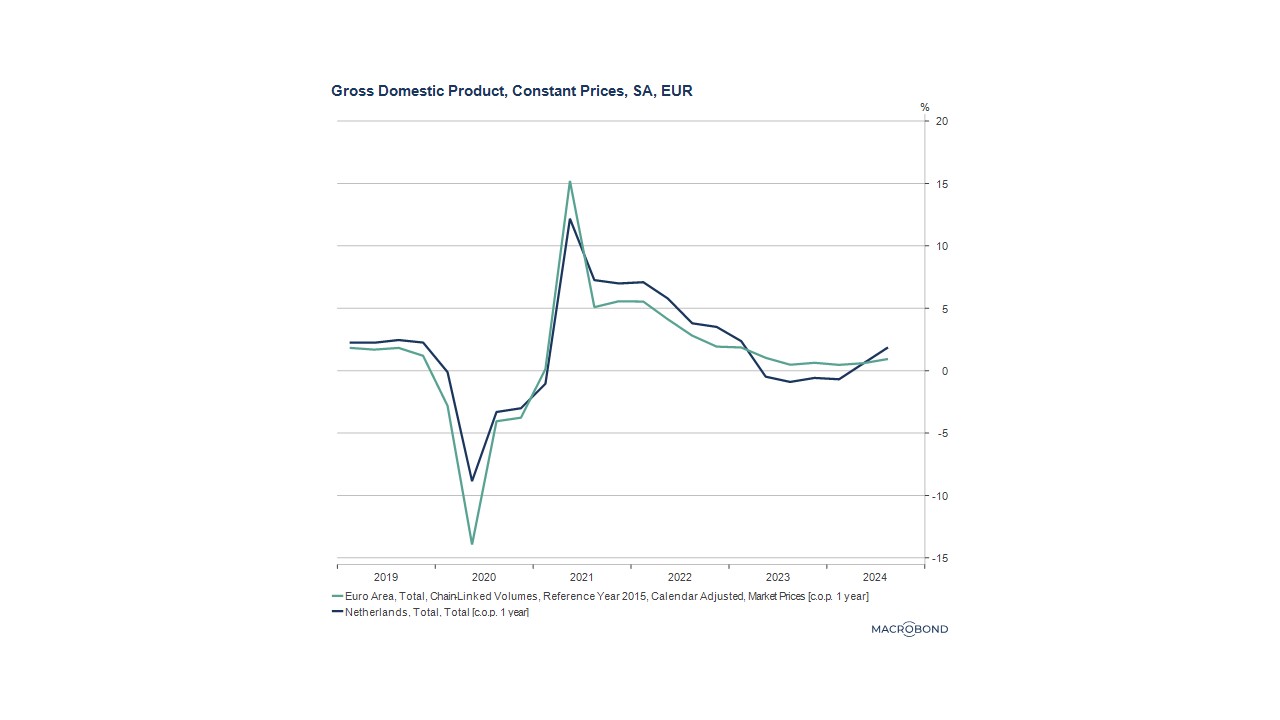

The Dutch economy was one of the worst performers in terms of growth in 2023 and early 2024. However, since then, GDP has experienced above-average growth in the eurozone, despite some momentum being lost in the third quarter due to the persistent weakness of business investment and public spending.

Private consumption, already strong in 2023, continues to support growth, benefiting from the strong growth in real wages linked to a still tight labour market. The unemployment rate remains very low, and many jobs remain unfilled. Business confidence indicators show a slight recovery from the low levels reached at the end of 2023, although industrial production remains weak.

Investment activity decreased for three consecutive quarters in 2023, with the construction sector being particularly affected by the tightening of financial conditions and labour shortages. As financial conditions improve and public investment increases, investment growth will likely accelerate modestly in 2024.

The technology, life sciences, sustainable energy, and logistics sectors play a major role in the Dutch economy. The Netherlands is a key player in international trade, with ports like Rotterdam remaining global logistics hubs. Efforts to strengthen innovation in the technology sector and investments in the green economy will support a significant part of long-term growth.

In 2025, private consumption will continue to accelerate, driven by strong wage growth, lower inflation, and tax cuts, which will support households' real disposable income. Consumer confidence has been maintained and improved, and house prices, which were severely affected in 2023, have been recovering rapidly since.

Inflation expected to fall

Inflation accelerated almost every month since the beginning of 2024, reaching 3.3% in October. The persistence of high service inflation and strong food inflation, affected by an increase in tobacco excise duties, drive this trend. Rents have also been adjusted to reflect the rise in inflation, contributing to the increase in the inflation rate.

Budget deficit increases, but remains manageable

In 2024, the budget deficit will be significantly lower than many had predicted, thanks to higher-than-expected revenues from income and wealth tax in the first two quarters of the year. The deficit will be very low, at 0.2% of GDP by the end of 2024.

In 2025, a court decision will require the government to refund taxpayers for taxes unduly paid on asset declarations, impacting the deficit by around 0.5%. The government will also lower the income tax rate in the two lower tax brackets, while public investment will increase more strongly than in 2024. The budget deficit will therefore deteriorate and reach 1.9% of GDP by the end of 2025 and 2.4% by 2026.

The debt-to-GDP ratio is much lower than in any other European country and will not exceed 45% of GDP. This significant difference sets the Netherlands apart from other eurozone countries where the deterioration of public finances is worrying.