Final nowcast for the fourth quarter: 0.4%

2 min

Our final “nowcast” for the fourth quarter of 2024 stands at 0.4% quarterly growth. A weak month of December is mainly responsible for this lower growth. The expectation is that this slowdown will continue in the coming months, as interest rates and international uncertainty weigh on our economy.

Belgian growth in the fourth quarter: 0.4%

Belgian growth in the fourth quarter also came out at 0.4%. A slight acceleration compared to the rest of 2024. Unfortunately, this is also a temporary boost, which will likely be followed by a slowdown.

Nowcast

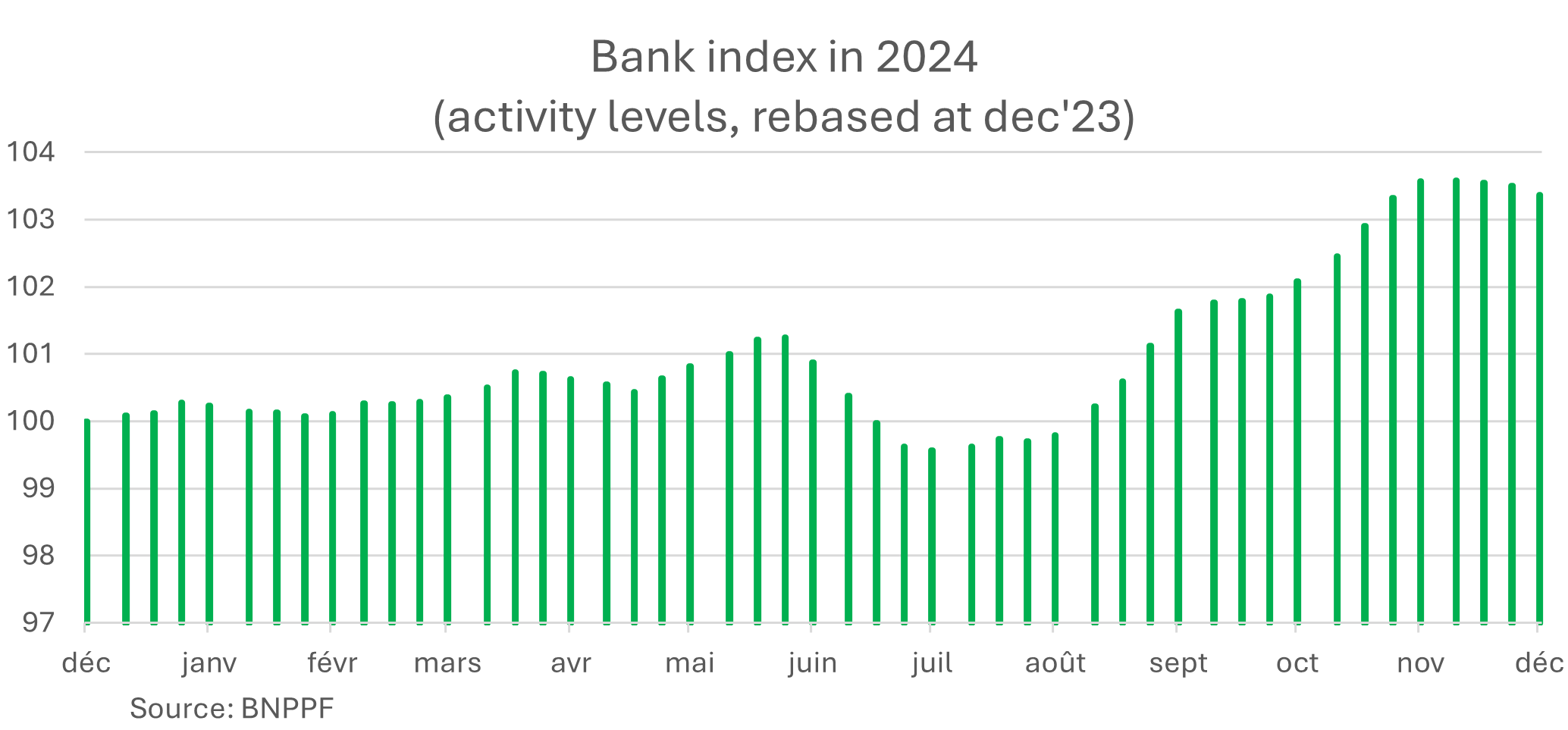

Last month, we reported on a possible very strong year-end: both the high-frequency indicators and our own bank index pointed to a strong increase in economic activity in October and November. The last weeks of 2024 confirmed this picture, but the first signs of a slowdown also became visible.

Very visible, in fact. All seven indicators used by the academics of Ghent University in the nowcast calculation declined at the end of last year. Quite a rare and worrying evolution. In particular, the fear of unemployment increased strongly among households. This is now at its highest level in two months. This variable has some predictive power for effective unemployment, but this evolution is not too worrying in itself. We continue to assume a so-called soft landing on the labour market, as both the vacancy rate and the Federgon index have been cooling down gradually for some time.

More striking is that the bank index also slowed down. This measure of economic activity is based on the aggregation of production cost-related payments from our business customers. While it rose sharply at the end of October, measured on a week-by-week basis, December brought mainly declines.

What does 2025 hold?

The fear of a growth slowdown early this year seems to be manifesting itself immediately. In an earlier report, we discussed how we adjusted our scenario as a result of the US presidential elections and the expected interest rates/greater uncertainty.

The first figures now seem to confirm this: companies and households are less optimistic. The ball is now again in the court of the government negotiators: a swift agreement could be a welcome boost.