European public finances: each to their own

3 min

Not a week goes by without the topic of European public finances being raised. Between rearmament expenditure, the need to continue combating global warming, and ensuring the EU's independence in terms of resources (rare earths, electronic chips, the race to develop AI), extravagant sums are bandied, without knowing in some cases where the money to finance this new expenditure will come from.

Each party's situation is different, making certain expenses much less problematic to finance for some than others.

Portugal has come a long way

The case of Portugal is particularly relevant at the beginning of April, as the country has just announced that it would not let the increase in defence expenditure jeopardise its hard-earned budget surplus. A snap election will take place in May, and polls suggest that the Minister’s centre-right Democratic Alliance is in a tight election race against the opposition socialists, with a strong chance that neither will be able to form a stable parliamentary majority. Spring could be hot in Portugal, and that's not just the weather!

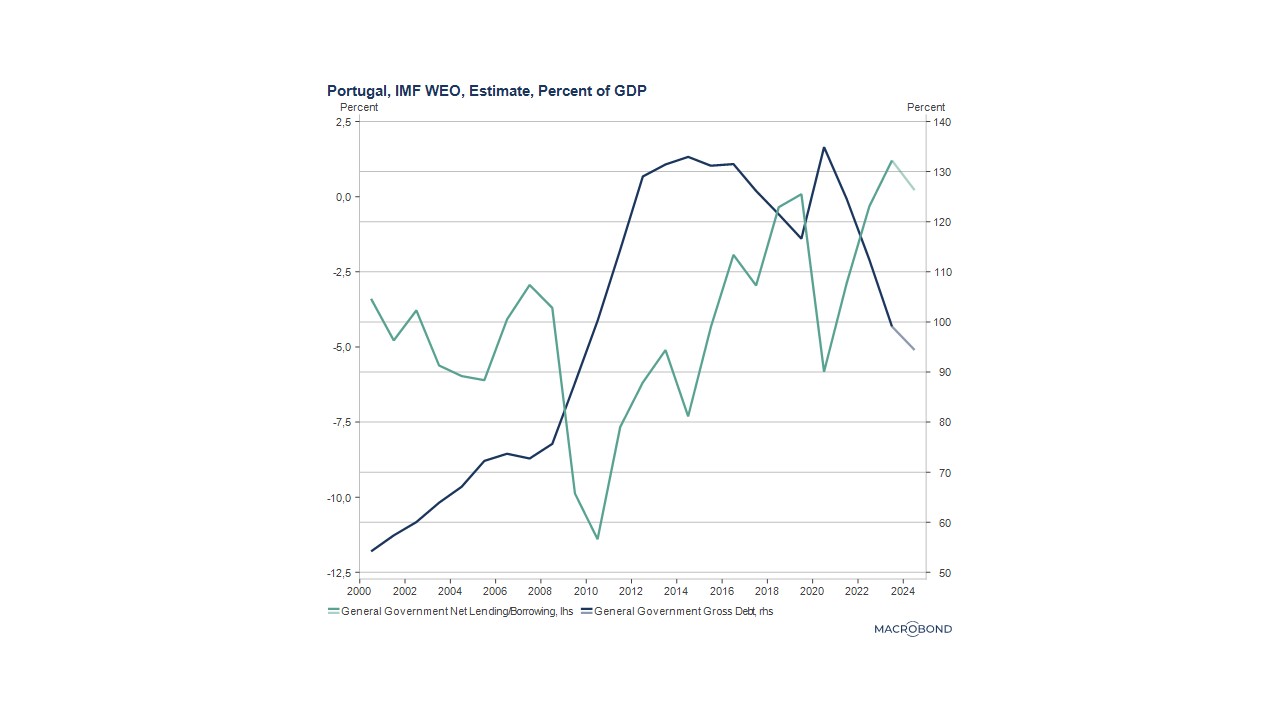

When it comes to managing public finances, the country has come a long way since being caught up in the turmoil of the European sovereign debt crisis in 2011, sparked by the Greek derailment. At the time, public debt stood at around 130% and the deficit at around 10% of GDP. The country's public debt decline has left its mark on the population. 13 years later, debt was below 100% of GDP again, and the country posted a small budget surplus (0.2% of GDP). The prospect of losing control of its accounts is not well-received, especially since the government has pursued closer relations with Western states and is not close to the Ukrainian front. Increasing military expenditure to guarantee physical security is less urgent than in Poland, Latvia or Sweden. Military expenditure represents 1.6% of Portuguese GDP, compared to 5% in Poland. While the country has committed to reaching the NATO guideline of 2% by 2029, we understand its reluctance to exceed this, as expected by NATO.

Rare budget surpluses in Europe

Portugal is one of the few countries in the eurozone, along with Germany, Denmark and Ireland, to post a budget surplus. It wants to maintain a margin during an economic turnaround: maintaining a budget surplus is essential to reduce the country’s public debt ratio. The goal is to bring it down to 80% by the decade's end.

Weighing the pros and cons

While Germany and Denmark have decided to spend more on defence, it seems that in Portugal, they are asking more questions about the financing and the impact of this new expenditure on the cost of borrowing. The Portuguese Minister of Finance said Portugal would do more regarding military spending. Still, first, he wanted to learn more about the conditions and how borrowing costs compare for the country in the sovereign debt market. The yield on 10-year Portuguese government bonds is currently 3.25%, lower than France, Italy, Spain and Belgium, indicating that Portugal is considered a less risky borrower. A tremendous victory, bearing in mind the challenges it had to overcome!

As regards spending priorities, Portugal believes it essential that EU member states coordinate to support specialised industries in each country. Portugal is home to strong shipbuilders and aircraft manufacturer Ogma, which is owned by the Brazilian company Embraer. The Portuguese company Tekever, meanwhile, has supplied drones to Ukraine.

Prudence is therefore appropriate in Portugal: Each to their own...

The opinions in this blog are those of the authors and do not necessarily reflect the position of BNP Paribas Fortis.