Europe suffers from a serious competitiveness problem

3 min

The Draghi report outlined the challenges Europe faces and proposed solutions. Over the coming weeks, we will share the key findings from this detailed study, combined with insights from the book “The 5 Trends of the New Global Economy” (another masterpiece 😉). The situation is serious.

A decline in competitiveness

In recent years, the European economy has sacrificed a substantial portion of its competitiveness. Between 2021 and 2024, the EU saw its prosperity eroded by over 4% due to the rising costs of importing energy from outside the bloc, according to calculations by the employer organisation Etion.

This has led to an immediate decline in prosperity. In the longer term, however, this degradation will weigh heavily on the competitiveness of European businesses, particularly energy-intensive industries. While service sectors contributed to reasonable growth from 2021 to 2024, the industrial sector contracted. In addition to rising energy costs, the forthcoming European Emissions Trading System (ETS) costs will add further pressure. Currently, these costs are largely offset by free emission allowances, but these allowances will be gradually phased out as the carbon tax is implemented.

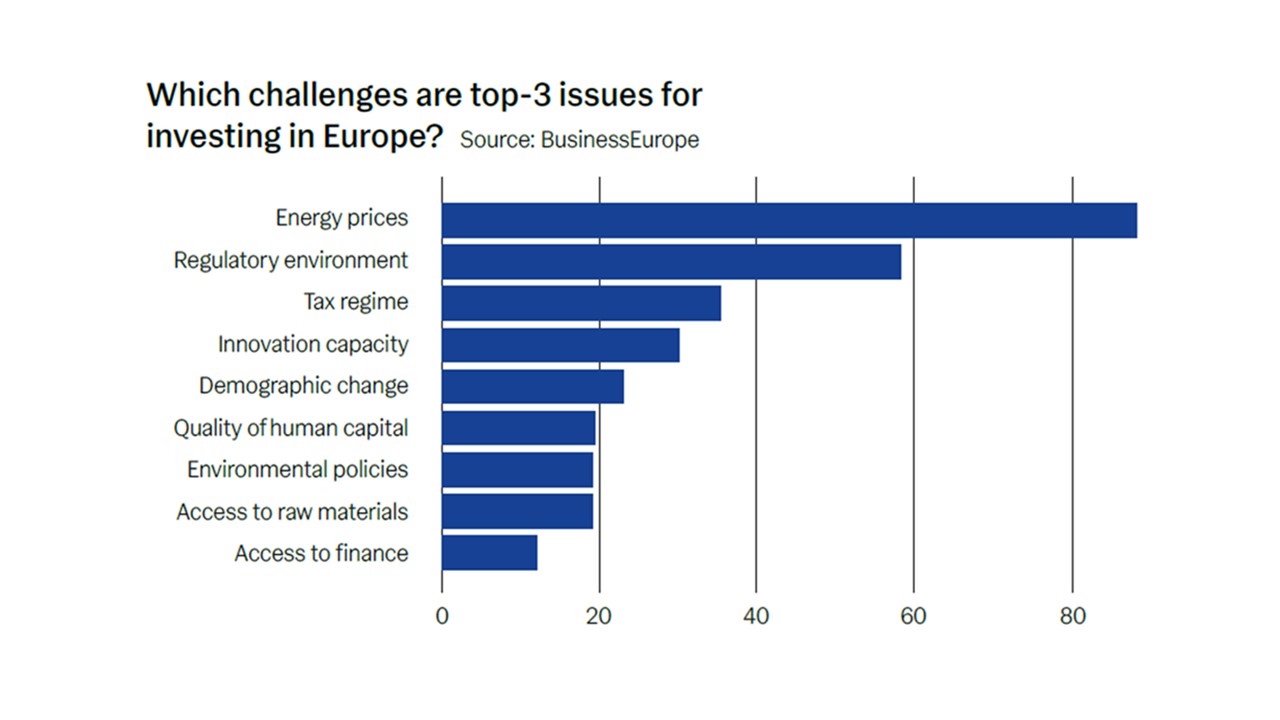

Besides high energy prices, businesses report numerous other obstacles that prevent them from investing in Europe (see graph).

Natural gas and electricity

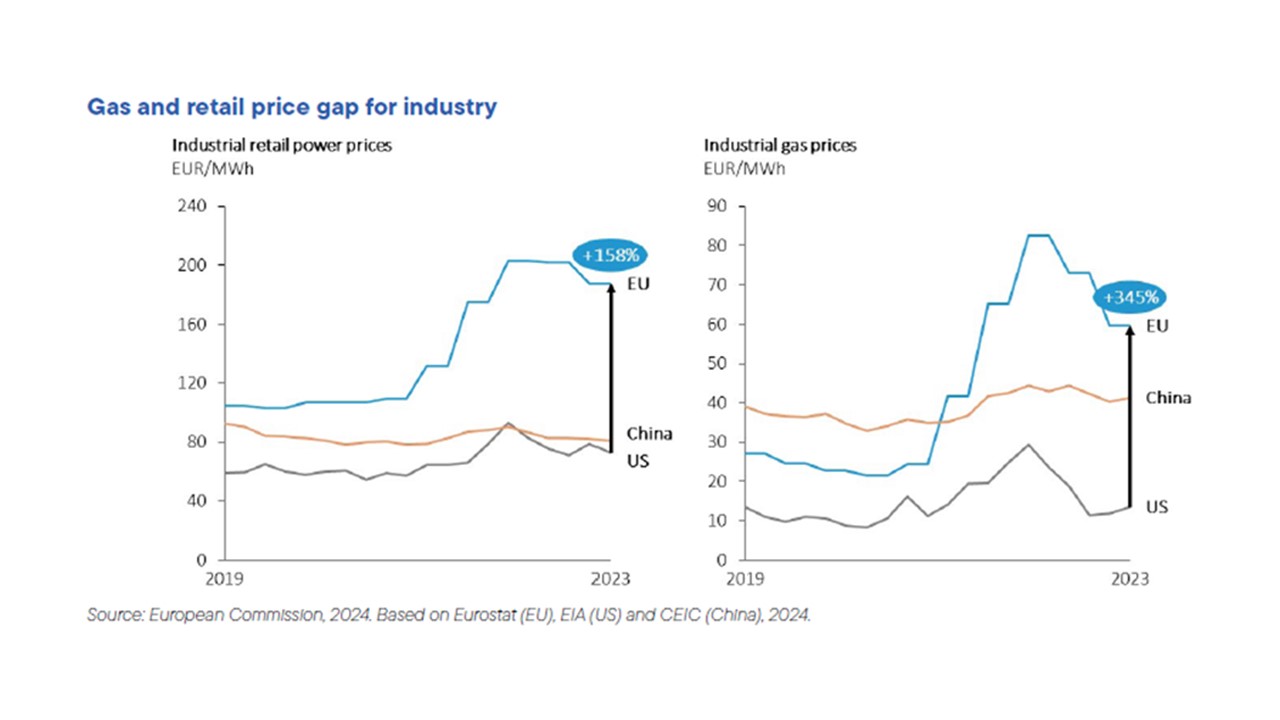

Above all, the rise in natural gas and electricity prices has severely impacted competitiveness. The most dramatic price spikes occurred in September 2022, but gas prices in Europe remain more than twice their pre-COVID levels. European businesses pay significantly more for both gas and electricity compared to their counterparts in the United States and China. The causes are structural, but while current and future challenges may sustain these price disparities, some positive developments are on the horizon.

The primary reason for the price gap with the US is Europe’s lack of natural resources. After moving away from Russian gas, Europe has become dependent on American liquefied natural gas (LNG). While the gas transport market currently faces shortages, the construction of new LNG terminals and tankers is reducing this problem. As regional gas markets reliant on pipelines evolve into a global market, price disparities between the US and Europe may narrow.

Fundamental weaknesses

Several fundamental weaknesses in the European energy market exacerbate the price gap:

Slow infrastructure investments: Investments in renewable energy sources (which reduce foreign dependence) and electricity networks are sluggish and suboptimal. Lengthy and uncertain permitting processes for new networks and facilities delay capacity expansion. Rapid electrification and the need for secure supply present significant challenges.

Fragmented gas procurement: The EU is the world’s largest importer of gas and LNG, but member states often compete against each other during shortages, driving prices higher rather than leveraging collective bargaining power. Additionally, spot market pricing instead of long-term contracts makes natural gas prices even more volatile.

Market concentration: A handful of dominant players exacerbate price volatility. According to the European Securities and Markets Authority (ESMA), the top five companies on trading platforms controlled up to 60% of positions between February and November 2022. Their short positions tripled during this period.

Energy pricing rules: European market rules pass price volatility onto end users, resulting in higher, less stable energy bills. This is puzzling, as Europe is a leader in renewable energy, accounting for 22% of final energy consumption in 2023 (compared to 14% in China and 9% in the U.S.). Yet European market rules fail to separate the (much cheaper) costs of renewables and nuclear energy from the volatile prices of fossil fuels. At the height of the energy crisis in 2022, natural gas set electricity prices 63% of the time, despite accounting for just 20% of Europe’s energy mix. Even if the EU achieves its 2030 goal of sourcing 42.5% of its energy from renewables, fossil fuels will still often determine prices. Long-term contracts could help address this issue.

Higher energy taxes: EU countries impose higher energy taxes compared to other regions of the world.

A competitiveness problem

Although Asian countries have faced similar gas price increases, European businesses have been hit harder. Like the US, G20 competitors often have access to domestic energy sources. Additionally, companies in countries such as China benefit from energy subsidies and other government support.

The EU’s decarbonisation goals are also more ambitious than those of its competitors, imposing short-term costs on European industry. The EU has enacted binding legislation to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels. By contrast, the US has set a non-binding target of a 50-52% reduction by 2030 from 2005 levels (a much higher baseline). China, meanwhile, only aims for peak CO2 emissions by the end of the decade.

These differences mean that European businesses face significantly higher short-term investment needs. For the four most energy-intensive industries – chemicals, basic metals, non-metallic minerals, and paper – the cost of decarbonisation over the next 15 years is estimated at €500 billion. For the most challenging transport sub-sectors to decarbonise (shipping and aviation), investment requirements are expected to reach €100 billion annually between 2031 and 2050.

The result

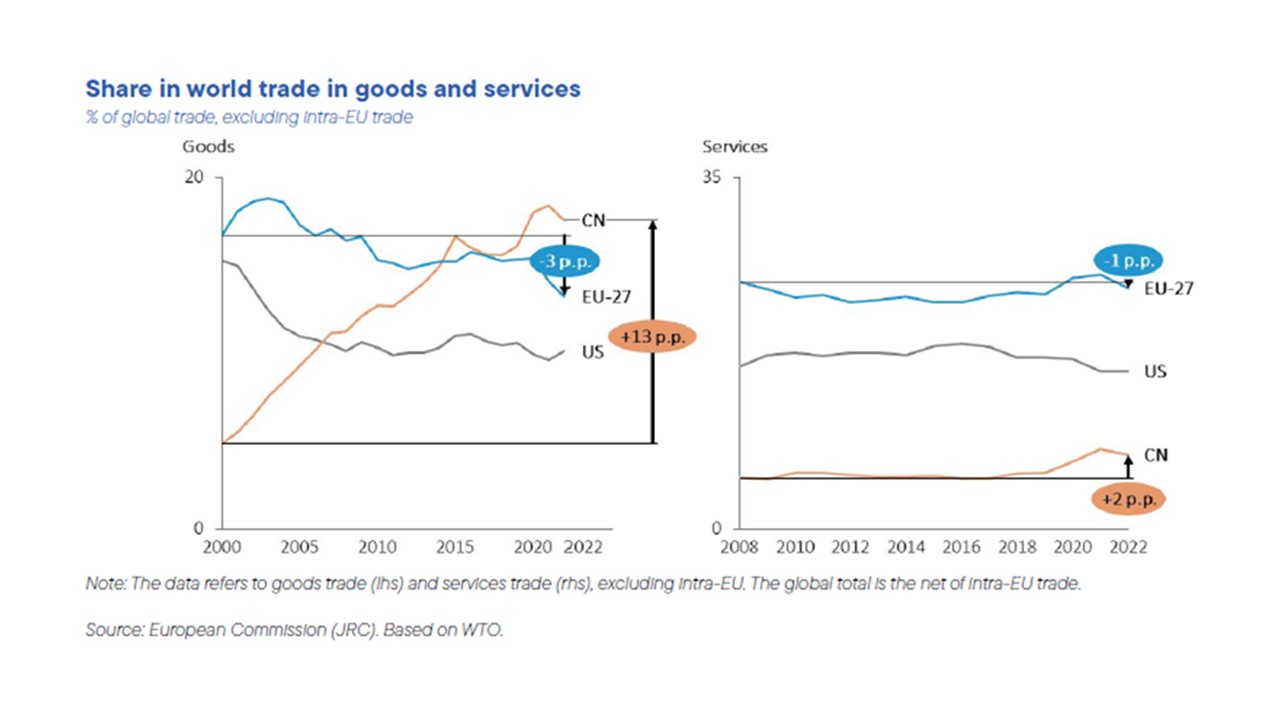

Since 2022, European competitiveness has significantly declined in these sectors, leading to a shrinking share of EU exports in global markets.