Alert on German employment

2 min

Germany’s economy is struggling more than the rest of Europe, and its relatively low unemployment rate deserves closer examination. The tide is turning, and the implications for Germany and its trading partners should not be underestimated.

Unemployment trends

The unemployment rate in Germany hit a low of 4.9% in 2019 but has since risen to 6%. While this figure may seem low compared to other European countries, a closer look reveals troubling trends. The increase is partly explained by the arrival of 1 million refugees from Ukraine, three-quarters of whom are of working age. Among them, 200,000 have found jobs, 210,000 receive unemployment benefits, and 300,000 are undergoing training.

Germany’s labour market is undergoing significant change, and its future looks bleak unless the country’s legendary ability to adapt and anticipate comes into play once more, as it has done many times in the past.

Industry in trouble

Last week, Volkswagen announced plans to close factories in Germany, a first in its 87-year history. The automotive sector is a cornerstone of the German economy, employing nearly 800,000 people and generating over €560 billion in revenue – almost equivalent to Belgium’s GDP.

In recent years, the industry has faced severe headwinds: skyrocketing energy costs, export challenges, and rapid technological changes that could overwhelm even the most seasoned executives. Over the past two years, the sector has shed more than 6% of its workforce, and this trend is expected to continue.

A recent survey revealed that 60% of German car manufacturers plan further workforce reductions over the next five years, despite Germany’s stringent labour laws. Continental, Germany’s third-largest automotive supplier with annual revenues of €41.4 billion, is exiting the car parts business to focus on tyres. The company is cutting thousands of jobs as it prepares to divest its sensors and braking systems unit.

However, Continental is striving to retain its skilled employees, organising training sessions to help workers transition into sustainable fields like robotics, logistics and electrification. Hopefully, such best practices will become widespread and inspire other countries to follow suit.

The chemical industry relocates

Germany’s chemical industry, another major provider of skilled jobs, is also facing significant challenges. As a highly energy-intensive sector, it is being forced to relocate outside Europe. BASF, for example, is shifting its operations from Germany and expanding in Asia. Many mid-sized companies are following the same logic, as discussed in a previous article.

Loss of skilled jobs

Despite Germany’s relatively low unemployment rate, the numbers mask a harsh reality. The jobs disappearing in Germany’s industrial sector are well-paid positions that supported purchasing power, limited public spending, and contributed substantial tax revenue to the state.

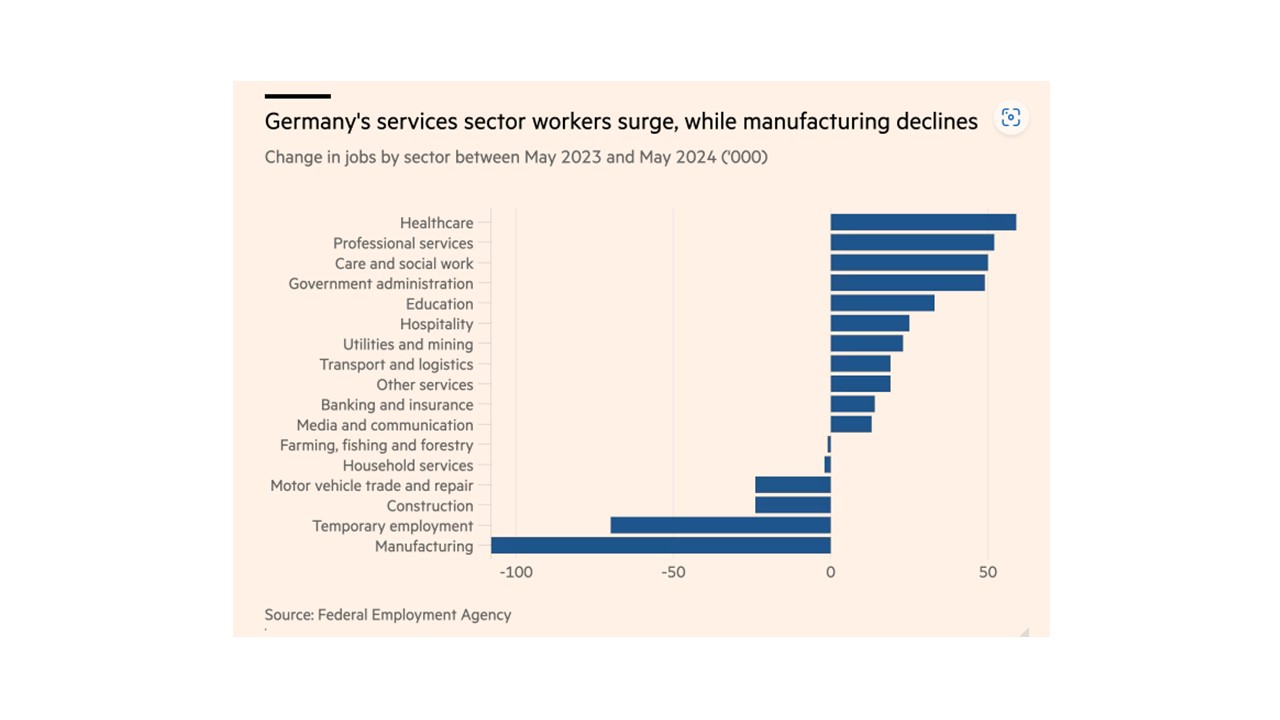

Between May 2023 and May 2024, more than 100,000 skilled jobs of this type were lost, while the healthcare sector created 50,000 new positions. However, these new roles, along with those in education and public administration, are far less well-paid, leading to a decline in purchasing power and reduced tax revenues.

European impact

Given that Germany’s economy has contracted in three of the last six quarters, some believe companies are retaining more workers than necessary. Rather than cutting jobs, firms are keeping employees on staff due to fears that Germany’s rapidly ageing population will lead to a widespread shortage of skilled labour.

In conclusion, Germany’s unemployment figures are far more concerning than they initially appear. The European repercussions could be significant: weakened German public finances, a stalled European economic engine, and relocations that could undermine the continent. This issue warrants close attention.