Bondholders call the shots

Bond markets are crucial to the economy, as governments finance themselves through them. In a world where debt is skyrocketing, it's essential to closely monitor these markets... and Donald Trump has finally understood this. Whew!

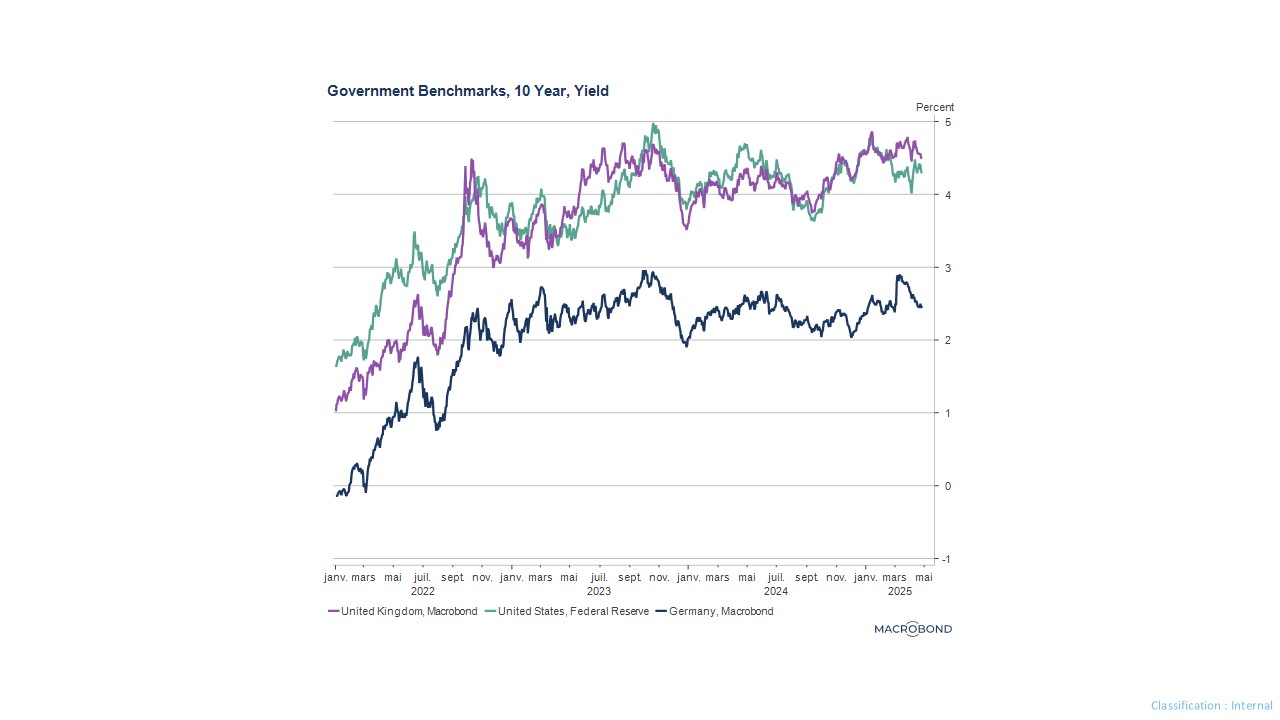

In recent weeks, global financial markets have been in turmoil. The root cause of this chaos was the US's announcement of a trade war with the rest of the world. As a result, growth prospects were revised downward, stock markets plummeted, business leaders faced an uncertain future, and the US bond market came under intense pressure. In just one month, the 10-year yield in the US rose sharply. The most significant consequence of this was that Donald Trump was forced to rethink his rhetoric and decisions, which had been all over the place. Whew!

What's driving this impact?

Bondholders are the ones who call the shots. They are, after all, the creditors of governments. US government bonds are typically considered a ‘risk-free’ investment and, therefore, a safe haven in turbulent times. If bondholders start to doubt the decisions made, fearing they will harm their interests, they can withdraw their money and invest it elsewhere. There are many examples of this in history. Not so long ago, in 2022, we witnessed a wave of discontent among bondholders in the UK. The then Prime Minister Liz Truss had announced drastic tax cuts, aiming to restart the economy, which had stalled following Brexit and the war in Ukraine. Bondholders quickly realised that such a policy was unsustainable and would inevitably lead to an increase in both the budget deficit and national debt, both of which they fear. Within days, they sold their bonds, fearing capital losses as government finances deteriorated. The resulting rise in interest rates forced Liz Truss to backtrack, ultimately leading to her resignation.

In 2011, Greece experienced a similar traumatic experience, which led to a debacle on all bond markets where the management of government finances suddenly no longer met expectations, such as in Spain, Portugal and Ireland. This forced central banks to intervene. To save the euro, the then ECB head Mario Draghi opted for the famous ‘whatever it takes’ approach.

Today, investors in US bonds are unhappy with the tariffs, which are driving up inflation. They are also concerned about the deteriorating growth prospects caused by the tariffs. As a result, tax revenues are likely to fall, despite Donald Trump's claims that his tariffs will bring in more money.

Also, investors remain on high alert regarding the situation on the other side of the Atlantic It's worth noting that Japan and China, which hold around 5% of the US debt, now totalling $36.4 trillion, are the largest holders of US bonds, followed by numerous pension funds and sovereign wealth funds. The stakes are enormous, and if these players panic, the consequences will be severe and immediate.

In search of a new safe haven

Many investors have withdrawn from the US market and repositioned themselves in Germany, drawn by the country's exemplary management of government finances. Even when Germany decides to invest heavily in improving its competitiveness and defence, its fiscal prudence remains a model. This shift in investor sentiment has led to a slight easing of long-term interest rates in Europe, which is a welcome development for Member States struggling with high debt burdens and the associated costs. This unexpected turn of events is a clear example of how one person's loss can be another's gain. However, not everything is positive.

Nevertheless, the fact that Donald Trump has acknowledged the importance of a healthy bond market is a significant and encouraging development, offering hope for a swift end to the tumultuous start to his presidency.

The opinions expressed in this blog are those of the authors and do not necessarily represent the views of BNP Paribas Fortis.