Belgium’s trade balance: where do we stand?

Belgium lost international market share despite the pandemic-related boost in vaccine production. Exports no longer exceed imports, slowing down economic growth. The wage gap with neighbouring countries is easing again, but at the same time, tariffs threaten to impact trade with the U.S. So, what does the future hold?

International trade is essential for our country. Exports account for 84.2% of our GDP. This is much higher than the EU (52%), the OECD (34%) and the U.S. (11%) average. Net exports (the value of a country’s total exports minus the value of its total imports), exports and imports, expressed in volume, contribute to the growth of total GDP. This contribution has been negative for our country in recent years. And it seems that this will continue to be the case in the near future.

Recent evolution

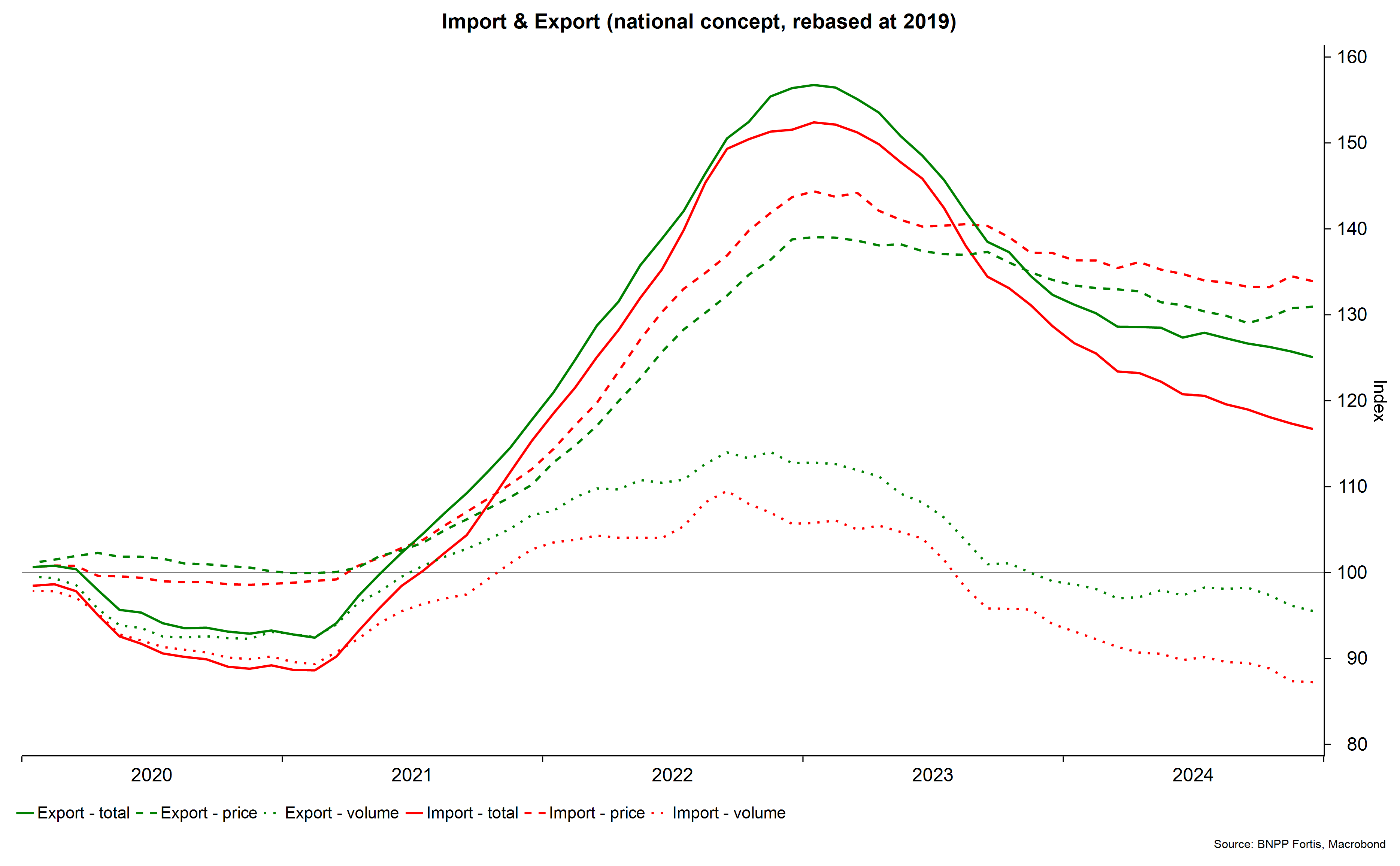

The graph below shows the evolution of imports and exports. It is worth noting that these are national figures, distinct from the national figures used to calculate GDP. Although this distinction is significant, the highest level of detail available for national figures can still be used to interpret recent developments.

Firstly, the solid lines (without gaps) indicate that last year, exports (in green) and imports (in red) were approximately 20% higher than just before the pandemic. During the pandemic, this increase was even more pronounced. This is partly due to the large-scale production of vaccines in our country.

The total amount is obtained by combining volume and price changes. It is striking that prices are much higher than they were five years ago. In contrast, volumes are significantly lower. This decline in volume growth is reflected in our GDP. A large share of Belgian exports is related to imports, but domestic demand also relies on imports. The faster growth of imports (or the slower decline that we see today) will not be offset by the same development in exports. As a result, net exports have contributed negatively to GDP in recent years. We do not expect this contribution to improve in the coming years.

A look ahead

After the surge in inflation at the end of 2022, automatic wage indexation in Belgium caused labour costs to rise sharply compared to neighbouring countries. In its recent annual report, the National Bank compares the newly widened wage gap to the situation just after the major 2008 financial crisis.

The difference in wage costs of around 6% was largely eliminated thanks to wage moderation in the five years preceding the pandemic. However, this delay was accompanied by a relatively significant loss of export market share. In this context, aside from index adjustments, the Central Economic Council has already indicated that there is no margin for conventional wage increases for 2025-2026.

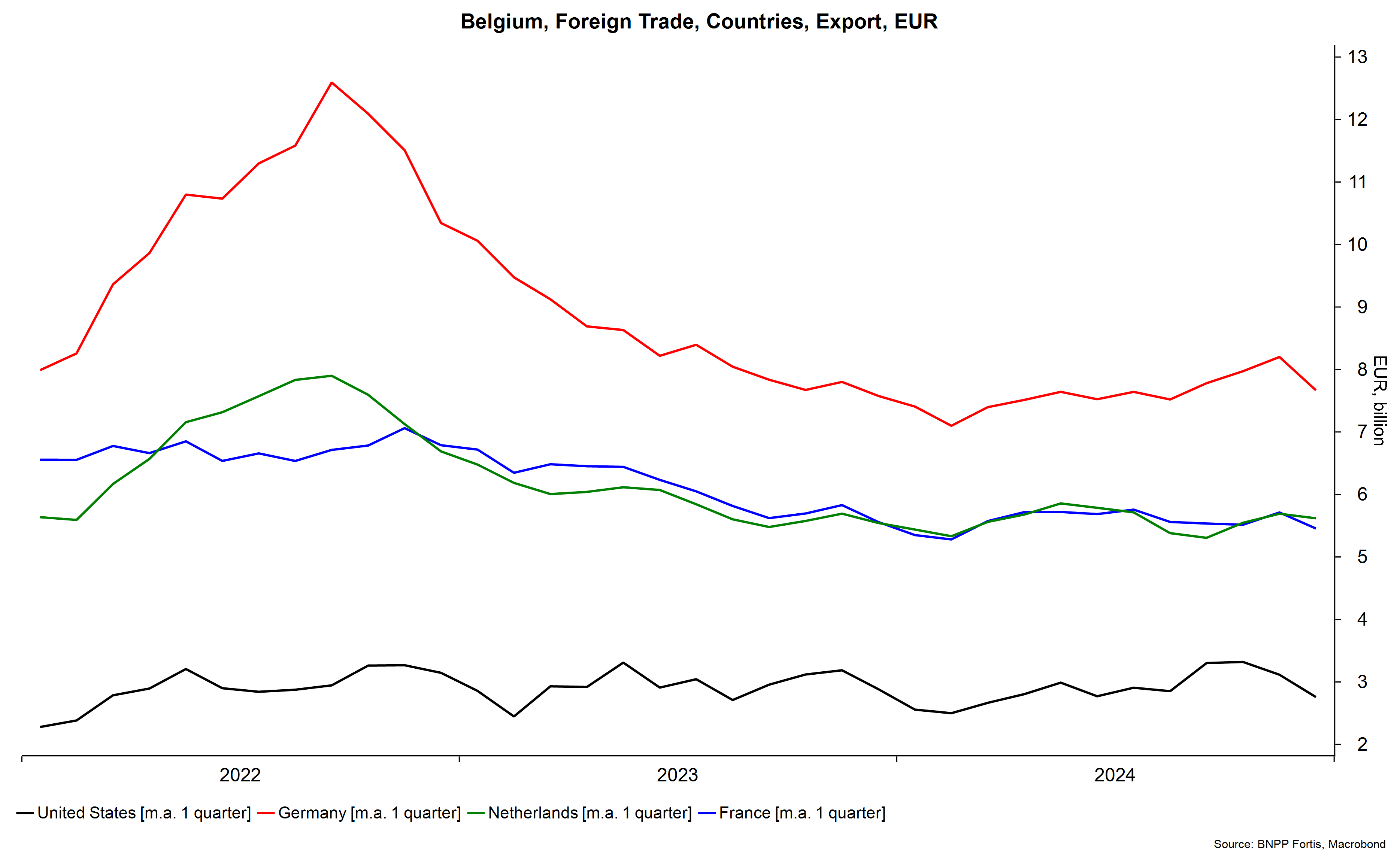

Most Belgian exports go to our three neighbouring countries, with the U.S. ranking fourth. Over the past five years, the U.S. accounted for an average of 6.3% of total Belgian exports and 6.6% of total Belgian imports. The threat of high tariffs could reduce the volume of exports to the U.S. in the future.

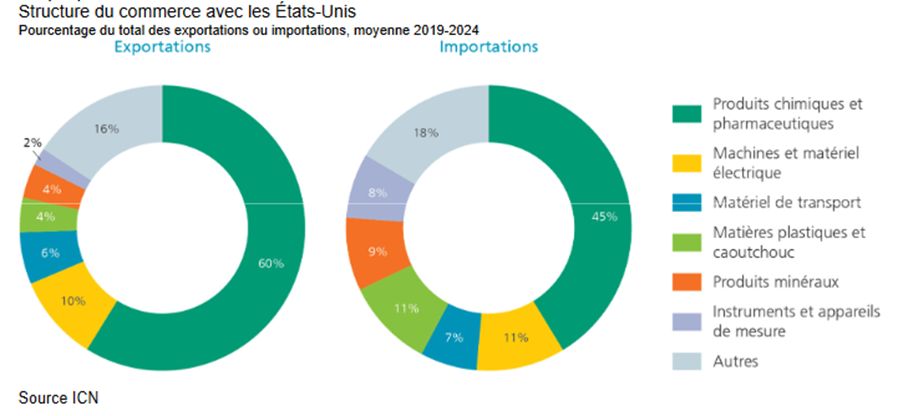

The National Bank stated that trade with the U.S. is primarily focused on chemical and pharmaceutical products, which accounted for an average of 45% of imports and 60% of exports between 2019 and 2024, as shown in the graph below. This is due to the presence of subsidiaries of large American multinationals in Belgium's chemical and pharmaceutical industry. The tax on these goods is not expected to have an immediate major impact, as they have relatively low-price elasticity. Therefore, the most likely scenario is that their share will return to pre-pandemic levels, without necessarily falling lower than this for an extended period. In other words, no further deterioration is expected, but international trade will continue to weigh on our growth in the coming years.

The opinions expressed in this blog post are the authors' and do not necessarily represent the position of BNP Paribas Fortis.